Introduction

Copper and zinc haven't really been popular in the market lately, but I was still curious about how Nevsun Resources (NYSEMKT:NSU) was doing, as this copper producer in Eritrea is converting itself to be a zinc producer from next year on. The company has now released an update on its zinc expansion plans, and even though there seems to be a one-month delay, I will explain why this is not a bad thing.

NSU data by YCharts

The construction update is actually pretty positive

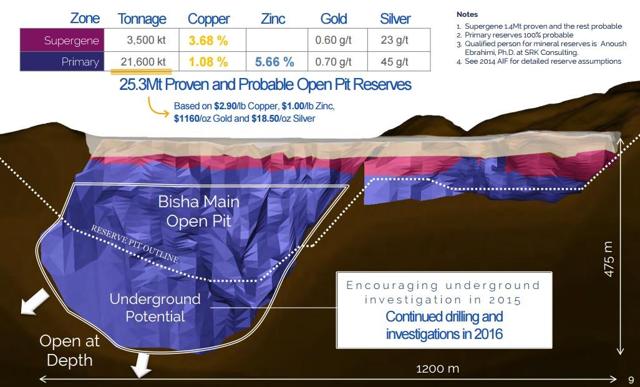

It's great to see how Nevsun is doing its best to keep its shareholders engaged by providing continuous updates on how construction of the zinc plant is progressing. As you might remember, Nevsun's Bisha project is a VMS type deposit, and after having produced gold, the company has reached a mineralized zone which is very rich in copper, but will reach a mineralized zone with relatively high levels of zinc from next year on. In order to be able to recover the zinc as efficiently as possible, the company had to construct a new plant to process the (primary) ore.

Source: company website

It's great to see the expansion is continuing on schedule, but it's even nicer to see the company now expects the zinc plant to be approximately 20% cheaper than originally anticipated. Instead of $100 million, the total capital expenditures are now expected to be approximately US$80 million, and this US$20 million of cost savings will immediately benefit the current shareholders of the company.

Source: company website

There also was some sort of negative connotation due to the fact that the company now expects to delay the commissioning of the project by one month, but there is a very simple explanation for this.

First of all, the company has gained access to more ore from the supergene phase (this is the layer with high-grade copper) which means the company will be able to extend its copper production phase by approximately one month, so a later start-up moment of the zinc phase is not really a big deal (it's not like the production process will have to be shut down for a month). On top of that, Nevsun says it wants to prioritize the sale of more precious metals stockpile material, as the company seems to be getting a very good price for the stuff.

Selling the precious metals stockpile will increase the cash position even further

Selling this precious metals stockpile 'concentrate' has always been the icing on the cake for Nevsun. As you might remember, the company had stockpiled some high-grade pyrite sands at the Bisha mine site as Nevsun was waiting for a good moment to sell. Selling the stockpile will have a big impact on the company's bottom line, as these pyrite sands were expected to contain approximately 60-70,000 ounces of gold. So basically, this is just cash (this is an end-product which I consider to be 'as good as cash') that was being held up as inventory as long as Nevsun was unable to sell the concentrate (at the terms it wanted).

Of course, it's always better to wait until you get a better price, and it looks like that moment has now arrived. Nevsun said the strong demand from prospective buyers has led to more favorable terms, whilst the crashing shipping rates for bulk transportation are also reducing the costs to transport and ship the pyrite sands to the end customers. Nevsun has already shipped 20,000 tonnes of the stockpile material to buyers in Q1 and expects the shipments to continue throughout 2016, unlocking additional value for its shareholders, as well as adding more cash on its balance sheet.

Source: company presentation

And selling the first 20,000 tonnes will be a boost for the company's financial results, as the copper price still isn't really cooperating. If the average grade of the 'concentrate' (yes, I dare to say this stockpiled sand has concentrate-like characteristics) that has been sold is indeed 20 g/t gold as well as 800 g/t silver, the company will have sold in excess of 12,000 ounces of gold as well as 500,000 ounces of silver, mitigating the impact of the low copper price on the revenue and cash flows.

Also, keep in mind the zinc production from Bisha has not been committed to an offtake agreement just yet, providing the company an additional leverage to negotiate a good deal. The zinc supply (and especially the supply from new mines that would also need offtake agreements) is expected to be much lower in the second half of 2016, when the Bisha zinc is expected to hit the market.

Investment thesis

Everything seems to be going all right at Nevsun, and I'm particularly pleased with the zinc plant coming in under budget whilst there will be more copper at lower production cost than originally expected. And the additional bonus is the fact that the company has been successful in marketing its precious metals stockpile, which could result in an additional $10M+ boost to the first quarter revenue (and $40-60M in the entire financial year).

I remain confident Nevsun knows what it's doing, and I wouldn't be surprised if the company's offtake agreement for the zinc would be based on more advantageous terms than the market is expecting. The company's shares currently have a dividend yield of in excess of 5%, whilst in excess of two-thirds of the market capitalization is backed by cash in non-Eritrean bank accounts.

Disclosure: I am/we are long NSU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.