Some days you just have to get out of the way and let the cash roll in. Especially the green kind.

(Canadian Dollars Unless Otherwise Indicated)

Source: Painted Pony April 5, 2017, Corporate Update

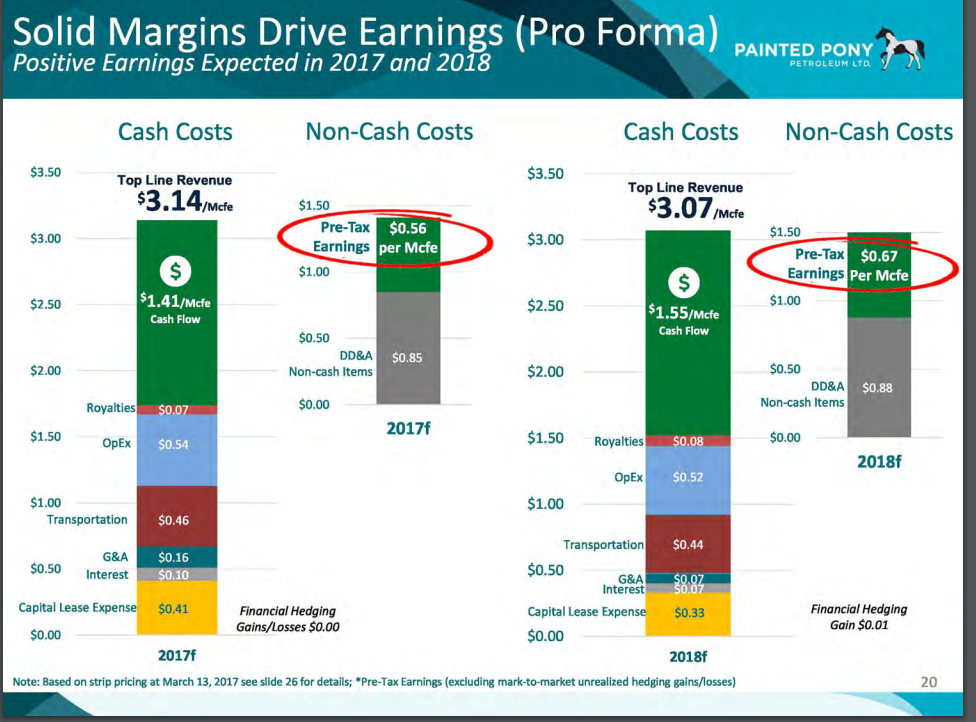

Sometimes management has some really hard choices to make. They can either let the cash roll in or they can let more cash roll in. In this case, Painted Pony Petroleum Ltd.'s (OTCPK:PDPYF) management went for the more cash option. What a shame! Management had always promised that the fast growing production would deliver profitable benefits. The latest pullback of a lot of gas producer stocks allows an investor to hitch a ride cheaply to an extremely fast galloping investment. The onrush of green could be a real crusher!

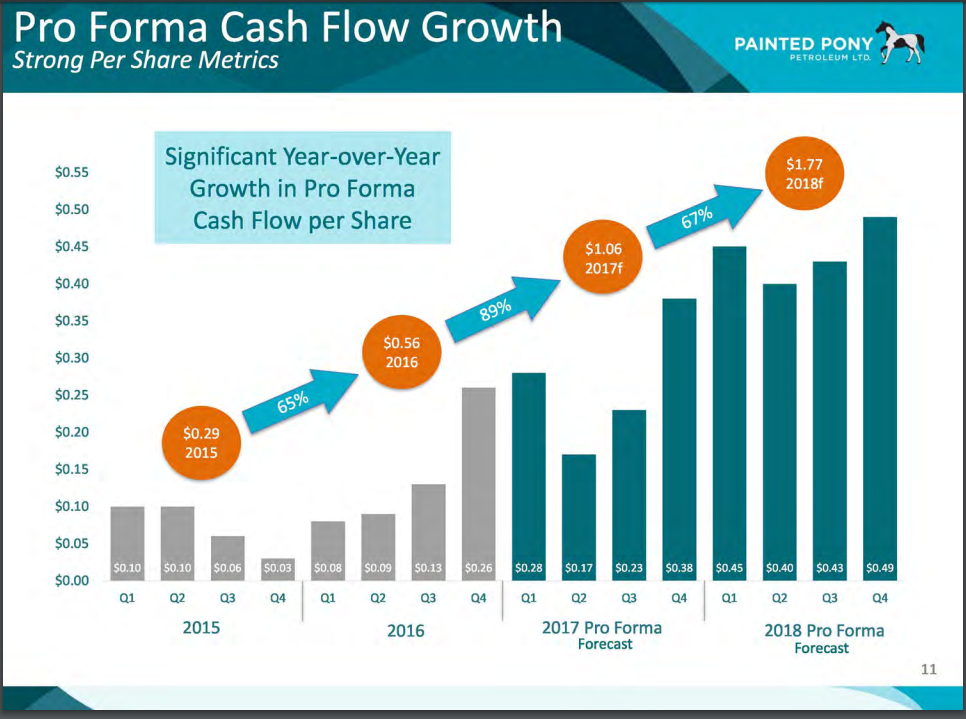

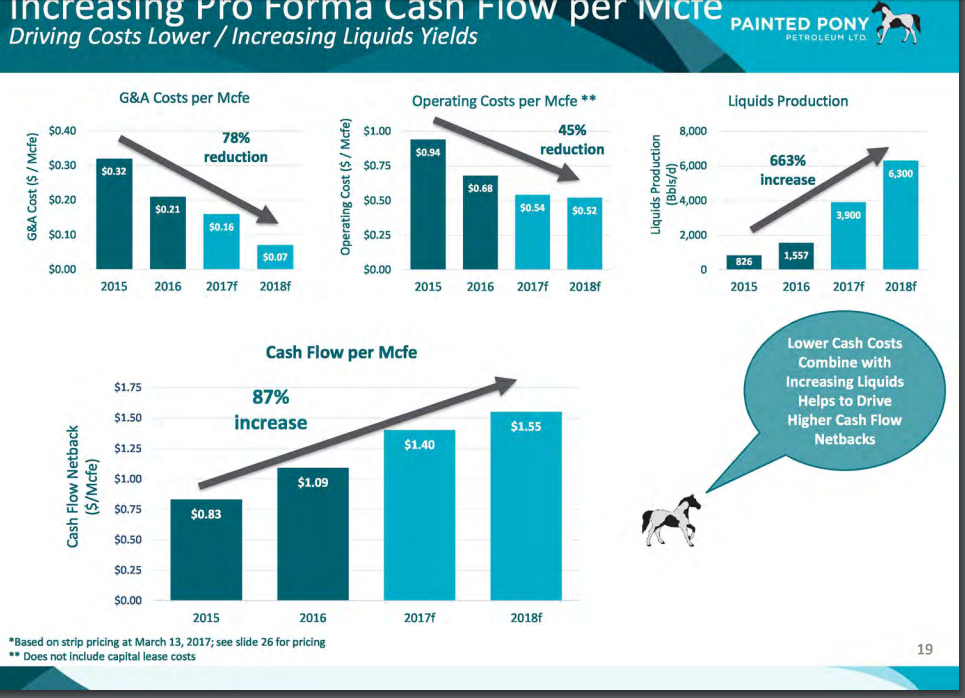

Fast growth in its own right carries risks. Executing large growth rates can be very tricky. The logistics can be very challenging. So far, this management appears to be up to the task. Plus the seller of the acquisition is a fairly sophisticated investor and evaluator of businesses in its own right. The fact that the seller accepted payment in shares of the company stock is a very large vote of confidence in the future of this company. Most investors want to find cash flow increases like the ones shown on the first slide.

Source: Painted Pony April 5, 2017, Corporate Update

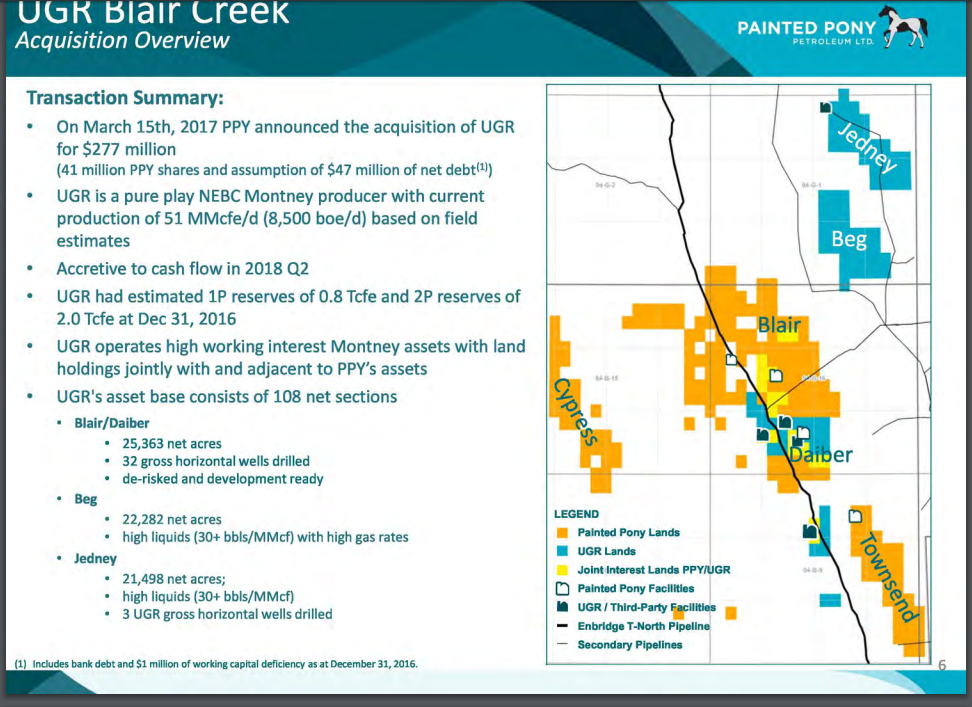

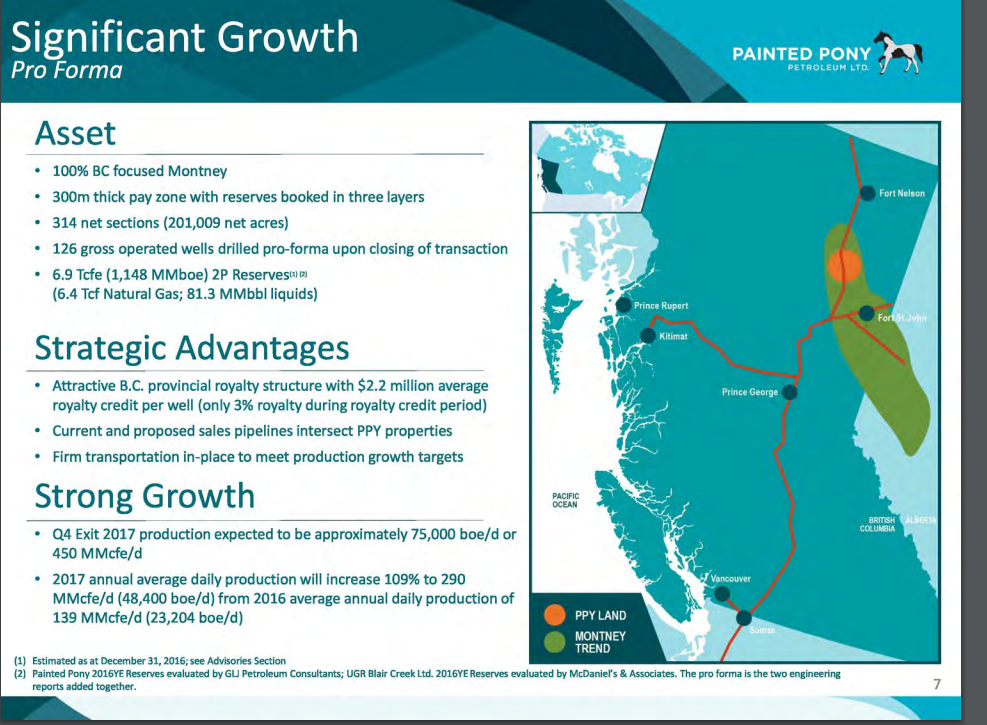

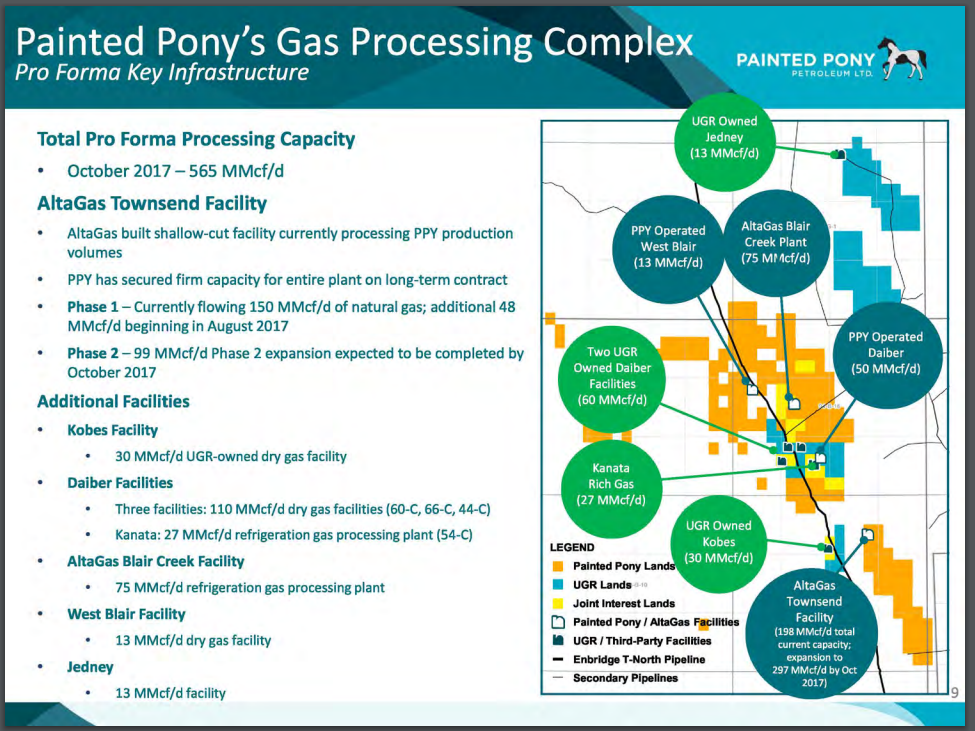

Management had a vision to lower costs as the expansion proceeded and production grew rapidly. AltaGas (OTCPK:ATGFF) is keeping up with the expanding production by supplying a comprehensive infrastructure that is keeping costs low. In fact, it is lowering costs as production grows. Plus, it lowers the capital costs of Painted Pony. The latest acquisition is right in the same neighborhood, so the infrastructure can service significant chunks of the acquisition. There are probably some operating savings as well. So, the acquisition has the effect of accelerating an already high growth rate and it raises the future cash flow per share. We have all seen far worse acquisitions than this one.

Source: Painted Pony April 5, 2017, Corporate Update

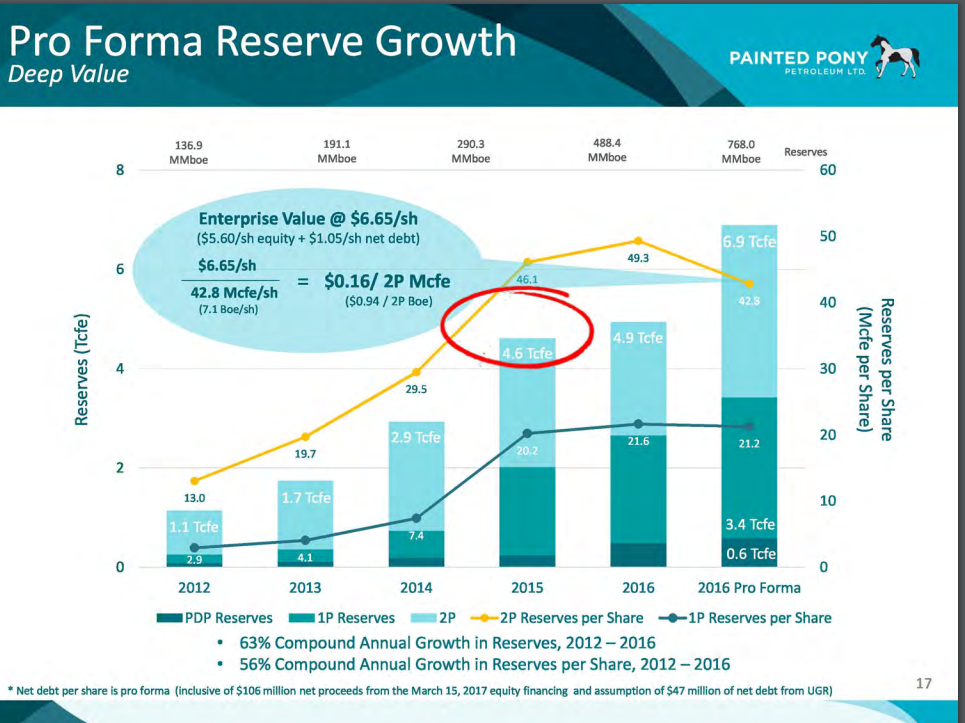

The reserve growth shown in the first slide is believable because the lower costs in the second slide support the probable development of those reserves. This company is about to cash in on some years of planning and growth. The stock price has not done much until the cash flow caught up with the enterprise value. That now appears about to happen. A company that grows at this rate should sell at a premium. But gas companies are so out of favor that this company sells for a fairly mundane multiple of the projected cash flow. At some point, this stock should gain visibility as an industry growth leader with very low costs.

The company website reported that on April 7, 2017, the stock price closed at $5.49 per common share. So the stock is trading at about 5 times the projected cash flow of a company growing at a rate one normally only sees in the high tech industry. This common stock is pretty cheap compared to a lot of alternatives. This year, the onset of liquids production at one of the gas processing plants will enhance the average selling price. That enhanced selling price will be combined with an operating cost reduction to increase the cash flow per MCFE. A more normal stock price to cash flow ratio would imply an immediate double of the current stock price. Future rapid growth could lead to another fairly quick double of the stock price. So this could be a home run stock.

Summary

Source: Painted Pony April 5, 2017, Corporate Update

This company has been on a roll for some time. The stock price may have been a little ahead of the company growth. But that no longer appears to be the case. Now it looks as though the stock price is lagging the company growth. This roller coaster is going straight up and using jet engines to get there. As the company gets larger, growth this fast will become an increasing logistical challenge. But the current stock price does not appear to really forecast any growth despite the company history. So if Mr. Market's current expectations of the company's future improve a little bit, current investors could receive some very sizable capital gains.

This company grew right through the industry downturn. If there was ever a more challenging time to expand production, I do not know what that time would be. This company has a remarkable track record that was achieved during some of the worst industry time. At some point, this company will command a premium for all of its accomplishments. In the meantime, the rapid growth should reward investors.

Source: Painted Pony April 5, 2017, Corporate Update

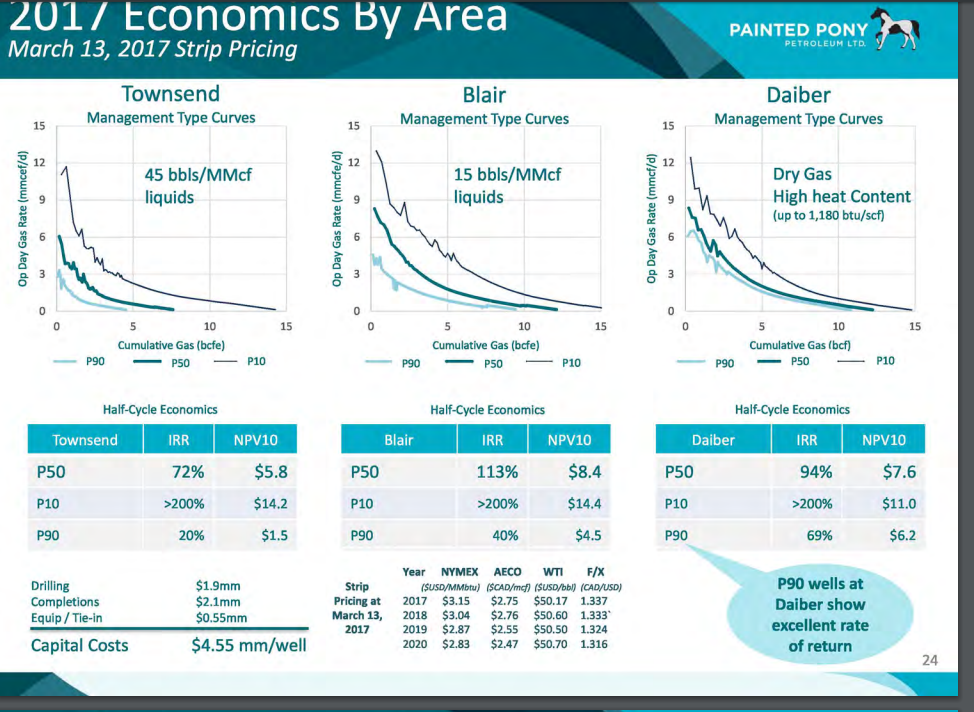

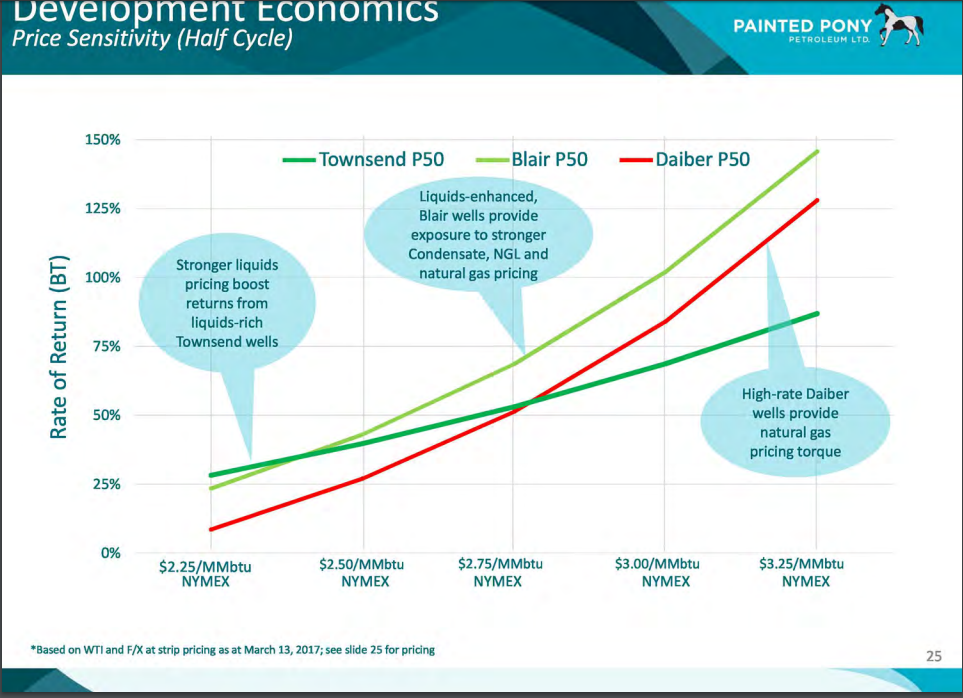

The rates of return are remarkably resilient at lower gas prices. At current prices, the cash rolls in from some remarkable returns on the different prospects. The increasing emphasis on changing the production mix to increase liquids production as market conditions change and maximize sales returns will make the slide more favorable in the future.

This pony is going at full gallop. So do not expect the stock price to remain in the resting position for long. Investors should expect to see a lot of green in the future at a galloping rate. This management does not do anything slowly. The stock offers a speculative return due to a fast growth rate.

But the balance sheet is very reasonable. In fact, management did not authorize any long-term debt until very recently. Bank debt at year-end was roughly C$200 million. So fourth-quarter cash flow of C$26 million would adequately service the debt. The rapid growth will change both figures significantly, so historical figures could be very misleading. Still, it does appear that management wants to keep the long-term debt at a conservative level when compared to cash flow. The recent sale of common stock in addition to the stock issued for the acquisition should keep debt at a conservative level through the end of the fiscal year.

Management may have reduced the capital budget because strip pricing was low and going lower, but the acquisition offset that decision and then some. This pony only knows how to race ahead.

Disclaimer: I am not an investment advisor and this article is not meant to be a recommendation of the purchase or sale of stock. Investors are advised to review all company documents and press releases to see if the company fits their own investment qualifications.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in PDPYF over the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.