RE:RE:RE:Stock extremes....Well Meritmat, I don't think the market is really expecting anything special from Suncor on Nov 29, so any significant positive news would be a surprise to the upside. No new substance I think would be a wash. Standard boilerplate and a verbal massage coming I think.

Compared to other names, SU is still able to capture most of the crack spread from the mine to your gas tank, without the worst influence of lower WTI, and blown out WCS differentials. Remember, half the FCF in Q3 came from the refining and retail side, and diesel crack spreads have continued to be very strong and into the near future with such low product inventories currently.

Diesel and HO dropped today which helps close the arbitrage that would have brought more product from Europe to PADD1. Diesel is still high, but came off it's peaks. Perhaps they expect better run rates to help them squeak through winter with near empty tanks, a milder immediate heating season, and the potential release of the heating oil reserves as a backup.

Read more about what is moving oil prices here:

https://www.qcintel.com/latest-news/ With China Covid, recession worry, and the current glut of crude on the water in transit and in floating storage largely caused by Russian oil front running the embargo, it is causing some downward pressure on WTI and Brent. Saudi OSPs are expected to drop in January to clear supply.

General energy market sentiment is low for all producers at the moment, however the share prices are holding near record highs. Draw a comparison chart for XLE to WTI and you will see how strong energy stocks still remain. Now this also works the other way, as instead of shorting oil, some are taking short positions in major producers as technically they think they have further to fall and drop down to close the gap with WTI.

Further significant drops in WTI from around here at $76.50 are getting unlikely, having so much support under it around these levels given Brandon's SPR refilling price floor, and OPEC+ intolerance for low prices.

All this is adding pressure for another significant OPEC+ cut.

Today, another day of watching paint dry. SU went down in sympathy with US big oil today, a little more than most. Super light volumes, only about 25% of the regular activity. Not much liquidity and market depth in the small cap names, so can't draw too many conclusions from today's action.

Further Russian oil price cap level discussions Monday, Dec 4 OPEC+ meeting, and Dec 5 Embargo are next up to bat.

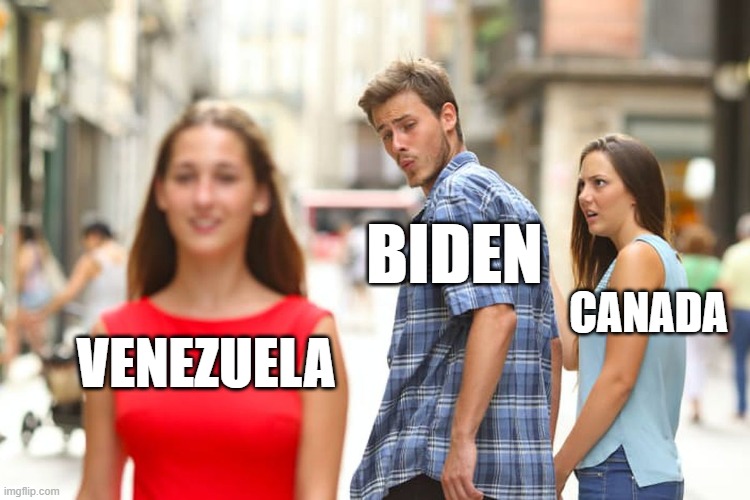

We also have a Chevron / Venezuelan meeting this weekend. I think this kind of news has the potential to offer a world of hurt to WCS differentials long term.

meritmat wrote: Will they really punish the share price if there's nothing of substance in the news release? We're 2/3 done 4th qt with the average oil price over 80. There printing money. Plus they just increased div. Keep doing what your doing no complaints here