A diamond mining and exploration company with operations in the Republic of South Africa (RSA) have released the results of its second tender and sale for Q3 2019, and the impressive numbers speak volumes for the Company’s profit potential moving forward.

Kelowna BC-based

Diamcor Mining Inc. (

TSX-V:DMI,

OTC:DMIFF,

Forum) sold 6,055.28 carats of rough diamonds, generating total gross proceeds of just over US$693,000, resulting in an average price of US$114.51 per carat. This brings the total rough diamonds delivered and tendered thus far in the Company’s third fiscal quarter, ending December 31, 2019, to 10,088.29 carats,

generating over US$1.1 million in revenue. That’s a lot of bling.

An additional 3,306.40 carats have been delivered for tender and sale at a third and final tender for the period in the coming weeks. This brings the total rough diamonds delivered to tender in the Company's third fiscal quarter to 13,394.69, which represents a significant increase when compared to the 3,882.82 carats tendered and sold which generated total gross proceeds of US$569,059 in the Company's previous fiscal quarter that ended on September 30, 2019.

This news follows their positive

Q2 report of net income of $350,676 for the period ending September 30, 2019 – a significant increase when compared to a net loss of ($417,368) realized during the same period in the prior fiscal year.

Diamcor President and CEO Dean Taylor commented:

“The exercises being performed by our new operational team continue to demonstrate the historical issues hindering previous operations have now been corrected, and we look forward to the benefits of this as we begin processing material from the quarry at increased volumes in the coming weeks and months. The exercises have not only allowed us to refine our operations and processing plant during the quarter but do so while reducing our operating costs during both this period, and for the long-term.”

“The exercises being performed by our new operational team continue to demonstrate the historical issues hindering previous operations have now been corrected, and we look forward to the benefits of this as we begin processing material from the quarry at increased volumes in the coming weeks and months. The exercises have not only allowed us to refine our operations and processing plant during the quarter but do so while reducing our operating costs during both this period, and for the long-term.”

In a

recent Stockhouse article, we discussed how Diamcor appears to be well on its way to profitability given their solid results in 2019. Stockhouse also

recently covered the Company’s push to expand on its successful Krone-Endora at Venetia Project in the Limpopo province of South Africa with a round of financing of up to C$1 million, which was announced as successful and overfilled on

August 26.

Since 2011, Diamcor has formed a long-term strategic alliance with world famous luxury retailer Tiffany & Co., and is now in the final stages of developing the near-term, production capable Krone-Endora project. Krone-Endora was successfully acquired from De Beers in February of 2011 and is located directly adjacent to the third largest diamond mine in the world, De Beers flagship Venetia Mine.

About Krone - Endora at Venetia

In February 2011, Diamcor acquired the Krone-Endora at Venetia Project from

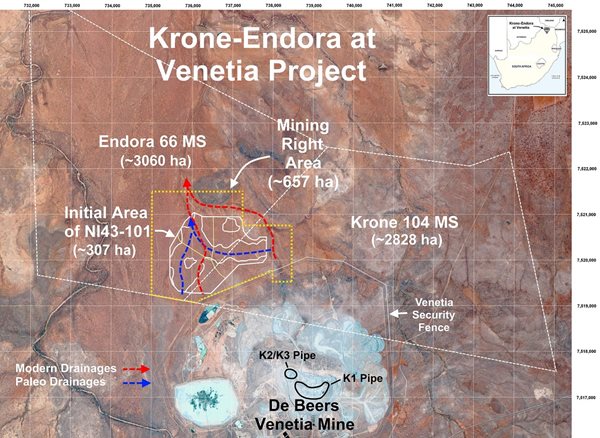

De Beers Consolidated Mines Ltd., consisting of the prospecting rights over the farms Krone 104 and Endora 66, which represent a combined surface area of approximately 5,888 hectares directly adjacent to De Beers' flagship Venetia Diamond Mine in South Africa.

On September 11, 2014, the Company announced that the South African Department of Mineral Resources had granted a Mining Right for the Krone-Endora at Venetia Project encompassing 657.71 hectares of the Project's total area of 5,888 hectares. The Company has also submitted an application for a mining right over the remaining areas of the Project.

(Click image to enlarge)

(Click image to enlarge)

The deposits which occur on the properties of Krone and Endora have been identified as a higher-grade "Alluvial" basal deposit which is covered by a lower-grade upper "Eluvial" deposit. The deposits are proposed to be the result of the direct-shift (in respect to the "Eluvial" deposit) and erosion (in respect to the "Alluvial" deposit) of material from the higher grounds of the adjacent Venetia Kimberlite areas.

The deposits on Krone-Endora occur in two layers with a maximum total depth of approximately 15 metres from surface to bedrock, allowing for a very low-cost mining operation to be employed with the potential for near-term diamond production from a known high-quality source. Krone-Endora also benefits from the significant development of infrastructure and services already in place due to its location directly adjacent to the Venetia Mine.

?width=599&height=399) Diamcor-Krone-Endora Dry Screening Plant (Photo courtesy Diamcor Mining Inc. Click image to enlarge)

Diamcor-Krone-Endora Dry Screening Plant (Photo courtesy Diamcor Mining Inc. Click image to enlarge)

The Krone-Endora project is located directly adjacent to the De Beers Venetia Diamond Mine, approximately 500 kilometres north-northeast of Johannesburg. The Venetia mine is South Africa's largest producer of diamonds – accounting for over 50 percent of the nation’s annual output. A high percentage of the diamonds produced at Venetia are reported as being gem quality, with the rest sold for industrial uses. Given the Krone-Endora project’s location directly adjacent to the established Venetia mine, many operational benefits are obvious.

As part of the acquisition process an independent NI 43-101 technical report for the Krone-Endora at Venetia project was released by the Company in July of 2009. The report provided an initial inferred resource estimate of 54,258,600 tonnes of diamond-bearing gravels with 1,314,000 carats of diamonds for the areas of the project on which work has been done to date. In conjunction with a planned move to immediate trial-mining exercises on these areas, Diamcor will concurrently perform additional drilling to determine the full potential of the project and arrive at final production decisions.

The deposit is also noted to be near surface, and diamond bearing from surface to bedrock, and with a total depth of 15 meters from surface to bedrock, will allow for a simple, low-cost strip mining operation to be employed.

?width=600&height=399) Diamcor-FlowSorts diamond sorting machine (Photo courtesy Diamcor Mining Inc. Click image to enlarge)

In Closing

Diamcor-FlowSorts diamond sorting machine (Photo courtesy Diamcor Mining Inc. Click image to enlarge)

In Closing

The Company say they remain confident that the average price per carat will increase to historical levels as the processing of mined material from the project's quarry resumes through the refined processing facilities in the coming weeks. Stockhouse mining and minerals investors should stay closely tuned.

FULL DISCLOSURE: This is a paid article produced by Stockhouse Publishing.