RE:RE:seeking alpha articleHere ya go....

Eldorado Gold - Mr. Market Is Overreacting To Bad News

Summary

Eldorado Gold has bad luck - most recently the company has been delivering only bad news.

For example, Kisladag, a flagship property, encountered technical issues.

Last year, the long-standing CEO retired.

Since 2015 (when Syriza came to power), the problems at Greek mining projects are growing.

However, I think that Mr. Market is overreacting - the company's shares are very cheap at the moment; in my opinion, too cheap.

Most recently Eldorado Gold (NYSE:EGO) has bad luck. For example, a few days ago, the company had to cut its production estimates at its flagship property, the Kisladag mine, in Turkey. In this article, I would like to discuss the last developments at Eldorado and, in the final section, defend the thesis that the company’s shares may be close to their price bottom.

Sale of the Chinese assets

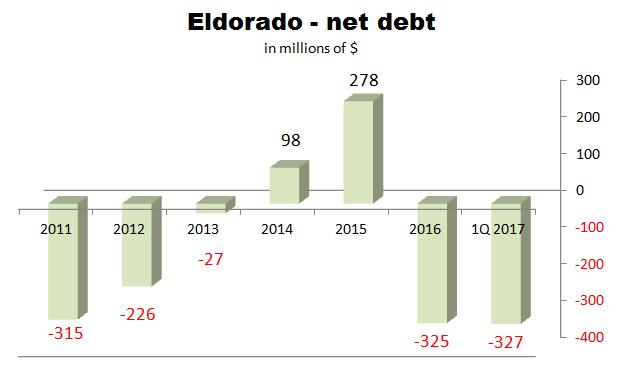

Last year the company made a strategic decision to sell all its Chinese assets for a joint consideration of $900M. As a result, now the company’s net debt (defined as debt less cash) stands at minus $327M, which means that Eldorado has much more cash than debt.

Source: Simple Digressions

In other words, the company is well positioned to grow its business in two strategic regions: Turkey and Greece.

Mr. Wright retires

In December 2016, the company announced that its long-standing CEO, Paul Wright, would retire in April 2017. At this point, I do not want to discuss whether he was a good CEO or a bad one, but there is an easy way to get some knowledge about it. The chart below shows the relative strength of Eldorado's shares against XAU (a performance measure for the entire precious metals market) since the beginning of the current great bull cycle in gold (2000):

Source: StockCharts.com

Note: The chart is a little bit unorthodox because it compares the price of Eldorado's shares expressed in Canadian dollars to the index expressed in US dollars; I am sure my readers will forgive me for this small, unorthodox improvement.

The red arrow indicates that Eldorado's shares have performed better than the average precious metals stocks, so Mr. Market definitely wants to provide us with the following message: "Paul Wright was a good CEO".

Further, in its announcement, Eldorado discloses that Mr. Wright is retiring. Well, I do not think so. Now he is 63, so legally he cannot be a retiree. Simply, in my opinion, Mr. Wright was removed from his post due to some undisclosed reasons. What is more, his successor, George Burns of Goldcorp (NYSE:GG), cannot be supported by a similar chart as that plotted above. Between August 2012 and December 2016 (when he was the chief operating officer of Goldcorp), Goldcorp's shares performed worse than the average precious metals stocks.

Summarizing: In my opinion, the resignation of Mr. Wright is not good news for Eldorado investors. An experienced business negotiator (Greece and Turkey) is out now, but his successor steps in at a very crucial moment for the company. I think that Eldorado investors should keep a close eye on Mr. Burns' moves in the nearest future. It will not be easy...

Kisladag problems

On June 27, 2017, Eldorado provided an update on Kisladag, the company's flagship property located in Turkey. Let me cite an excerpt:

"Placement of estimated recoverable gold on the leach pad is proceeding as planned, however, gold solution grade and consequently gold recovery from the leach pad has recently lagged internal expectations. Recent laboratory and in situ tests where solution chemistry has been adjusted have indicated normal recovery rates are still expected. However, more time is now required to adjust the overall pad solution chemistry and allow solution to flow through the current stack height of the leach pad, which is at approximately 80 metres at the highest point."

Well, I think that this statement is not too informative so I have scrolled through the last technical report on Kisladag (published in 2010) and found this piece (page 89):

"Final product from the crushing and screening circuit is transported to the heap leach pad by two stage overland conveyors and a series of portable conveyors. A radial stacker distributes the ore onto the pad. Depending on the location and geometry of the pads, advance stacking is applied as well. Stacking is carried out in 10 m lifts to a projected design height of 60 m."

Now I think I know where the problem is. Probably Eldorado has made a mistake and loaded up too much stuff on the Kisladag heap leach pad (around 20 meters above the limit). As a result, recovery rates are worse than they should be because the entire leach cycle is distorted now.

On the other hand, I cannot understand why Eldorado’s management did not explain the Kisladag problem in detail. Now this operation is the company’s core business and the way it works has a big impact on the company in the long term (for example, cash flow generated by Kisladag is crucial for the company’s growth). That is why I think that Eldorado investors should keep an eye on the nearest developments at Kisladag.

Greece - Problems, problems...

Since Syriza, a left-wing party, came to power in 2015, Eldorado has been encountering a number of problems with its Greek properties. For example:

- August 2015 - Shortly after coming to power, the Greek government suspended operations at Olympias for six weeks.

- January 2016 - The construction of the Skouries mine was suspended due to permitting issues.

- June 11, 2017 - According to the Mining Greece website, Greece will seek arbitration to settle its differences with Eldorado; if that is the case, the company may be forced to suspend the construction of Skouries and Olympias once again.

Well, it does not look well. I think that Eldorado is a classic example of how the Murphy’s law works. For those unfamiliar with Mr. Murphy, it is a tendency for bad things to happen whenever it is possible for them to do so. As a result, since January 2015, Eldorado's shares are down 57% while GDX (a broad precious metals stock market) is up 19%.

Acquisition of Integra

In May 2017, Eldorado entered into an agreement with Integra Gold to acquire all the shares of Integra (yesterday, Integra’s shareholders approved this transaction). The total transaction value is C$516M, excluding the shares already owned by Eldorado (the company reports the value of C$590M but this figure comprises the Integra shares previously acquired by Eldorado).

Let me go a little bit deeper into this deal.

Project’s economics

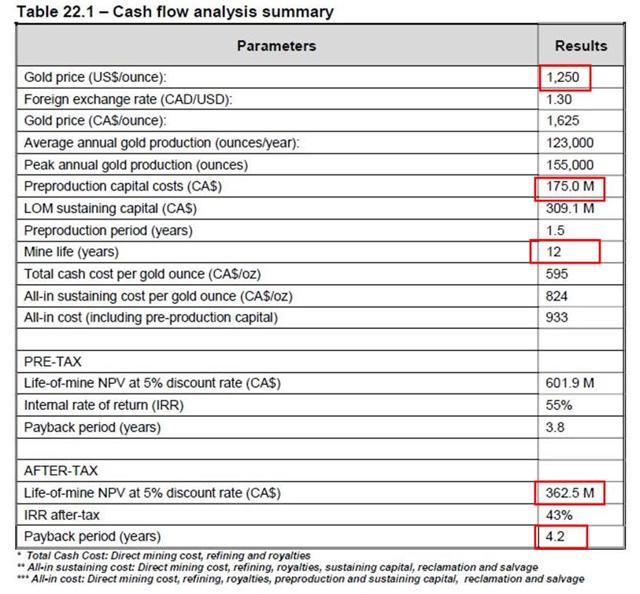

This year Integra published the Technical Report on the Lamaque project. Here is the table showing basic economic figures (the main figures are marked in red):

Source: Integra

Comment:

- All economic measures were calculated assuming the price of gold of 1,250 per ounce of gold over the life of mine so the project’s economics is realistic.

- Initial capital cost is $135M (C$175M), which means that Eldorado can very easily build the Lamaque mine.

- The life of mine is 12 years, but the current economic study does not take into account additional resources (I discuss this issue below).

- Lamaque should be a low-cost project, which is a big positive. For example, the all-in sustaining cash cost of production should stand at $634 per ounce (C$824).

- The project’s net present value (NPV) is $279M (C$363M). At this point, I am skeptical about the price Eldorado has paid for Integra; in my opinion, the company has overpaid.

What other assets does Integra own?

Firstly, as I have pointed out above, there are additional mineral resources of 626 thousand ounces that are not included in the economic study. Keeping in mind that the study is based on mineral resource of 1,784 thousand ounces, it means that the project can be extended by 35% (626 thousand/1,784 thousand).

Secondly, Lamaque is a prospective deposit, so most probably it may be get bigger than it is today.

Thirdly, there is a former mine called Lamaque Deep. This mine consists of two zones where mining operations were conducted until 1985. Last year Integra started a new drilling program targeting the lower zones of these closed mines (below 1,150 and 1,850 meters). I am very curious about the results of this program.

Lastly, there a few additional deposits but, in my opinion, now they are immaterial for Integra.

Summarizing: At first glance, it looks like Eldorado has overpaid for Lamaque. Here is the evidence:

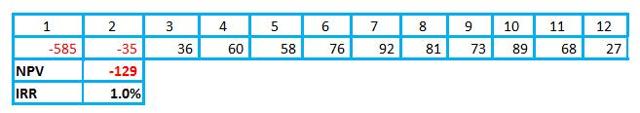

All figures are in millions of Canadian dollars

The table shows free cash flow to be delivered by Lamaque. I have rewritten all figures from the company’s economic model for the Lamaque mine. The only exception is the first year where I have included the consideration paid by Eldorado (so, instead of minus C$69M (as it is in the model), there is a negative cash flow of C$585M (C$516 paid by Eldorado less C$69M). As a result, the net present value is negative (minus C$129M or US$99M) and the internal rate of return is 1.0%.

To be honest, at this point, Eldorado looks like a typical big gold miner. When times are good, or at least not bad, the majors go shopping and buy whatever the shop/market offers. Another thing - it is probably the first deal made by the new CEO but…in my opinion, he was too fast and made a mistake.

Fortunately, there is the light at the end of the tunnel. Lamaque is located in the famous Val-d’Or gold camp in the province of Quebec, Canada. It is a historical mining district where a few exploration and mining companies are active. For example, in the close vicinity of Lamaque, the following miners are operating: Metanor (OTCPK:MEAOF), IAMGOLD (NYSE:IAG), Agnico Eagle (NYSE:AEM), just to name a few. Simply, the region is very prospective and Lamaque may deliver positive surprises in the future.

Summary

Eldorado has bad luck. Most recently the company has encountered problems such as:

- Kisladag technical issues.

- Legal actions taken by the Greek government.

- Top management change.

- Overpaid acquisition of Integra.

As a result, Eldorado's shares are close to their cyclical bottom established in January 2016. Of course, if something goes bad, it can go even worse, but I think the company is close to getting its critical mass at the moment.

Why do I think so? Firstly, today the Eldorado market capitalization is $2.03 billion (including 77 million shares issued to Integra shareholders). It is not much. In my opinion, Kisladag, the flagship property, is worth around $1.51 billion (my readers will find the appropriate calculation below). Adding to that value the net debt of $0.33 billion (details in the section "Sale of the Chinese assets"), I arrive at $1.84 billion, which is very close to the current market capitalization.

It means that all Greek assets (mainly Skouries and Olympias, two excellent projects), Efemcukuru (a very decent mine operating in Turkey), the Lamaque project, Vila Nova in Brazil plus a few more or less advanced mining projects are valued at nearly zero.

No, I cannot agree that these assets are worth zero. Although some of them are quite risky now (I mean mainly Greek assets), I am sure the company will have success at the not so distant future. Therefore, I would not short Eldorado shares now - quite contrary, a small, speculative (due to a few major risks) long position seems to be a good idea.

Appendix

Kisladag - Valuation model

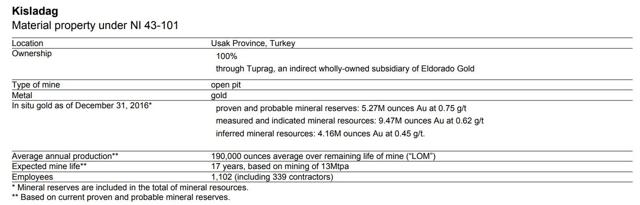

The table below shows the Kisladag valuation model:

Source: Simple Digressions

Assumptions:

- Gold price: $1,250 per ounce

- Mineral reserves and mine life according to Eldorado:

Source: Eldorado

- Depreciation: $178 per ounce (as in 1Q 2017)

- Total cash cost: $464 per ounce (as in 1Q 2017)

- Sustaining capital expenditures: $40M a year

- Tax rate: 20%

- Discount rate: 8%

Applying these assumptions, I have arrived at the net present value of $1,514 thousand.

Disclosure: I am/we are long GDXJ.