I see you have been with stockhouse only since July,10 2016. I will give you a little bit of advice......start to buy as much as you can of CYP, because you will be rewarded nicely at some point. I can see a news release sometime this week or next coming, on the Dean property.

Here at Outsider Club, we strive to give our readers an early advantage when it comes to emerging investing trends. That's why we've been following this particular growth story with keen interest.

There's an extraordinary opportunity unfolding for energy investors today...

Goldman Sachs is calling it “the new gasoline.”

The Economist has called it “the world's hottest commodity” with a “global scramble to secure supplies.”

Energy experts have dubbed this the "oil" of the future.

I'm talking about lithium: a one-of-a-kind element, used in consumer electronics, computers, and communication — think everything from cell phones all the way up to electric vehicles... basically anything necessitating a compact, rechargeable power source.

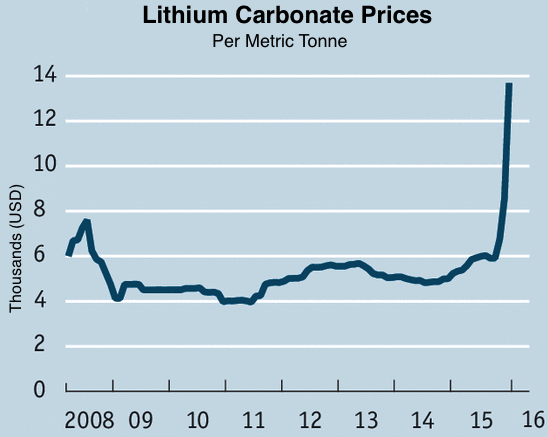

Right now, lithium prices are catapulting forward more aggressively than any other energy investment. The main driver for this explosive lithium growth is the rechargeable battery sector. In the past several weeks alone, lithium prices rose by more than a third last year from $6,000 per ton to $8,000 per ton. In some cases, it's even fetched as much as $25,000(!) on the spot market.

Surely you won't be surprised to learn that innovator, inventor, and investor Elon Musk is pushing this trend forward. Indeed, Tesla's CEO is changing the world, one lithium battery at a time. Here's how:

-

Musk has initiated an era of electric cars. Electric cars require batteries. His cars run on batteries powered by lithium-ion cells. As the need for these batteries increases, we're going to need lots of lithium.

-

Mr. Musk is also a huge champion of solar. This spring, he unveiled a product line of electric solar batteries for homes and small businesses. The Powerwall battery is a lithium-ion battery that lets you store electricity; it's a charging system that could easily take a home off the power grid, especially with the use of many solar panels, Musk said. As sales of these innovative new power storage devices take off, we're going to need lots of lithium.

Mr. Musk is also a huge champion of solar. This spring, he unveiled a product line of electric solar batteries for homes and small businesses. The Powerwall battery is a lithium-ion battery that lets you store electricity; it's a charging system that could easily take a home off the power grid, especially with the use of many solar panels, Musk said. As sales of these innovative new power storage devices take off, we're going to need lots of lithium.

Citing that Tesla (NASDAQ: TSLA) is not just an automotive company but an "energy innovation" one, Musk aims to shift the planet away from its dependence on fossil fuels. And batteries are the key to this bright new future.

Thus, lithium demand has gone congruently berserk in the wake of all this battery innovation.

Lithium — the lightest and most versatile of the metals — is the backbone of this exploding battery market. Lithium is already a key part of our everyday lives, but as batteries become the rule of the day in a new global energy picture, demand for lithium is soaring — and we are only at the beginning of this curve.

Fortune reports:

Global lithium consumption doubled in the decade before 2012, driven largely by its use in lithium-ion batteries for cell phones and power tools. The boom will continue thanks to electric cars—Tesla’s huge gigafactory lithium-ion battery facility could by itself soak up as much as 17% of existing lithium supply.

Indeed, we're in the midst of a very momentous energy revolution. From electric cars and solar panels to Tesla's battery gigafactory in Nevada, the battle is on: the battle for the cheapest, most efficient battery. Lithium has officially stolen the limelight.

Global Growth Trends Exploding

Although renewable energy storage and electric vehicles are the two largest drivers of growth, lithium is also a major component in some psychiatric medications (treating bipolar disorder and depression) and highly covetable in the defense and aerospace arenas, too.

But demand will soar most aggressively amongst companies engaged in the production of hybrid, plug-in hybrid, and electric vehicles from Toyota (NYSE: TM), Honda (NYSE: HMC), Nissan (OTC: NSANY), Renault (EPA: RNO), and Mitsubishi (OTC: MSBHY) to Ford (NYSE: F), Chevrolet, and GM (NYSE: GM). And of course Tesla Motors.

By 2040, 35% of light vehicles sold will be electric, generating a battery market worth a projected $250 billion.

Tesla's giant Gigafactory alone is going to need 15,000 tons of lithium carbonate per year just to start.

At last count, the U.S. only has 38,000 metric tonnes in proved reserves. The 500,000 lithium car batteries that Musk wants the Gigafactory to produce per year will eat that up.

According to Tesla’s CEO, Elon Musk, demand for stationary storage batteries has skyrocketed to the point that an expansion of the Gigafactory may have to be considered before it is even built.

Musk's vision includes a “complete transformation of the entire energy infrastructure of the world to completely sustainable zero carbon,” which translates to lithium-battery production on a mind-blowing scale. Tesla is planning to produce more lithium-ion batteries in this factory than in the entire global marketplace combined.

Supply is definitely going to be tight... especially when you consider how much we've taken lithium for granted before this new energy craze really got going.

Up until now, lead-acid batteries were the norm. Indeed, many large-scale battery systems are still run on them, due mostly to the high cost of lithium batteries. But as that cost drops, more customers will have access to the technology. Tesla's CTO JB Straubel insists that the key to the energy market is cheap lithium-ion batteries.

We are on the edge of a profound competition over batteries as Tesla drives down lithium-ion battery production costs, lowers the benchmark, and increases cost competition. The response will be new entrants to this market and competing battery gigafactories.

Tesla’s biggest rival will likely be Build Your Dreams (BYD), the Chinese automaker backed by Warren Buffett. Already, BYD is building electric buses on American soil and has global gigafactory ambitions. By the end of the year, according to Reuters, BYD should have 10 GWh of battery production capacity, which it expects to increase to 34 GWh by 2020 with a new factory in Brazil — about the same capacity as Tesla’s.

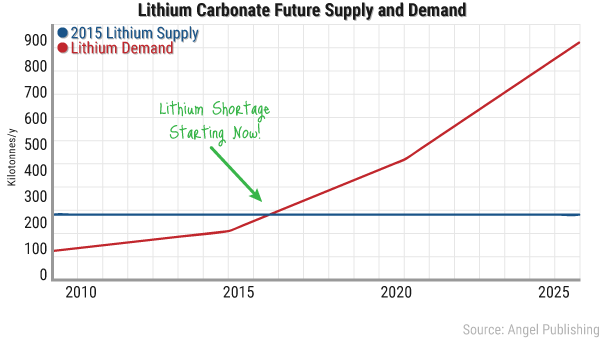

According to Credit Suisse, the lithium industry is “poised for significant volume growth,” which could lead to shortages of supply. That leaves lithium producers in a pretty lucrative position going forward...

Macquarie estimates global demand is currently about 184,500 tons, and it's slated to rise to more than 260,000 tons in 2020. Metals and minerals consultancy Roskill Information Services has a similar estimate, pegging its base scenario for lithium consumption at 290,000 tons in 2020. However that figure rises to a whopping 420,000 tons in its "optimistic" scenario.

In any case, 2020 supply figures to be less than 238,000 tons. So the projected shortfall is obvious.

Supply Situation (and Investment Opportunities)

Most of the global supply for lithium is produced by just four companies:

- Albemarle (NYSE: ALB)

- Chemical & Mining Co. of Chile (NYSE: SQM)

- FMC Corp (NYSE: FMC)

- Talison Lithium (a JV by Chengdu Tianqi Industry Group and Albemarle)

Talison operates the Greenbushes hard rock (spodumene) mine in Western Australia, from which it exports over 350,000 tonnes of lithium products annually. It also owns a prospective project in Chile that consists of eight salars (brine lakes). Talison is a private company. It is 49% owned by Rockwood, which was purchased by Albemarle in 2014 for $6.2B.

Albemarle (Rockwood), in addition to its 49% stake in Talison, owns and operates a mine at the Salar de Atacama project in Chile and the Silver Peak mine in Clayton Valley, NV. Albemarle is a $6.5B market cap diversified chemical corporation and is not a pure play on lithium production, though it is positioning itself as the face of the lithium mining industry.

SQM also operates in the Salar de Atacama, with a project adjacent to Albemarle's. It has run into political and legal problems in both Chile and the U.S., and the life of its mine could be reaching an end in the next five years. It is a diversified mining and chemical company and not a pure play on lithium.

FMC Operates the Salar de Hombre Muerto brine mine in Argentina, which has had substantial technical problems expanding production. FMC is also a diversified chemical company and not a pure play on lithium.

Obviously, these stocks have done rather well over the past year.

Albemarle was up 47% at one poine, SQM rose 30%, and FMC jumped 24%.

Many Australian miners are benefiting as well, because electric car demand in China is absolutely booming. Australia is the world's top lithium producer and home to the world's two biggest lithium mines.

Galaxy Resources (ASX: GXY), which is in the middle of a friendly merger with General Mining (ASX: GMM), saw its share price rise from less than A$0.01 a year ago to A$0.45 in the final week of July. General Mining went from A$0.04 to A$0.74.

Once their merger is completed, Galaxy-General will become the second-biggest listed lithium stock in Australia after Orocobre (OTC: OROCF).

Pilbara Minerals (ASX: PLS) is developing the Pilgangoora Project in the iron ore-rich Pilbara region of Western Australia. It just signed an offtake agreement with Chinese firm General Lithium and plans to start mining next year.

Pilbara chief executive Ken Brinsden says potential Chinese customers are already building new processing operations, noting that most westerners aren't aware that many Chinese electric car makers there are buttressing demand.

He says his company will increase focus on new lithium developers and choose low-cost operations with proximity to ports. Meanwhile, Pilbara's competitor Neometals (ASX: NMT) is looking to commercialize its lithium resources at Mount Marion in the goldfields region of Western Australia. It will launch a pilot plant in the fiscal year of June 30, 2017.

There's also the Global X Lithium ETF (NYSE: LIT), which seeks to track lithium's price movement.

The fund is a great way to track the overall lithium market while investment and demand grows over the next few years into unparalleled territory in the coming decades.

Included in the holdings of the Lithium ETF are miners, chemical companies, battery manufacturers, and other industrial companies.

By diversifying the exposure to lithium, the Global X Lithium ETF provides investors with less risk and the potential for long-term reward.

-The Outsider Club Research Team