RE:RE:RE:Anyone know why...BayStreetWolfTO wrote: Scienceguy, I agree you need to determine your metrics. Since you mentioned CJ yes right now they are in good shape but you need to understand the downside in all names

For instance CJ is looking good now but with a drop to $70 not my first pick.If you are confident $90+ it is a good hold

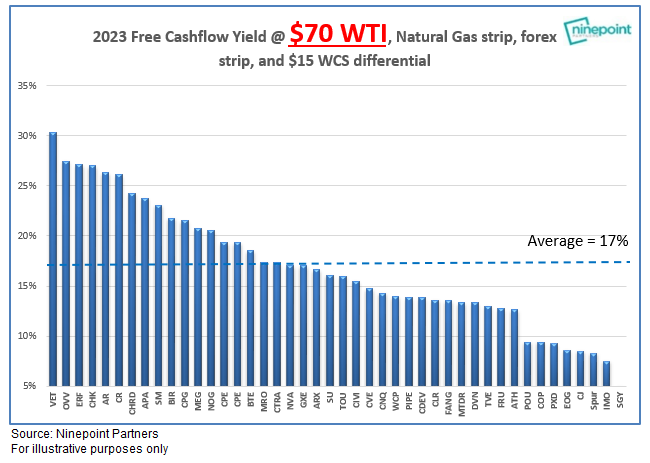

This chart helps detail the downside risk in $70 oil

Again is confident oil will be $90+ it could change your views

here's what CJ said about their dividend when they announced it " When setting the initial rate for the reinstatement of the dividend, Cardinals Board of Directors took into account the backwardation of the one year price curve for WTI crude oil, current debt levels and the sustainability of the dividend in the case of a significant drop in oil prices. The Company's goal is to sustain this level of a monthly dividend with a long-term oil price down to US$55/bbl. At this oil price level, Cardinal expects it could fund the dividend, required ARO expenditures and a capital program maintaining its base production. As the Company continues with its debt reduction strategy and interest costs are reduced, this base oil price level to fund our outlays could also be lowered"

based on Nuttall's chart, at 70 wti using his fcf percentage there wouldn't be enough fcf to pay the dividend. Something doesn't add up.