Premiums Paid for 100 Ounce Silver BarsThere has been much recent coverage of the rising premiums beingpaid to purchase physical gold and silver bullion. This has been citedas a consequence of the extreme demand for precious metals and evidenceof the growing disconnect between market prices and physical prices.

Idecided to look at some data to calculate exactly what kind of premiumsare being paid and see if any trend or patterns in the data could bedetermined.

Specifically, I looked at selling prices for 100 ounce silver bars on eBay (EBAY).I decided to use this as a source of data since 100 ounce silver barshave historically been a low premium method to acquire silver. Also,bars of silver are relatively undifferentiated. Bullion coins fromdifferent countries or with different dates often carry premiums basedon those differences.

I used eBay data because it wasaccessible. Completed auction records can be obtained for the prior twoweeks or more. Also, I believe that eBay represents a real time, liquidmarket of buyers and sellers who discover prices through a biddingprocess. Quoted dealer prices may be for delivery at a later date andmay not represent actual available supplies.

There are somepossible flaws with this method. It does not take into accountpotential premiums for different manufacturers. I don’t know if peoplepay more for different makes of bars. Also, shipping costs are notincluded in the price data used. Some auctions may carry highershipping charges which would impact the final selling prices. Andlastly, some auctions were “true auctions” which start at a minimalopening bid while others were fixed price listings.

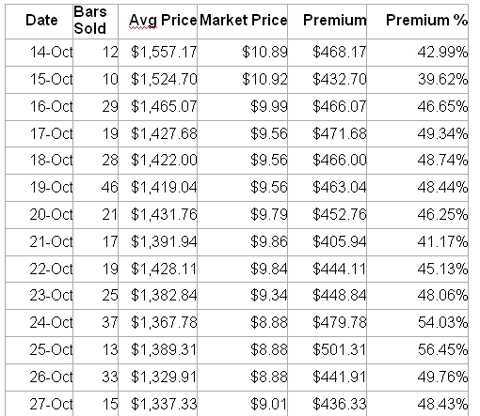

Data wasavailable from October 13 to yesterday’s date. I did not include datafor yesterday or October 13, since it may represent partial data. Idetermined the average price for each day’s auctions which closed witha sale. I compared this to the closing market price of silver for eachday.

Here is a summary of the data:

Average Price for 100 Ounce Silver Bars on eBay Compared to Market Price of Silver

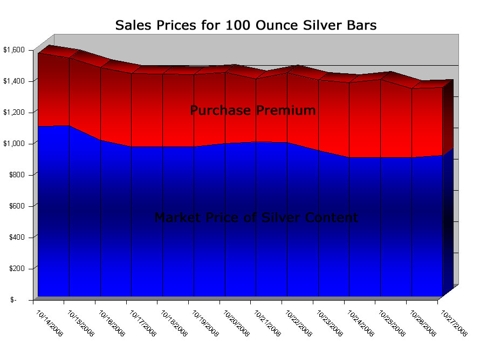

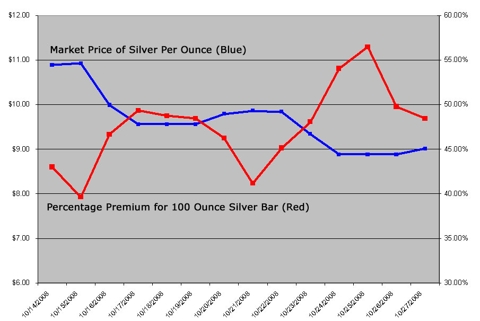

Somecharts based on this data appear below. The data is only for a limitedtime frame, but it does spur some interesting observations (click toenlarge images).

Thepremium paid for a 100 ounce silver bar has ranged from 39.62% to56.45%. The premium represents the amount paid in excess of theso-called “market price” of silver. People are clearly payingastounding premiums to acquire physical silver.

On October 15and 22, the market price of silver dropped. In each instance thiscaused the percentage premium to rise. This lends some evidence to theanecdotal observation that a decline in market price only spurs greaterdemand for the physical metal.

Two distinct prices for silverseem to exist. The paper price for the contractual right to acquirefuture silver, and the physical price to acquire real silver, in hand.How and when will this situation resolve itself?

There have been several recent reportsof bullion buyers seeking to take physical delivery of silver and goldfrom the COMEX. This would allow buyers to purchase real silver at theheretofore “fictional” paper price. If these deliveries take place andbecome a dependable source of purchasing physical silver, premiums for100 ounce bars and other physical silver would likely begin to subside.

Onthe other hand, some are voicing the possibility that since the COMEXonly has small coverage of physical metal for outstanding contacts, ifenough contact holders demand delivery they will be forced to defaultand settle in cash. If this occurs, the likely result would be soaringmarket prices for silver and potentially greater premiums as theargument for physical scarcity gains another leg of support.

Disclosure: Author owns physical gold and silver.