FM Volume SoaringGood article regarding FM volumes..

First Quantum Minerals Is Soaring In The TSX Volume Charts

Summary

After many setbacks is the time right for a short-term hold in First Quantum Minerals.

Positive changes in the copper market are creating tail winds for First Quantum Minerals.

The Q2 2016 report is coming on July 27, is now the time to buy?

Over the past couple of years First Quantum Minerals (OTCPK:FQVLF), has struggled with lower copper prices, mine issues and a debt load which led many to question the future of the company. Now things are beginning to change in the company itself and the overall markets which may create a prime opportunity for investors to jump in for a short-term hold on the stock.

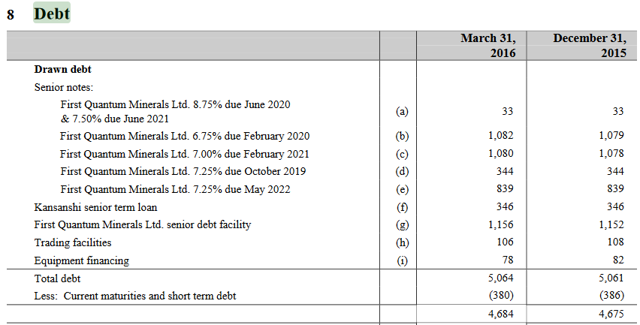

Back in May 2016 executives with the company stated that "The liquidity crisis at First Quantum Minerals Ltd. is largely over". A crisis which was sparked by the company's ballooning debt loads of (as of Q1 2016) $4.68 billion in total debt and $7.99 billion in total liabilities. Then there were also debt covenants which stated that First Quantum had to maintain a net debt to EBTIDA ratio of no less than of 5.5 times in Q1 2016 & Q2 2016, and a ratio of 4.5 times in Q3 2016 and Q4 2016.

Click to enlarge Source

The timing of the debt repayment forced to company to take drastic measures including; raising C$1.44 billion in the largest base metals equity offerings in nine years and the sale of its Kevitsa mine located in Finland for $712 million.

Then there has been the sharp decline in the price of copper in recent years which has put added strain onto the company and investors. In Q1 2016 copper represented the bulk of First Quantum's revenues, as $576 million of First Quantum's Q1 2016 revenues of $720 million came from copper.

A stirring from the east

Along with First Quantum's push to get out from under its debt burden, news from the east is shinning a faint light on the company. Following the recent election in Japan which saw Shinzo Abe and his coalition win hands down has brought with it talk for a national stimulus program. Early talk about the stimulus program has it pegged around $100 billion for public works project, as the government states that , "We are going to make bold investment into seeds of future growth". Another driving factor for the yet to be confirmed stimulus package is the continued lower machinery orders in the country, and voter outcry for economic revival.

This news alone has already begun to start a recovery in the price of copper as it is now trading at $2.23/lb a price not seen for several months. There is also news coming out of China that in June it had a 20.3% year over year increase in copper imports. It appears that June wasn't just an anomaly as over the first six months 2016 copper imports in China are up 21% year over year.

What to do with First Quantum

First Quantum is still far from being a perfect company and a long term hold is still a risky venture, however a shorter term hold could prove to be profitable. Given the positive news about the company and the copper industry recently First Quantum has been surging near the top of the TSX volume charts with a ten day average of 7,479,405 and a three month average of 7,992,154.

Another factor which could be ramping up trading is the upcoming Q2 2016 report which is scheduled for release on July 27. In a quick review in Q1 2016 First Quantum posted revenues of $720 million up from $602 million and a net loss of $218 million up from the Q1 2015 net loss of $98 million. These results came in while copper had an average price of $2.20/lb, and as of Thursday copper was trading at $2.24/lb.

With all of the trading activity around this stock and the positive news the stock has gone from (on the TSX) C$8.73 on June 27 to C$10.85 on July 14 and has a 52 week range of C$2.15 to C$16.33. There is still an underlying belief that the company will end the year in positive territory as a report from Jefferies Group has shown that they have increased their estimated 2016 EPS from $0.17 to $0.19, which would be a major increase from the 2015 EPS of -$0.77.

Analysts are slightly mixed about the stock with six firms recommending "sell", seven have a "hold" and finally nine with a "buy" rating. This has brought the average price target to C$11.06, When we look into these price targets the more bullish estimates such as C$12.50 with an outperform rating from Scotiabank and the most bearish estimate comes from Goldman Sachs with a price target of C$5.50 and a "sell rating".

With so many analysts at odds with each other it becomes apparent why with First Quantum it is such a hard case to make for a long-term hold. Given its history, rich fwd p/e ratio of 47.15 and nominal dividend of C$0.09 annualized with a yield of 0.84%. However in the short term given all of the positive momentum the stock should exceed its current average price targets, how long that'll last is another question entirely.

Author's note: If you enjoyed this article and found it helpful, please "Follow" me on Seeking Alpha to receive notification whenever I publish a new article.

You may also be interested in other recent articles I have written for Seeking Alpha with my Canadian point of view that focus on stocks and stories that I have found compelling. You can also find my previous articles here for further study.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.