nopparit/iStock via Getty Images

GCM Mining (OTCQX:TPRFF) made another important news release. Only earlier this week, the company announced the change of name from Gran Colombia Gold to GCM Mining, which should better reflect that the company is not only about Colombia and not only about gold anymore. And yesterday, it released the results of an updated PEA for its shovel-ready and fully funded Toroparu project in Guyana.

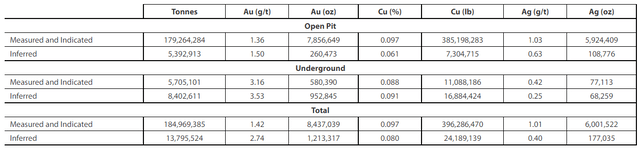

The PEA was accompanied by an updated resource estimate. What is positive, the measured & indicated resources increased. On the other hand, the inferred resources decreased. When GCM acquired Toroparu, the project contained measured & indicated resources of 7.35 million toz gold, 6.28 million toz silver, and 444 million lb copper, and inferred resources of 3.15 million toz gold, 276,000 toz silver, and 104 million lb copper. However, according to the new resource estimate, there are measured & indicated resources of 8.44 million toz gold, 6 million toz silver, and 396.29 million lb copper, and inferred resources of 1.21 million toz gold, 177,000 toz silver, and 24.19 million lb copper.

The PEA was accompanied by an updated resource estimate. What is positive, the measured & indicated resources increased. On the other hand, the inferred resources decreased. When GCM acquired Toroparu, the project contained measured & indicated resources of 7.35 million toz gold, 6.28 million toz silver, and 444 million lb copper, and inferred resources of 3.15 million toz gold, 276,000 toz silver, and 104 million lb copper. However, according to the new resource estimate, there are measured & indicated resources of 8.44 million toz gold, 6 million toz silver, and 396.29 million lb copper, and inferred resources of 1.21 million toz gold, 177,000 toz silver, and 24.19 million lb copper.

So the overall volume of gold, silver, and copper contained in resources decreased. However, the metals didn't simply disappear. The difference is caused by different cut-off grades used by the two resource estimates. While the old one used a cut-off grade of 0.3 g/t gold, and it focused only on the open-pittable ore, the new one uses a cut-off grade of 0.4 g/t gold for open-pit and 1.8 g/t gold for the underground portion of the deposit. These changes helped to elevate the measured & indicated gold grades from 0.91 g/t to 1.42 g/t, and the inferred gold grades from 0.76 g/t to 2.74 g/t. Moreover, the deposit remains open at depth and along strike.

Source: GCM Mining

Source: GCM Mining

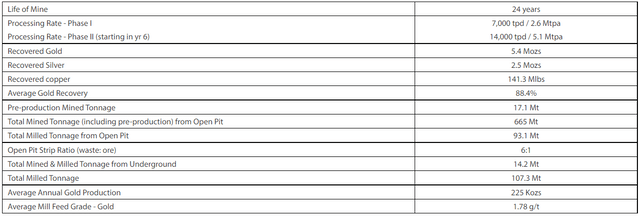

The updated PEA confirms that Toroparu should be a very profitable long-life asset. The mine should be developed in two stages. The first stage will have a throughput rate of 7,000 tpd. The second stage will have a throughput rate of 14,000 tpd, starting in year 6, and will include a copper concentrator which will enable the mine to generate valuable by-product credits. The expansion should cost $103 million and it is included in the sustaining CAPEX.

In the beginning, the mining activities will focus only on the open-pit material. Underground mining should start 10 years later. The mine should be able to produce 225,000 toz gold per year on average, over 24-year mine life. The AISC is estimated at $916/toz, and the initial CAPEX at $355 million. At a base-case metals prices of $1,500/toz gold, $20.22/toz silver, and $3.13/lb copper, the after-tax NPV(5%) equals $794 million, and the after-tax IRR equals 46%. These are very good numbers.

Source: GCM Mining

Source: GCM Mining

As can be seen, there are several notable changes in comparison to the old PEA. The old PEA envisioned AISC of $780/toz gold, which is approximately 15% below the new projection. On the other hand, the initial CAPEX was originally estimated at $378 million which is 6.5% higher than the updated estimate. Also the NPV and IRR improved. The new PEA presents an after-tax NPV(5%) of $794 million, which is favorable to the old projection of $495.2 million. However, the improvement is partially attributable to higher metals prices, as the old study used a gold price of $1,300/toz, silver price of $16/toz silver, and copper price of $3/lb.

According to Lombardo Paredes, CGM's CEO, the pre-construction activities have already started. The construction itself should start in 2022 and be completed in 2023. The first full year of production should be 2024, with expected production of 280,000 toz gold.

Conclusion

The updated PEA confirms the huge potential of the Toroparu project. And the upside potential of GCM's shares. The company has a market capitalization of $386 million right now. The net debt stands at -$17.9 million which leads to an enterprise value of approximately $370 million. But GCM holds also a 44% equity interest in Aris Gold (OTCQX:ALLXF), a 27% equity interest in Denarius Silver (OTCPK:DNRSF), and a 26% equity interest in Western Atlas Resources (OTC:PPZRF).

The current market value of the equity interests is approximately $93 million (not talking about the fact that Aris Gold alone is significantly undervalued). It means that the market attributes value of less than $280 million to GCM's Segovia mine that produces around 200,000 toz gold per year, and to the Toroparu project with an after-tax NPV(5%) of $794 million (or more than $1 billion at the current gold price). GCM remains one of the most undervalued gold producers.

If you like my articles, please, feel free to visit my new marketplace service "Royalty & Streaming Corner". It will be primarily focused on precious and industrial metals royalty and streaming companies; however, it will include also investment ideas from the small- and mid-cap mining environment. We are starting on December 14! Early subscribers will receive a 25% legacy discount!