scyther5/iStock via Getty Images

Investment Thesis

1 - Presentation

The Canada-based GCM Mining (OTCQX:TPRFF) owns Segovia operations in Colombia, the company's principal producing asset. GCM Mining is also involved in Guyana with the Toroparu Project.

Important note: This article is an update of my article published on April 13, 2022. I have been following TPRFF on Seeking Alpha since 2021.

Recent news: On June 27, 2022, posted encouraging drilling program results at Sandra K and El Silencio at its Segovia operations in Colombia.

Announced today multiple high-grade intercepts from the latest 32 diamond drill holes, totaling 8,299 meters, from the 2022 in-mine and near-mine drilling programs, as well as a further 28 diamond drill holes, totaling 7,735 meters, from the 2022 brownfield drilling programs at its Segovia Operations, Colombia.

Approximately 32% of the brownfield exploration drilling programs for this year were completed by the end of April

GCM Mining could be considered a long-term potential in the gold segment. Strong balance sheet and an exciting project in Guyana on the way called Toroparu with secured financing from Wheaton.

2 - 1Q21 results snapshot and commentary

The company reported its first-quarter 2022 results on May 12, 2022.

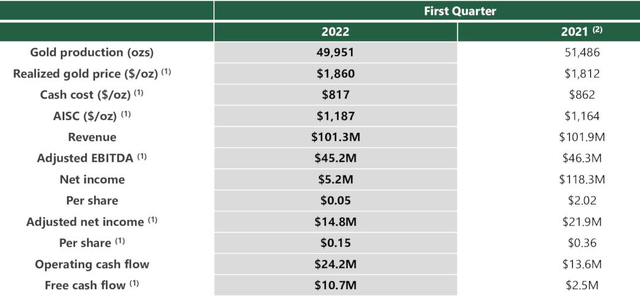

TPRFF 1Q22 highlights (GCM Mining)

Lombardo Paredes, Chief Executive Officer of GCM Mining, commenting on the first-quarter 2022 results:

We have started o 2022 on a positive note, meeting our expectations for production, costs, and cash ow in the first quarter. We are on track to once again meet our annual production guidance for 2022.

GCM's gold production from its Segovia Operations was 49,951 ounces in 1Q22, up 2% over the first quarter of last year.

The company indicated a gold production of 18,321 ounces for April, bringing Segovia's trailing 12 months' total gold production to 208,130 ounces, up 1% over 2021.

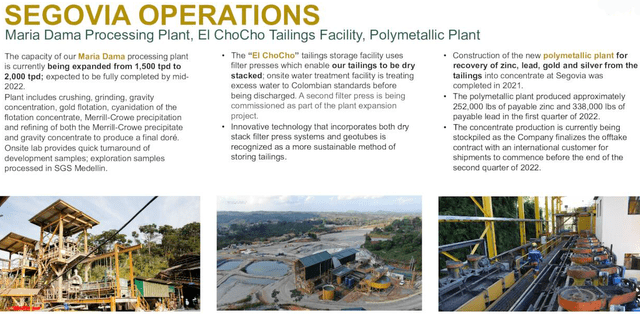

Expansion of the Company's processing plant at Segovia to 2,000 TPD is proceeding well and is expected to be completed by mid-2022. Moreover, the Company is on track to meet its annual production guidance for 2022 of between 210K and 225K ounces of gold.

Finally, the new polymetallic recovery plant constructed in 2021 at Segovia produced approximately 252K lbs of payable zinc and 338K lbs of payable lead in the first quarter of 2022.

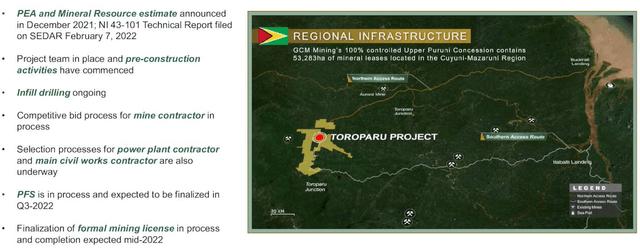

3 - The Toroparu Project - One of the most significant Gold/Copper projects in the Americas

It is an exciting project that will make a big difference for the company when completed. Shareholders will have to use weakness to accumulate and be patient.

TPRFF Toroparu Project1Q22 (GCM Mining)

Gran Colombia has already started pre-construction activities on the camp, airstrip, and an access road, carrying out additional infill drilling.

The bid process for the mine, power plant, and main civil works contractors has started.

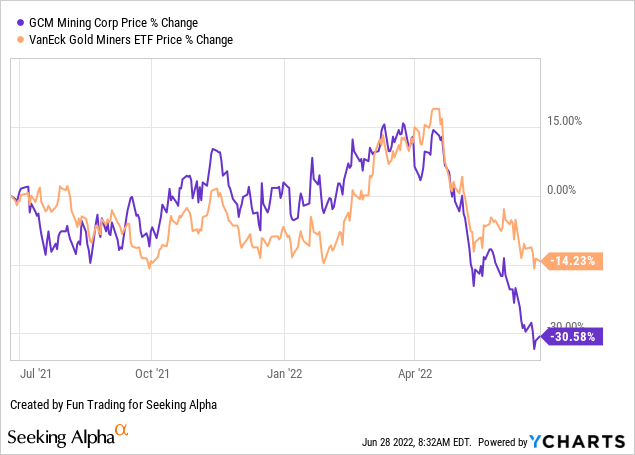

4 - Stock Performance

TPRFF has underperformed the VanEck Vectors Gold Miners ETF (GDX) and is down 31% on a one-year basis.

Data by YCharts

Data by YCharts

GCM Mining - Financial Snapshot 1Q22 - The Raw Numbers

| Gran Colombia | 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q22 |

| Total Revenues In $ Million | 99.67 | 96.35 | 90.72 | 93.62 | 101.32 |

| Net Income in $ Million | 124.56 | 29.80 | 25.26 | 6.61 | 5.24 |

| EBITDA $ Million | 143.45 | 53.69 | 50.90 | 32.14 | 35.18 |

| EPS diluted in $/share | 1.28 | 0.28 | 0.20 | 0.07 | 0.05 |

| Operating Cash flow in $ Million | 13.62 | 12.79 | 26.74 | 27.41 | 24.21 |

| Capital Expenditure in $ Million | 11.12 | 15.77 | 14.61 | 21.97 | 20.26 |

| Free Cash Flow in $ Million | 2.50 | -2.98 | 12.13 | 5.44 | 3.95 |

| Total Cash $ Million | 73.71 | 57.80 | 331.31 | 328.04 | 315.06 |

| Total Long term Debt (incl. current) In $ Million | 57.00 | 40.86 | 307.67 | 314.27 | 311.31 |

| Shares outstanding -(diluted) in Million | 61.67 | 83.90 | 109.35 | 94.89 | 99.96 (with fully diluted at 109.89 million) |

| The dividend is paid per month now/ Quarterly dividend in $/share. | 0.034 | 0.034 | 0.034 | 0.034 | 0.034 |

Data Source: Company release. (More data available for subscribers only).

Analysis: Revenues, Earnings Details, Free Cash Flow, Debt, And Gold Production

1 - Total Revenues and others were $101.32 million in 1Q22

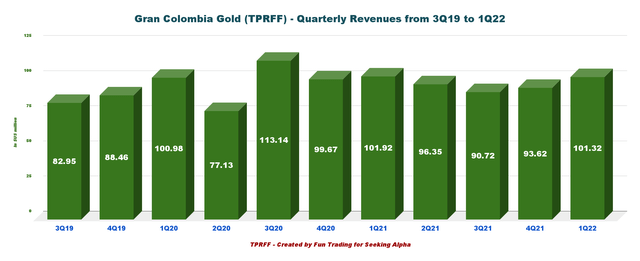

TPRFF Quarterly revenues history (Fun Trading)

Note: Gold sale represents $99.783 million and $1.539 million for silver. The company announced first-quarter revenues of $101.32 million, down slightly from the same quarter a year ago and up 8.2% sequentially. The company posted a net income of $5.24 million compared to $124.56 million last year.

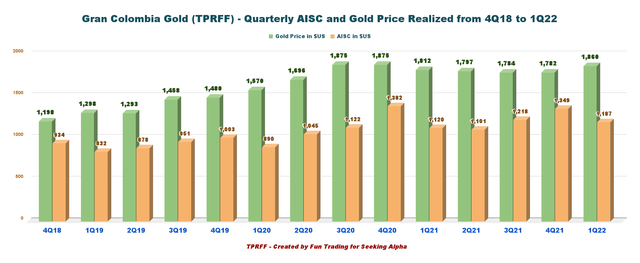

The spot gold price in the first quarter of 2022 was higher than the same quarter a year ago to an average of $1,860 per ounce sold in the first quarter of 2022 compared with an average of $1,812 per ounce sold in 1Q21.

The first-quarter adjusted EBITDA was $45.218 million compared to $46.323 million in 1Q21.

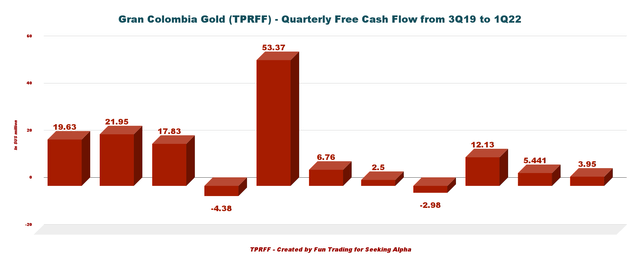

2 - Free cash flow was a loss of $3.95 million in 1Q22

TPRFF Quarterly Free Cash Flow history (Fun Trading)

Note: Generic free cash flow is cash flow from operations minus CapEx. GCM Mining uses another calculation that indicated $10.7 million in free cash flow in 1Q22. GCM Mining is adding the CapEx for Toroparu.

The trailing 12-month free cash flow is now $18.54 million, with free cash flow in 1Q22 of $3.95 million.

As of March 31, 2022, the company's investments in associates totaled $159.86 million, primarily representing Aris (OTCQX:ALLXF).

GCM Mining repurchased approximately 0.3 million shares for $1.1 million in 1Q22. Also, in April 2022, the Company purchased and canceled 100,000 common shares.

GCM Mining may purchase up to 9,570,540 common shares over 12 months ending October 19, 2022. As of May 12, 2022, the Company has purchased 957,402 common shares.

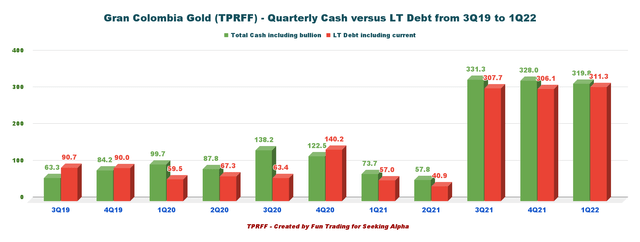

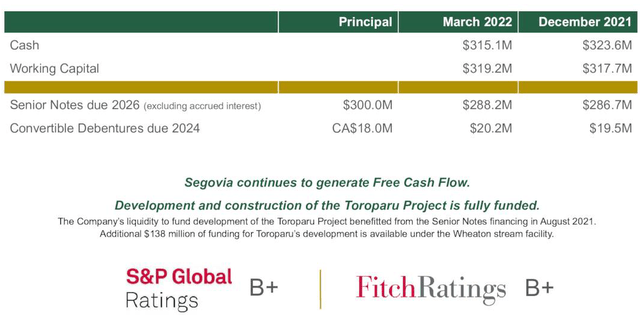

3 - Gran Colombia was net debt-free at the end of the 1Q22

TPRFF Quarterly Cash versus Debt history (Fun Trading)

At the end of March 2022, GCM Mining had a cash position of approximately $319.75 million (including bullion), and the total debt was $311.31 million, including current.

TPRFF Quarterly Debt profile Presentation (GCM Mining)

The Company's balance sheet is solid and enjoys $138.0 million of funding available for constructing its Toroparu Project in Guyana through a precious metals stream facility with Wheaton Precious Metals (WPM).

Also, on April 12, 2022, the Company acquired a $35 million convertible senior unsecured debenture issued by a wholly-owned subsidiary of Aris at 7.5%.

The Aris Debenture will be due, in cash, 18 months from closing of the Soto Norte Acquisition. At any time after 12 months from closing of the Soto Norte Acquisition, the Aris Debenture may be converted, in whole or in part, at the Company's sole discretion into common shares of Aris at a conversion price of $1.75 per share.

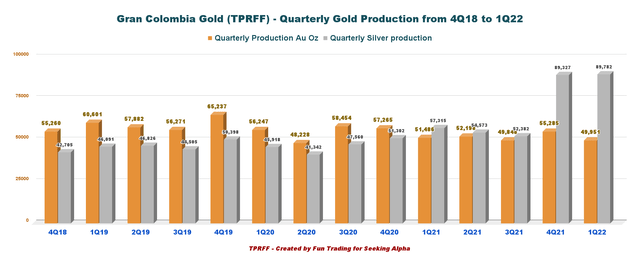

4 - Production was 49,951 Au Oz and 89,782 Ag Oz in 1Q22

Note: Including production from the Marmato Project up to February 4, 2021, the date of loss of control of Aris.

4.1 - Gold and Silver production: Historical chart

TPRFF Quarterly gold and silver production history (Fun Trading)

Note: Gold sold in 1Q22 was 53,645 Au Oz and silver 67,611 Ag Oz. Production comes from Segovia operations mainly. Segovia operations include:

- Sandra K mine - 7,346 Oz

- Providencia mine - 14,867 Oz

- El Silencio mine - 18,862 Oz

- Carla is a potential with a probable reserve of 33K Au Oz - 1,253 Oz

- Polymetallic Zinc and Lead - 87 GEOs (86 days only).

With Maria Dama Processing Plant, "El ChoCho" Tailings Storage and Polymetallic plant update for 1Q22.

TPRFF Segovia Details (GCM Mining Presentation)

In April 2022, the Company processed 50,802 tonnes, equivalent to 1,693 TPD, at an average head grade of 12.4 g/t resulting in gold production of 18,321 ounces.

One issue is the head grade which has been dropping since 2020 from a high of 16.86 G/T 2020 to 12.4 G/T.

4.2 - Quarterly AISC (consolidated) and the gold price received: Chart history

TPRFF Quarterly gold price and AISC history (Fun Trading)

The AISC decreased sequentially to $1,187 per ounce but was still uncomfortably high. It is up 6% from 1Q21.

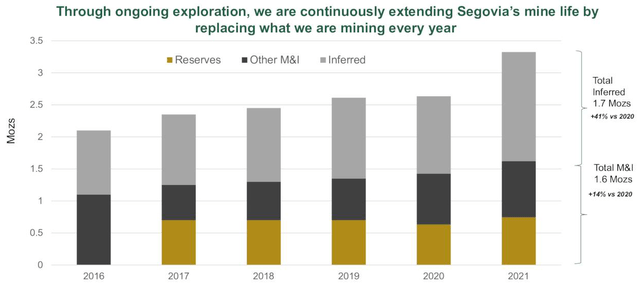

4.3 - Reserves

TPRFF Reserves Presentation (GCM Mining)

The company's ongoing exploration is extending significantly Segovia's mine LOM. Total M&I jumped 14% from 2020 to 1.6Moz.

4.4 - Great Pipeline projects (unchanged)

- Zancudo Project - Colombia 100%

- Juby Project - Ontario, Canada, with Aris Gold

- Toroparu Project - Guyana to be 100%

- Meadowbank - Nunavut 26%

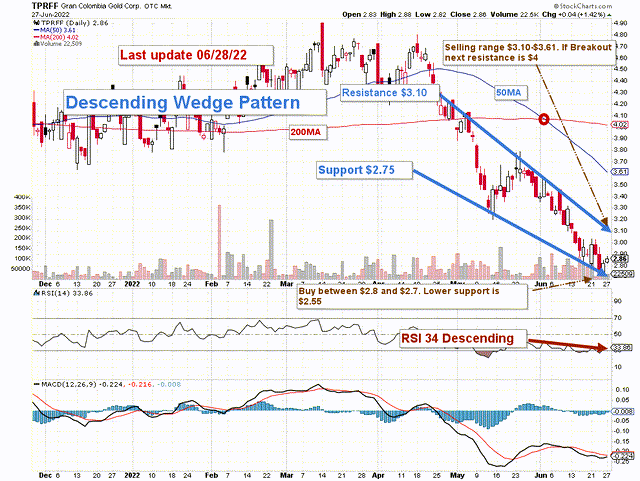

Technical analysis (short term) and commentary

TPRFF TA Chart short-term (Fun Trading)

TPRFF forms a descending wedge pattern, or a falling wedge, with resistance at $3.10 and support at $2.75. The trading strategy is to sell about 30% between $3.10 and $3.61 and accumulate between $2.80 and $2.70.

For those who have decided to keep a long-term position, I strongly recommend trading LIFO while holding a core long-term position for a potential test of $5s or higher.

In a bearish case, TPRFF could cross the support and drop at or below $2.55.

Conversely, if the gold price turns bullish and can trade above $1,880 and $1,920 per ounce, I see TPRFF trading between $5 and $5.50.

Thus, watch the gold price like a hawk.

Note: The LIFO method is prohibited under International Financial Reporting Standards (IFRS), though it is permitted in the United States by Generally Accepted Accounting Principles (GAAP). Therefore, only US traders can apply this method. Those who cannot trade LIFO can use an alternative by setting two different accounts for the same stock, one for the long term and one for short-term trading.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author's note: If you find value in this article and would like to encourage such continued efforts, please click the "Like" button below to vote for support. Thanks.