FYI Why Fitbit Might Break Out This Year

Summary

Fitbit benefited from strong holiday sales and issued a strong outlook.

Broad range of products should help grow sales.

Strategic spending in R&D and sales and marketing will bear fruit this year.

Despite a 30 percent short float on Fitbit (NYSE:FIT), the company may prove its resilience in the wearable athletics market. The company has a broad spectrum of products and faces limited competition from Garmin (NASDAQ:GRMN) and Apple (NASDAQ:AAPL) (via Apple Watch). Due to its strategic investment in research and marketing, Fitbit may prove the bears wrong this year.

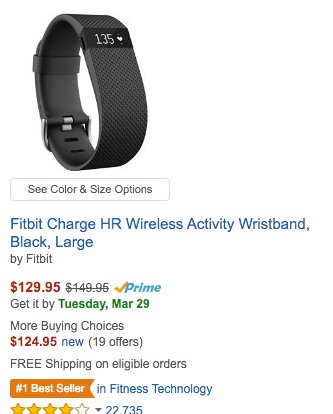

Fitbit's sales may surprise investors this year after it introduced several new products a year ago. On its website, consumers have nine products to choose from. Two new devices, the Alta and the Blaze, address the fashion aspect of wearable devices. Apple's price cut announced on March 21 strongly suggests the company faced weak demand despite all the initial hype. Apple is still addressing the demands of fashion by offering choices of watchbands. Similarly, Fitbit's Blaze is priced at $249, $50 lower than that of the Apple Watch. Smart watches are less of a competitive threat for Fitbit than Garmin. Engadget ranked Garmin's vivosmart HR as the best fitness tracker, followed by the Fitbit Charge HR.

Garmin has a technical advantage over Fitbit for reporting more accurate fitness data. This is due to the use of a GPS to measure such things as running distance. Still, Engadget said Garmin's user interface is less user-friendly for users compared to that of Fitbit.

R&D costs increase

Fitbit boosted its R&D by threefold, increasing headcount to 624 by the end of 2015, compared to 226 the year before. By aligning the products with the needs of the growing user community, the company's revenue should improve over time. Fitbit's active users grew to 16.9 million, up from 6.7 million as at the end of 2014.

To support its global growth, Fitbit more than doubled its sales and marketing expenses. As awareness for the company's product improves worldwide, expect Fitbit to lower S&M spend but sustain its revenue growth.

Source: Fitbit

As Fitbit inks supply deals with corporate employers, such as Wendy's (NASDAQ:WEN) and YMCA, it will further build its moat in health wellness.

Investors who believe Fitbit's stock is rebounding need not rush into buying just yet. The company's last quarter benefited from seasonal strength. Holiday sales helped the company grow revenue by 92 percent in the fourth quarter. Gross profit margin improved to 48.8 percent, up from 45.9 percent year-over-year. It is worth noting expenses grew at a faster clip, up 139 percent year-over-year. As brand recognition strengthens, expect expenses to decline.

Risks

Fitbit runs the risk of not outpacing expenses with better sales. In the fourth quarter, DSO (day sales outstanding) jumped from 48 (in Q4/2014) to 56 days. An inventory overhang may hurt the current quarter. Fortunately, Fitbit issued its guidance for this year. It expects up to $2.5 billion in revenue and sustained gross margins (to 49%).

Fitbit a worthwhile speculation

Fitbit's profitability is at an inflection point. If the company's sales and marketing spend help boost awareness for its brand and offering worldwide, revenue growth will accelerate. The broad array of products gives Fitbit flexibility in adjusting the product mix as required.

Already, on Amazon.com, Fitbit Charge is the number one best seller in the fitness technology. Conversely, Microsoft (NASDAQ:MSFT) Band has only around 650 reviews, while Garmin's vivofit has 1,500. With its brand dominance over the competition, Fibit has strong momentum in exceeding its own expectations.

1. Hope springs eternal, but IMO has a time limit

2. Hopefully the short float will provide support, but at what level do they cover?

carlos