China Locking Up Materials Instrumental for EV Batteries

China's EV Battery Industry Could Be A Repeat Of Solar And Rare Earth Dominance

Summary

The Chinese have come to dominate the Solar and Rare Earth industries, and electric vehicle batteries may be next.

Chinese companies are locking in supplies of materials instrumental for EV batteries which will impact prices and supply.

Chinese EV battery manufacturers are developing products that will eventually be technologically better and at a lower price than non-Chinese batteries.

Solar

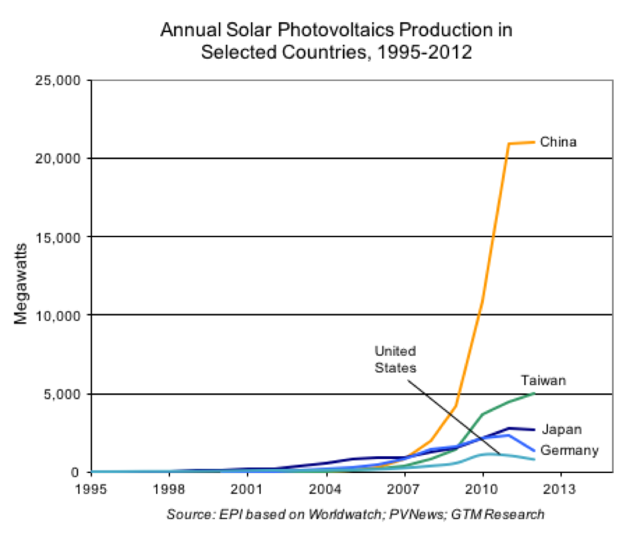

We all know what happened to the solar industry. In 2001 China made just 1% of the solar panels produced worldwide. In 2012, China held 58% of the solar panel production. The chart below illustrates the transition to global dominance.

In 2015, China's manufacturers held five of the top ten spots. Two Taiwanese companies entered the top ten rankings in 2015 compared to none in 2014.

|

2015 Rank

|

Company

|

Headquarters

|

|

1

|

Trina Solar TSL)

|

China

|

|

2

|

JA Solar (NASDAQ:JASO)

|

China

|

|

3

|

Hanwha Q Cells (NASDAQ:HQCL)

|

South Korea

|

|

4

|

Canadian Solar (NASDAQ:CSIQ)

|

China

|

|

5

|

First Solar (NASDAQ:FSLR)

|

USA

|

|

6

|

Jinko Solar JKS)

|

China

|

|

7

|

Yingli Solar (NYSE:YGE)

|

China

|

|

8

|

Motech Solar

|

Taiwan

|

|

9

|

NeoSolar

|

Taiwan

|

|

10

|

SunPower (NASDAQ:SPWR)

|

USA

|

With the rise of Chinese solar manufacturers came the demise of hundreds of competitors.

Shown below is a list of solar manufacturers that have either gone out of business or were acquired by other manufacturers, as compiled by GTM.

|

Solar Companies Out of Business 2009 - 2015

|

|

|

2009 to 2010

|

|

|

Bankrupt, closed, acquired

|

|

|

• Advent Solar (emitter wrap-through Si) acquired by Applied Materials

|

|

• Applied Solar (solar roofing) acquired by Quercus Trust

|

|

• OptiSolar (a-Si on a grand scale) closed

|

|

• Ready Solar (PV installation) acquired by SunEdison

|

|

• Solasta (nano-coaxial solar) closed

|

|

• SV Solar (low-concentration PV) closed

|

|

• Senergen (depositing silane onto free-form metallurgical-grade Si substrates) closed

|

|

• Signet Solar (a-Si) bankrupt

|

|

• Sunfilm (a-Si) bankrupt

|

|

• Wakonda (GaAs) closed

|

|

|

|

2011

|

|

|

Bankrupt, closed

|

|

|

• EPV Solar (a-Si) bankrupt

|

|

• Evergreen (drawn Si) bankrupt

|

|

• Solyndra (CIGS) bankrupt

|

|

• SpectraWatt (c-Si) bankrupt

|

|

• Stirling Energy Systems (dish engine) bankrupt

|

|

|

Acquisition, sale

|

|

|

• Ascent Solar (CIGS) acquired by TFG Radiant

|

|

• Calyxo (CdTe) acquired by Solar Fields from Q.cells

|

|

• HelioVolt (CIGS) acquired by Korea's SK Innovation

|

|

• National Semiconductor Solar Magic (panel optimizers) exited systems business

|

|

• NetCrystal (silicon on flexible substrate) acquired by Solar Semiconductor

|

|

• Soliant (NYSE:CPV) acquired by Emcore

|

|

|

|

2012

|

|

|

Bankrupt, closed

|

|

|

• Abound Solar (CdTe) bankrupt

|

|

• AQT (CIGS) closed

|

|

• Ampulse (thin silicon) closed

|

|

• Arise Technology (PV modules) bankrupt

|

|

• Azuray (microinverters) closed

|

|

• BP (c-Si panels) exits solar business

|

|

• Centrotherm (PV manufacturing equipment) bankrupt

|

|

• CSG (c-Si on glass) closed by Suntech

|

|

• Day4 Energy (cell interconnects) delisted from TSX exchange

|

|

• ECD (a-Si) bankrupt

|

|

• Energy Innovations (CPV) bankrupt

|

|

• Flexcell (a-Si roll-roll BIPV) closed

|

|

• GlobalWatt (solar) closed

|

|

• GreenVolts (CPV) closed

|

|

• Global Solar Energy (CIGS) closed

|

|

• G24i (DSCs) bankrupt in 2012, re-emerged as G24i Power with new investors

|

|

• Hoku (polysilicon) shut down its Idaho polysilicon production facility

|

|

• Inventux (a-Si) bankrupt

|

|

• Konarka (OSCs) bankrupt

|

|

• Odersun (CIGS) bankrupt

|

|

• Pramac (a-Si panels built with equipment from Oerlikon) insolvent

|

|

• Pairan (Germany inverters) insolvent

|

|

• Ralos (developer) bankrupt

|

|

• REC Wafer (c-Si) bankrupt

|

|

• Satcon (NYSEARCA:BOS) bankrupt

|

|

• Schott (c-Si) exits c-Si business

|

|

• Schuco (a-Si) shutting down its a-Si business

|

|

• Sencera (a-Si) closed

|

|

• Siliken (c-Si modules) closed

|

|

• Skyline Solar (LCPV) closed

|

|

• Siemens (CSP, inverters, BOS) divestment from solar

|

|

• Solar Millennium (developer) insolvent

|

|

• Solarhybrid (developer) insolvent

|

|

• Sovello (Q.cells, Evergreen, REC JV) bankrupt

|

|

• SolarDay (c-Si modules) insolvent

|

|

• Solar Power Industries (PV modules) bankrupt

|

|

• Soltecture (CIGS BIPV) bankrupt

|

|

• Sun Concept (developer) bankrupt

|

|

|

Acquisition, fire sale, restructuring

|

|

|

• Oelmaier (Germany inverters) insolvent, bought by agricultural supplier Lehner Agrar

|

|

• Q.Cells (c-Si) insolvent, acquired by South Korea's Hanwha

|

|

• Sharp (a-Si) backing away from a-Si, retiring 160 of its 320 megawatts in Japan

|

|

• Solibro (CIGS) Q-Cells unit acquired by China's Hanergy

|

|

• Solon (c-Si) acquired by UAE's Microsol

|

|

• Scheuten Solar (BIPV) bankrupt, then acquired by Aikosolar

|

|

• SolFocus (CPV) layoffs, restructuring for sale

|

|

• Sunways (c-Si, inverters) bought by LDK, restructuring to focus on BIPV and storage

|

|

|

|

2013

|

|

|

Bankrupt, closed

|

|

|

• Bosch (c-Si PV module) exits module business

|

|

• Concentrator Optics (CPV) bankrupt

|

|

• Suntech Wuxi (c-Si) bankrupt

|

|

|

Acquisition, sale, restructuring

|

|

|

• Diehl (Germany inverters) inverter division sold to PE firm mutares AG

|

|

• ISET (CIGS) moving into "microsolar"

|

|

• MiaSol (CIGS) acquired by China's Hanergy

|

|

• Nanosolar (CIGS) restructuring for sale

|

|

• NuvoSun (CIGS) acquired by Dow

|

|

• Twin Creeks (kerfless Si) acquired by GT Advanced Technology

|

|

• Wuerth Solar (installer) business turned over to BayWa

|

|

|

2014

|

|

|

Bankrupt, closed

|

|

|

Areva's solar business (NYSE:CSP) closed

|

|

• HelioVolt (CIGS thin-film PV) closed

|

|

• LDK (vertically integrated module builder) filed for bankruptcy

|

|

• Masdar PV (a-Si) closed its SunFab-based amorphous silicon PV factory in Germany.

|

|

• SolarMax (PV inverters) -- Swiss inverter maker SolarMax's parent firm, Sputnik Engineering, filed for insolvency.

|

|

• Sopogy (small-scale CSP) closed -

|

|

• TEL (a-Si) withdrew from its a-Si solar business

|

|

• Xunlight (a-Si) went bankrupt

|

|

|

Acquisition, sale, restructuring

|

|

|

• Emcore's CPV business -- Suncore acquired the remaining interest in Emcore's CPV business.

|

|

• RSI (CdTe PV panels) sold to Chinese strategic -- RSI,

|

|

• Solar Junction (CPV semiconductors) sold to Saudi strategic

|

|

• SAG Solarstrom, a bankrupt PV project developer, was sold to Shunfeng Photovoltaic, the owner of PV panel builder Suntech

|

|

|

2015

|

|

|

Bankrupt, closed

|

|

|

• Enecsys (microinverters) bankrupt

|

|

• QBotix (trackers) closed

|

|

• Solar-Fabrik (c-Si) bankrupt

|

|

• Soitec (CPV) closed

|

|

• TSMC (CIGS) closed

|

How did this happen, one might ask? A rush of new products from low-cost Chinese manufacturers pushed panel prices down sharply and squeezing margins. China can make solar panels for about 25% less than U.S. companies because Chinese factories are four times larger than a U.S. plant, and because of economies of scale, bigger operations can negotiate better contracts with suppliers and equipment can be used more efficiently.

But the real culprit was cheap debt provided by the Chinese Development Bank (CDB). In 2010 alone, the bank handed out $30 billion in low-cost loans to the top five manufacturers in the country, enabling China's solar producers to grow to GW scale in a very short period of time.

Rare Earth Elements

Through a series of clever, systematic manipulations China now owns the rare earth element (NYSEMKT:REE) market. During the past twenty years there has been an explosion in demand for many items that require rare earth metals. China being China capitalized on its rich REE deposits and cheap labor to drive down prices to a point that nearly every mine outside China was forced to shut down because they couldn't compete on price. The ROW being the ROW allowed China to take away business because of cheap labor. In 2010, China cut export quotas for the minerals needed to make hybrid cars and televisions by 72%.

The price hike sparked a huge expansion in production in China, including unregistered output estimated to account for 40% of the domestic industry. At the same time, manufacturers stepped up efforts to find ways of doing without rare earths, recycle higher volumes from discarded products, or swap the most expensive rare earths for those that are more abundant. By 2012 prices had collapsed, falling as much as 80%.

However, China still dominates the critical supply chain. Rare earth materials require a number of processing stages before they can be used in an application:

- Mining rare earth ore from the mineral deposit;

- Separating the rare earth ore into individual rare earth oxides;

- Refining the rare earth oxides into metals with different purity levels;

- Forming the metals into rare earth alloys; and;

- Manufacturing the alloys into components, such as permanent magnets, used in defense and commercial applications.

Based on industry estimates, rebuilding a U.S. rare earth supply chain may take up to 15 years and is dependent on several factors, including securing capital investments in processing infrastructure, developing new technologies, and acquiring patents, which are currently held by international companies.

China possesses around 50% of the world's REE reserves, and has over the past two decades supplanted the US as the premier world REE supplier, due to a few significant factors.

China supplies between 85% and 95% of global demand for the 17 rare earth powders and metals, which are used in high-tech applications such as smartphones, catalysts, LED screens, polishing compounds and ceramics. The single biggest use is in permanent magnets for wind turbines and hybrid electric cars, while metal alloys are emerging as a growth area, particularly for hydrogen storage.

The development of REE resources has over the years received Chinese government support (some sources even quote Deng Xiaoping saying that one day China will become 'the Saudi Arabia of rare earths').

Is the EV Battery Industry the next Battleground?

Tesla (NASDAQ:TSLA) has hinged its EV business on a lithium ion battery supplied by Panasonic (OTCPK:PCRFY). Tesla has used these batteries to power its Model S and Model X electric cars using the cylindrical 18650 format (18 millimeters in diameter and 65 millimeters in length). For the Model 3, cost considerations for the lower-priced model forced Tesla to move to a 2170 format (21 millimeters in diameter and 70 millimeters in length), but still with the Lithium Nickel Cobalt Aluminum (Li1-xNiCoAlO2) (NYSE:NCA) chemistry, although slightly modified to further reduce cost. I discussed this move in a Seeking Alpha https://seekingalpha.com/article/3997232-teslas-battery-strategy-spot-improvements-delay-model-3 entitled "Tesla's Battery Strategy Is Spot On, But Improvements Could Delay The Model 3."

New revelations in Tesla's October 7, 2016 S-4A filing have surfaced about Panasonic's $1.7 billion purchase commitment. Simply put, Panasonic purchased battery making equipment and installed in in Gigafactory, but Tesla must pay it back through battery purchases. It makes me wonder whether Tesla stayed with Panasonic for the Model 3 because Musk was staring at a much needed $1.7 billion cheque or whether the Panasonic battery was the best choice.

Why do I bring this up? Remember, there were rumors in May 2016 that Tesla was evaluating batteries from LG Chemical and Samsung SDI. Those rumors evaporated and Musk denied them. LG Chemical's polymer pouch cell batteries are used in models from Volkswagen (OTCPK:VLKAY), Ford (NYSE:F), Hyundai (OTC:HYMTF), Renault-Nissan, Audi, Chevrolet, Kia (OTC:KIMTF), GM (NYSE:GM), and Daimler Group (OTCPK:DDAIF). Samsung SDI's customers include Fiat (NYSE:FCAU) and BMW. Both companies use Lithium Nickel Manganese Cobalt (Li1-x(NiMnCo)O2) (NMC) chemistry.

But the biggest EV industry is in China encompassing more than 200 manufacturers. According to Bloomberg Technology:

"China has used a combination of subsidies and directives to push local governments, automakers and consumers to embrace the use of electric vehicles, which are seen as a way to reduce air pollution while serving the strategic goal of cutting oil imports. State incentives are coming under increased scrutiny amid a probe into funding fraud and as the government weans companies from handouts to speed up improvements in technology."

Investors have poured more than $2 billion into building new-energy vehicles. China surpassed the U.S. last year to become the world's biggest market for new-energy vehicles -- comprising electric vehicles, plug-in hybrids and fuel-cell cars. Domestic automakers sold 331,092 units in 2015, according to the China Association of Automobile Manufacturers (CAAM)

Sales in 2016 are growing at a torrid rate. For the first seven months, the production and sales of new energy vehicles reached 215 thousand units and 207 thousand units respectively, increasing 119.8% and 122.8% year on year, according to CAAM.

One issue with China batteries is the chemistry. While LG and Samsung are making Lithium Nickel Manganese Cobalt (Li1-x(NiMnCo)O2) (NMC) batteries, as noted above, most Chinese battery manufacturers use Lithium Iron Phosphate (Li1-xFePO4) (LFP) chemistry.

China in Locking in Supplies of Cobalt and Lithium Raw Materials

Cobalt

Both Tesla's NCA and LG's and Samsung's NMC batteries use cobalt in its chemistry. Much of China's production was from ore and partially refined cobalt imported from Congo (Kinshasa). Internal stocks of cobalt materials also contributed to China's supply. China was the world's leading consumer of cobalt, with nearly 75% of its consumption being used by the battery industry.

Freeport-McMoRan Inc. (NYSE:FCX) announced on May 9, 2016 that it has entered into a definitive agreement to sell its interests in TF Holdings Limited to China Molybdenum Co., Ltd. (CMOC) for $2.65 billion. In addition, FCX has agreed to negotiate exclusively with CMOC to enter into definitive agreements to sell its interests in Freeport Cobalt, including the Kokkola Cobalt Refinery in Finland, for $100 million and the Kisanfu Exploration project in the Democratic Republic of Congo for $50 million.

The purchase of the Tenke mine illustrates how Chinese companies are now moving to take a dominant position in battery materials, just as they did for Solar and REEs. If the Tenke mine acquisition goes through, Chinese companies will be responsible for more than 60% of global refined cobalt production.

The price of raw cobalt is a major component of the Tesla/Panasonic NCA battery and is presently priced at $26.26 per kg. The weight of the cells is 318 kg. In the compound, Co weighs 32% of the total mass from the stoichiometry of the compound. That translates to $3.30/Wh just for the cost of Co for the cathode. However, some compositions have as little as 10% Co, which reduces the price to $1.00/Wh for Co.

As Chinese battery manufacturers move from LFP (I'll discuss why later in the article), which contains no cobalt, to NCM which does, we can expect to see a rise in cobalt prices.

Lithium

With respect to lithium, higher than expected EV sales in China caused lithium prices to triple between 2H15 and 2H16, although prices have since moderated.

Currently, the majority of Chinese lithium comes from the Chang Tang plain in Western Tibet. The US Geological Survey pegs the country's lithium reserves at 3,500,000 tons. China is moving to expand its supply of lithium as it is doing with cobalt.

China's Tianqi Lithium Industries is set to build a $306 million plant in Australia which it aims to open in late 2018, expanding its output of lithium hydroxide used in EVs. The Greenbushes mine is run by Talison Lithium, which is jointly owned by Tianqi and lithium producer Albemarle and accounted for more than 35% of global supply last year.

Tianqi beat out Rockwood Holdings to take control of Talison Lithium, which owns the Greenbushes mine in Australia, in 2012. However, it subsequently sold a 49-percent interest in the company to Rockwood, which is now owned by Albemarle.

Like Tianqi, Ganfeng is also buying up interests in lithium companies outside of China. It owns a 14.7-percent stake in junior lithium company International Lithium.

Ganfeng Lithium Co. has agreed to buy 100 percent of the lithium mined from the as-yet untapped NeoMetals resource at the "Mount Marion project" in Western Australia. According to Neometals, when in full production, Mt Marion will produce 5,500 tonnes annually which is more than China produced (5,000 tonnes) for all of 2014.

In mid-2016, Champlain Mineral Ventures received a huge bulk sample order from an unidentified Chinese mining company. According to CBC News, the Asian firm ordered 10,000 tonnes of lithium, or the equivalent to 340 containers, which the firm expects to be able to ship by the end of October.

Chile has a vast amount of natural resource reserves and Sociedad Quimica y Minera de Chile (ADR) (NYSE:SQM) has access to a great deal of reserves in northern Chile. CITIC CLSA Capital Markets a Chinese firm has shown interest in the purchase of 88% stake in Pampa Calichera, which holds 20% stake in SQM.

China Batteries

China will have twice as much lithium-ion battery production capacity as the United States by 2020. Nearly 70 percent of global demand for raw materials comes from China, as the country's major lithium-ion battery manufacturers continue to expand their capacity with the aim of becoming the world's lowest-cost producer.

Chinese EV battery companies originally used LFP chemistry, but that's changing to NCM. Five out of the top 10 best-selling electric passenger vehicle models in China were NCM type. market. Lishen, CATL, Tianneng, and BAK have shipped NCM EV batteries. Guoxuan Hi-tech and BYD will have them shortly.

Chinese NCM batteries are estimated to be 1-2 years behind Korean and Japanese products in terms of energy density, consistency, production automation, and cost. Overall, the Chinese EV battery companies are not competitive in the international market so far compared to their Korean/Japanese peers.

EV Companies are making significant investments in their business:

- BYD invested CNY6bn to build additional 6GWh LFP battery production capacity in Shenzhen.

- CALB signed an agreement with Changzhou local government in Aug-2015 to build an EV battery plant in Changzhou. Phase-1's capacity is 2GWh, ultimate capacity is planned to be 12GWh.

- CATL is constructing a new EV battery plant in Qinghai Province, China. The ultimate capacity of the new plant will reach 5GWh and will be ready in 10 years. The Phase-1 project with 1.5GWh capacity will be ready by year-end 2016.

- Guoxuan has set up a new subsidiary in Qingdao to build 1GA' EV battery capacity, and its batteries will be supplied to BAIC.

- Lishen has invested CNY1.2bn to expand its capacity in Tianjin by about 1GWh as well additional capacity in Suzhou, Hangzhou, and Wuhan.

- Tianneng is building an additional 1GWh EV battery capacity, expected to complete by 2016.

Investor Takwaway

The Chinese government has made substantial efforts to initiate and expand the EV industry. Subsidies for EVs are provided by both the central government and local governments, although they may be modified shortly. The central government spent RMB28.4bn on green car subsidies from 2013 to 2015, while local governments shelled out RMB20bn during that period, according to China's State Council.

China's 13th five-year plan places significant emphasis on innovation, but the country's slowing economic growth has softened efforts.

Both LG Chem and Samsung SDI established plants in China to produce batteries based on NCM. The government is believed to have decided that Korean firms could threaten Chinese players as they supply batteries at half the price of Chinese products. Suspicion arises that the Chinese government might have intentionally excluded leading battery makers from Korea and Japan to give more time for Chinese companies to catch up their advanced rivals.

China's battery makers still used dated LFP chemistry and are behind in newer NCM chemistry and pose no threat to Korean and Japanese battery makers now. But efforts to create more technologically advanced batteries will soon make them on par and better than their non-Chinese competitors, based on how the Chinese have come to dominate high-tech industries. They did it in solar, and now make technologically enhanced solar panels with high efficiencies that dominate the industry.

In addition, China's efforts to lock-in raw material supply, namely cobalt and lithium, also will impact non-Chinese battery manufacturers in the future. They did it in the REE industry, restricting opportunities for non-Chinese REE manufacturers to compete because there was limited product out their and the Chinese raised prices.

Over the next few years, I expect Chinese manufacturers to supply better EV batteries than competitors, while at the same time their strategies, and that of the Chinese government, will impede non-Chinese EV battery manufacturers. TSLA will then need to make some major decisions on models beyond the Model 3.

https://seekingalpha.com/article/4014657-chinas-ev-battery-industry-repeat-solar-rare-earth-dominance