edv in new seeking alpha article Endeavour Mining (OTCQX:EDVMF) - Eating And Growing - Full Steam Ahead (original write-up here)

Current Price: C$14.05

Shares Outstanding: 59.0 million

Net Debt: US$125 million

Target Price: C$18.00

Total Return to Target: 28%

52-Week Range: C$4.35 - C$14.45

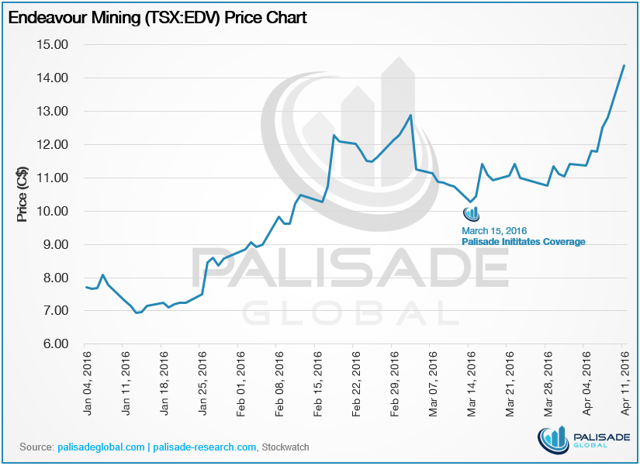

We are raising our price target for Endeavour Mining from C$15.30 to C$18.00. The increase reflects the green-light or de-risking of Hound and the lower than expected AISC. With the acquisition of True Gold expected to close in the near future, Endeavour's production profile has changed drastically since we began coverage just last month. We have already seen a great return since we initiated coverage (March 15, 2016 at C$10.43), however, we believe there is still plenty of room to run.

Just last month, Hound was fully permitted and awaiting an investment decision, which was scheduled for H1 2016. Upfront capital was expected to be $325 million, and would provide Endeavour with 190 koz gold per year for over 10 years at an expected mine-level AISC cost of less than $720 per ounce.

The lower AISC of $709 per ounce will lower EDV's overall AISC guidance from $870-920 per ounce to ~$850. What is most impressive with the construction of Hound is that it will be financed almost all with cash. EDV's total existing sources of capital, excluding 2016-2017 cash flow is $352 million, well above the estimated initial capital expenditure of $328 million.

By 2018, Endeavour expects to produce 900 koz per year, and lower its average AISC to below $800 per ounce. Our forecast is not as aggressive, projecting Endeavour will be an 890 koz producer by 2018, (737 koz attributable to Endeavour), with AISC remaining around the current $850 per ounce.

To achieve the lower AISC, we expect EDV is actively marketing Nzema, which is expected to incur an AISC of $970-$1,020 per ounce this year. Once that dead weight is shed, Endeavour will be on the hunt for another acquisition.

Moving forward, EDV will be the consolidator of West Africa, and we have some guesses on its next target. Furthest down the list we have Roxgold (OTC:ROGFF) (TSXV:ROG, Mkt Cap: C$ 353.3M), who owns the Yaramoko project in familiar Burkina Faso. Yaramoko expects to pour its first gold in June 2016 and will produce on average 99,500 ounces per year for 7.4 years. Did we forget to mention an average AISC of $590 per ounce? Our only doubt about Roxgold is that it does not really fit EDV's project profile; Yaramoko will be a high-grade underground mine, while Endeavour's bread and butter has been open-pit with a significant oxide component.

That is why Orezone Gold Corp. (OTCPK:ORZCF) (TSXV:ORE, Mkt Cap: C$82.8M) seems like the more intuitive play. Orezone's flagship asset is the Bombor project, also located in Burkina Faso. It is the largest undeveloped gold deposit in the region, and can be built in stages to reduce initial capital expenditures, an attractive feature as the mine comes with a $250 million price tag. Bombor fits EDV's project mold, an oxide resource, a production profile for first eight years of 135 koz per annum, and an attractive AISC of $687 per ounce. 2016 will be a momentous year for Orezone as it plans to update its resource through 50,000 meters of additional drilling, but more importantly, it expects approval of its mining permits.

Lastly, on more of a project level, we believe Perseus Mining (TSX:PRU, Mkt Cap: C$227.6M)'s Sissingue Gold Project in Cote d'Ivoire almost fits the mold, albeit it is on the small side . The project's feasibility plans on 75 koz per year for the first five years with an AISC of $632 per ounce.