Here is a topic that has been covered intensively in the past, but we feel is due for a quick refresher. Prospect generation (PG) has been quite the buzzword since it was invented in the late 90s by resource veteran, Rick Rule. A concept born from two facts: mineral exploration is extremely capital intensive, and just 1 out of 3,000 mineralized anomalies became a mine.

Thus, Rick combined the age old financial adage of “other’s people mining” across numerous exploration projects. The outcome was the prospect generation model, which to this day remains a staple in the mining sector. Exploration companies amass large portfolios of grassroots projects, while establishing joint-ventures with companies that will pay cash and for exploration in exchange for majority ownership. Prospect generators alleviate both capital spending and exploration, while retaining upside.

Here is an example of the typical prospect generation value chain:

To put this into context, here is an example of Carube Copper’s (TSXV:CUC) recent joint-venture with Australian-based miner, OZ Minerals:

Under the terms of the joint venture agreement, OZ Minerals will complete a minimum of $500,000 of exploration expenditures by December 7, 2016. To earn a 70% in the Above Rocks project, OZ Minerals is required to spend $6.5 million on exploration and make payments to Carube of $275,000 over five years. OZ Minerals can then earn a further 10% by financing all work to the completion of a feasibility study.

This is a typical JV agreement where the prospector gives up the bulk of the upside, but is effectively carried for the entire duration of exploration.

Well does the model work? Let’s look at Rick’s track record. He has been involved in 55 public prospect generators, which in aggregate yielded 22 economic discoveries, resulting in 15 takeovers. Thus, instead of rolling the dice and hoping for a 1 out of 3,000 score, Rick effectively increased his odds from less than a percent to almost 30%.

Valuing A Prospect Generator

So how do you value a prospect generator? Most of these companies have no flagship project, but numerous early-stage projects, most certainly with no economics. Therefore, investors cannot use traditional tools to derive value, that is, cash flow models, peer valuation, etc. As a result, prospect generators are often the first mining companies to be sold in an extended bear market, which in most cases is the wrong thing to do, especially those with established JVs with much larger, cashed up partners.

PGs are less risky than the traditional explorer as risk is diversified across several projects, and PGs do not have to spend its own money, relying on partners to do so. Thus, do not burn through cash as quickly, while also minimizing dilution.

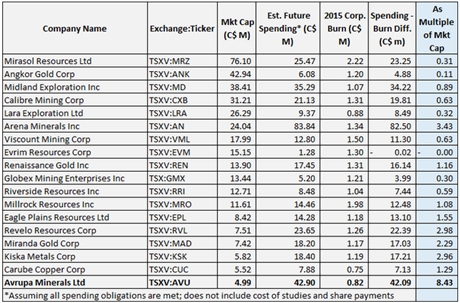

One way to determine the kind of leverage a PG has is looking at how much potential cash and exploration expenditures is in the pipeline, minus the corporate burn rate, and compare the net figure to the current market capitalization of the company. If the ratio is significantly higher than the average of all other PGs, further investigation is warranted.

Here is a list of prospect generators we compiled under the market capitalization of $100 million, and higher than $2 million:

Avrupa Minerals (TSXV:AVU) is a company familiar to us, having been in our portfolio for over a year. At first glance, it appears the company is highly undervalued, at least compared to the amount of spending it has in its pipeline. The company has done a great job minimizing its G&A, the second lowest amongst its peers, but most importantly, has a proven management team with a track record of success.

The last point mentioned is extremely important in the PG model. When investing in a PG, you are a betting on management and the geologists, maybe more so than the assets a company has in its portfolio. PGs normally have small teams of geologists who perform low cost reconnaissance work to identify promising targets. Since PGs want to minimize spending as much as possible, reconnaissance work may go to as far as drilling a few holes, but the brunt of spending is left to more deep-pocketed partners. If a company cannot find attractive projects, the whole model will be broken.

Current Price: C$0.105

Shares Outstanding: 55.5 million

Market Capitalization: C$5.8 million

52-Week Range: C$0.07 – C$0.17

Cash: C$0.16 million

Total Liabilities: C$0.8 million

Avrupa is a Europe-focused PG, led by a team of geologists with an exceptionally strong track record in the continent. The company combines ‘old world’ districts with modern exploration, which has led three joint ventures, and another 6 projects looking for partners. The company has a several discoveries in Portugal, Kosovo and Germany:

Portugal, Covas project (25%)

Avrupa established a JV with Blackheath Resources (TSXV:BHR) on its Covas property in Portugal after Blackheath spent €1,320,000 in exploration on the property to earn 75%. Covas is a past producing tungsten mine, and the remaining historic (non-compliant) resource has been estimated at 922,900 metric tonnes of 0.78% WO3, based on work including 327 drill holes on the property.

Through the work of Blackheath, a 43-101 compliant resource was released on March 31, 2015, consisting of seven separate deposits in close proximity: 449,800 MTUs WO3 indicated resource based on 1,081,000 tonnes at an average grade of 0.42% WO3; and 767,100 MTUs WO3 inferred resource based on 2,211,000 tonnes at an average grade of 0.35% WO3.

While the price of tungsten has been increasing, the resource markets remain tumultuous and Blackheath has not met the exploration requirement, due by March 20, 2016. Thus, Avrupa is currently working with Blackheath for the next appropriate steps. In the current market, tungsten is a hard commodity to market and we expect this project to remain on the backburner.

Kosovo, Slivovo project (25%)

Avrupa Minerals currently holds 25% of Slivovo, which is operated by partner Byrnecut International Ltd. Under the terms of the JV, Byrnecut earned 75% by spending over €2,000,000 (~C$2.84 million) and recently informed Avrupa that it will proceed with financing a prefeasibility study (PFS) of the Slivovo, which will increase its ownership to 85%.

The initial discovery at Slivovo created enormous market interest. In December 2014, Avrupa announced drilling results, highlighted by 126.5 meters of 6.2 g/t, and the stock responded accordingly, spiking to a high of C$0.40. The excitement slowly petered as the JV drilled more, and expectations were tapered.

That being said, the Slivovo project is comprised of a number of exploration prospects, with the most work on the Peshter Gossan zone. Some drilling targeted the nearby Gossan Extension zone, but not enough to be included in Slivovo’s resource estimate.

The Slivovo project currently contains an indicated resource of 98,700 ounces gold and 302,000 ounces silver. The estimate is conservative, and more importantly, further drilling is anticipated later this year in both the Gossan Extension zone and the Peshter Gossan. We expect Avrupa and its partner continually upgrade and add to Slivovo’s existing resource.

Portugal, Alvalade (40%)

For this project, Avrupa first entered into a JV agreement Antofagasta Minerals to explore Alvalade in 2011 and in January 2015, the partners signed an amended JV that allowed for more interim funding by Antofagasta, extended time to get a feasibility study decision, and a means for Avrupa to be carried to production.

On August 31, 2015, Avrupa signed an agreement with Colt Resources (TSXV:GTP) and Antofagasta, where Colt purchased Antofagasta’s 60% interest. Colt is now the optionee partner earning into the existing agreement, and can earn up to 80% of the JV through a combination of exploration expenditures, completion of a feasibility study, and generation of a mine development decision by the end of the year 2023.

Alvalade is located in the Iberian Pyrite Belt, where Europe’s richest active copper mine operates. Three out of four of the last greenfield discoveries in the Pyrite Belt: Neves Corvo in 1977, Aguas Tenidas in 1980, and Las Cruces in 1994, are now large operating mines. Even with prolific area code, there has been no real exploration in the region since the mid-1990s.

Since Avrupa’s foray, the JV has drilled 43 holes and over 17,500 meters, resulting in the discovery of a new massive sulfide system at Sesmarias, and new massive sulfide targets within the Sesmarias and Pombal basins, both along the Neves Corvo trend. Colt Resources has stated that future drilling will be focused on the discovery of additional massive sulphide lenses, with a goal to delineate a potentially economic base metal resource.

Avrupa Minerals – The Investment Thesis And Value Proposition

Compared to its peers, we would emphasize Avrupa is a riskier investment because its partners are not as large and deep-pocketed as others. However, the aggregate committed spending of C$43 million compared to its paltry market cap of C$5 million is alluring and worth the risk.

We also cannot forget Avrupa’s other projects that have been prepped and ready to be optioned. Avrupa is operating in elephant country, and is the proprietor of a new geological model that is essential in operating in the Iberian Pyrite Belt. Thus, we expect as the markets rebounds, Avrupa to option off its Portugal licenses to the highest bidders. This includes: Marateca, which hosts 12 known VMS targets areas including an undocumented 1,000 meter gozzan zone; Mertola, which has over 15,000 meters of previous drilling; and Santa Margarida, which already has historic geophysical data and drill core available for review.

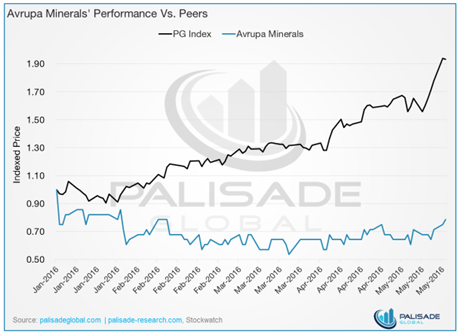

While its peers have taken off with the rest of the market, Avrupa’s share price has languished.

As far as we are concerned, the market has overlooked Avrupa. Is this a risky investment? You bet, but Avrupa is led by tried and tested veterans of the prospect generation game, namely Mark Brown and company, who we believe he will be able to secure further JVs and navigate AVU through its current perilous waters.

Upcoming catalysts in the near future include continual updates from Slivovo, Kosovo, updates on the status of Alvalade, establishing joint ventures in Portgual, and bringing the Oelsnitz Project in Germany to a JV-ready stage.

Bonus Recommendation – Carube Copper (TSXV:CUC) – The Start-Up Prospect Generator

Last year in our research we came across a prospect generator operating in Jamaica and British Columbia. Carube Copper (TSXV:CUC) primarily operates in Jamaica, a surprisingly mining-friendly jurisdiction with an established Mining Act and a legal system is based on British Common Law.

The company has four projects in Jamaica (260 km2) covering the best copper‐gold exploration potential on the island. Of the four projects, two are currently under joint-venture agreement with OZ Minerals, an Australian based copper-gold producer with a market cap of $1.1 billion.

Jamaica, Bellas Gate (30%)

OZ Minerals has spent over $8.3 million at the Bellas Gate project to earn a 70% interest and can increase its interest by another 10% by financing all work to the completion of a feasibility study (FS).

When OZ completes the FS, Carube Copper can request that OZ either buy all or half of its remaining interest at a price referenced in the FS, and/or finance Carube Copper’s remaining interest to production on a loan basis.

Bellas Gate is comprised of fourteen copper-gold prospects with high discovery potential. OZ Minerals is prioritizing the numerous copper-gold porphyry targets at Bellas Gate through exploration, and recently initiated an induced polarization (IP) geophysical survey. OZ is currently determining targets that can be brought to feasibility the most efficiently. Some 11,028 meters of drilling of have been completed to date. Drill results include:

From hole CON-14-003: 297 metres of 0.53% copper equivalent, including 55 m of 1.00 per cent CuEq*

From hole CON-14-005: 294 metres of 0.56% copper equivalent, including 96 m of 1.00 per cent CuEq*

* CuEq calculated using US$3.00/pound Cu and US$1,200/ounce Au, 100% recovery

Jamaica, Above Rocks (100%)

OZ Minerals completed airborne geophysical surveys over Carube’s three other projects in Jamaica and recently JV’ed the 104 km2 Above Rocks Project.

OZ expects to complete a minimum of $500,000 in exploration by December 7, 2016, is required to spend $6.5 million on exploration and make payments to Carube of $275,000 over five years to earn a 70% interest in the project. Similar to Bellas Gate, OZ can then earn a further 10% interest by financing all work to a feasibility study. OZ and Carube have identified five high priority targets and have already deployed a diamond drill rig.

Jamaica, Main Ridge and Hungry Gully (100%)

Carube Copper holds 100% of the 48 km2 Main Ridge Project and the 32 km2 Hungry Gully Project.

Main Ridge has multiple large copper-gold porphyry or IOCG targets and a two kilometer gold zone that are virtually unexplored. Two on-license drill holes at end of the gold zone yielded historic intersections of 7.7 g/t Au over 3 meters and 22.9 g/t Au over 2 meters. A small inactive mine whose head grades run 5-15 g/t Au lies on the adjacent ground. Work has started on this gold zone and on a large magnetic-potassic anomaly with an associated soil anomaly. CUC has initiated exploration in order to prioritize drill targets.

Hungry Gully holds at least three underexplored areas that are highly prospective for copper-gold porphyry and epithermal gold mineralization.

British Columbia Projects (100%)

Carube Copper holds three properties totaling 547 km2 in a rapidly emerging copper gold porphyry belt in southwestern BC’s Cascade Magmatic Arc, where Amarc Resources (TSXV:AHR) newly discovered IKE deposits (592 meters of 0.44% Cu Eq.) has been optioned to Thompson Creek Metals (TSX:TCM). Two of the properties showing signs of copper-gold mineralization lie on-strike with the IKE deposit, one being adjacent. All properties are accessible by road.

Carube Copper (TSXV:CUC) – The Catalyst Generator

Current Price: C$0.09

Shares Outstanding: 64.89 million

Market Capitalization: C$5.8 million

52-Week Range: C$0.045 – C$0.21

Cash: C$0.18 million

Total Liabilities: C$1.77 million

Carube Copper is chaired by Alar Soever, a geologist with over 35 years of experience in the mineral exploration industry. He has been the President of Wallbridge Mining (TSX:WM) since 2003, and has been integral in its growth, including the spin-out of two companies, Duluth Metals (acquired by Antofagasta for C$96 million) and Miocene Metal. Wallbridge owns 16.8% of Carube and is a strategic, long-term investor.

At the helm of CUC is President and CEO, Jeffrey Ackert, who brings over 30 years of experience as a geologist and mining executive. He was a mine geologist at LAC Minerals’ Golden Patricia Mine (acquired by Barrick Gold in 1994) and was appointed VP Exploration for Orezone Resources focusing on West Africa. Since 2007, Mr. Ackert has been the sole principal of JSA International Geoconsulting and since early 2008 he has been a Director of Advance Gold and since 2013, a Director of Altai Resources.

There you have it, a start-up prospect generator with a strong technical management team and projects to boot. For a $5.8 million company, Carube Copper has large cap news on the horizon. The company will be releasing steady drill results from the Bellas Gate and Above Rocks projects, and will be highlighting exploration work on gold and copper targets the Main Ridge project. As Carube progresses at Main Ridge, we expect JV interest to pick, obviously with the main suitor being OZ Minerals. We also believe there is a good chance CUC will find a partner one of its BC assets.

Palisade Global Investments Limited holds shares of Avrupa Minerals and Carube Copper. We receive either monetary or securities compensation for our services. We stand to benefit from any volume this write-up may generate. The information contained in such write-ups is not intended as individual investment advice and is not designed to meet your personal financial situation. Information contained in this report is obtained from sources we believe to be reliable, but its accuracy cannot be guaranteed. The opinions expressed in this report are those of Palisade Global Investments and are subject to change without notice. The information in this report may become outdated and there is no obligation to update any such information. Do your own due diligence.