You must be only talking about the last week. The trend is still up. All we have done is level off to where we were on Sept 15th after we made a very big jump on some news.

I am looking forward to the Denver Gold Presentation. Read this if you haven't already.....the link was posted before but I almost missed it.

In late June, Alio Gold (ALO) made a private placement worth C$50 million ($41 million). The placement occurred shortly after a strong share price growth that took Alio's share price close to the $6 level. Shortly after the announcement, the share price declined below $4 and although it has recovered slightly, it hasn't managed to cross the $5 level yet. Although the private placement utilized the increased share price, its timing was questionable as the construction of the Ana Paula mine isn't expected before Q2 2018. However, yesterday's news reveals the true intentions of the management. A substantial portion of the money will be used for exploration activities and underground development that has the potential to boost the production volumes of the Ana Paula mine notably. The news was welcomed by the market very positively as Alio's share price jumped by 10%, although the gold mining sector was down (the VanEck Vectors Gold Miners ETF (GDX) declined by 1.6% and the VanEck Vectors Junior Gold Miners ETF (GDXJ) declined by 2.3%) due to a steep gold price decline.

ALO data by YCharts

ALO data by YCharts

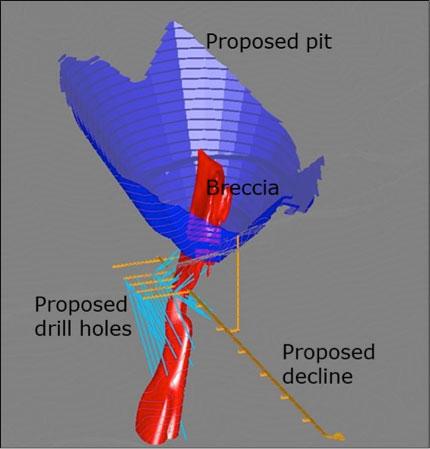

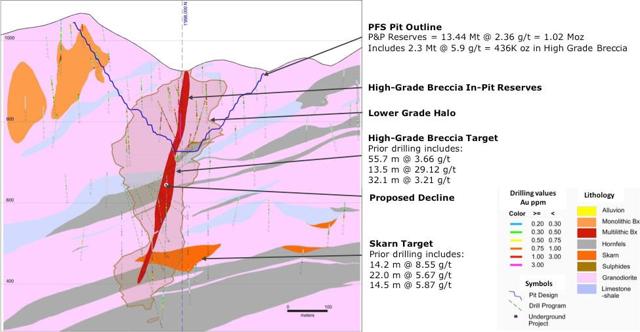

Alio announced that it has initiated a $16 million underground decline and exploration program. The decline has been already approved by SEMARNAT (Secretaria de Medio Ambiente y Recursos Naturales - Secretariat of Environment and Natural Resources) and the development should start in October. It is expected to take approximately 9 months which means that it should be completed by July 2018.

Source: Alio Gold

According to the company:

A 1,200-meter long decline will be driven from a portal site located in the adjacent valley from the proposed pit and approximately 400 meters from the proposed mill site. The underground decline is expected to take nine months to reach the mineralized area after which an underground diamond drill program will commence.

The decline should enable an underground exploration program that is expected to include 20,000 meters of drilling (80 holes). Moreover, the decline should be used also for underground mining operations, starting as soon as in the first year of the Ana Paula mine production:

The potential to add value to the existing project is significant as the project as currently proposed in the May 2017 PFS is limited to mining rates of 5,000 tonnes per day ("tpd") from the open pit due to the geometry of the pit. However, the PFS envisions installing a used processing plant that the Company has purchased and is currently refurbishing which while in operation at the El Sauzal mine had a processing capacity of 6,000 tpd. Further work is being undertaken on grindability testwork to confirm mill capacity and if positive, there could potentially be latent capacity that could be capable of treating material from underground mining commencing in the first year of operations.

In other words, Alio's management believes that an underground operation could help to better utilize the capacity of the mill. There is a high potential to add a significant volume of resources to the mining plan as the high-grade breccia continues at least 300 meters below the bottom of the proposed open pit. Besides the breccia, there was also a deeper skarn target identified. Some of the intersections from the deeper skarn target include 97.88 g/t gold over 4 meters, 5.67 g/t gold over 22 meters or 14.47 g/t gold over 2.8 meters.

Source: Alio Gold

Source: Alio Gold

The underground measured and indicated resources contain 266,700 toz gold at gold grades of 2.8 g/t. However, given that the intersections from the deeper sections of the high-grade breccia and the skarn zone average 4.97 g/t gold and 6.11 g/t gold respectively based on the intersections reported in yesterday's news release, it is possible that further drilling will improve the grades slightly. Assuming that the underground operation will be able to produce material grading 2.8 g/t gold, and using the 85% gold recoveries projected by the PFS, a 1,000 tpd underground operation should be able to add approximately 28,000 toz gold to the annual production volumes. It is quite a nice addition given that the PFS projected an average annual production of 108,000 toz gold over the 8-year mine life. The underground operation has the potential to increase it by 25%.

Except for the underground exploration, Alio plans to drill another 11 holes from the surface in the coming months. The holes should help to confirm some of the historical drill results as well as provide some additional metallurgical data. Further $1.8 million was allocated to an exploration program focused on an exploration target only 100 meters to the north of the proposed Ana Paula pit. The program will consist of an airborne magnetic survey (Q4 2017) and 12 drill holes totaling 4,000 meters (H1 2018). Some of the historical drill intersections include 4.21 g/t gold over 8.4 meters, 17.23 g/t gold over 1.5 meters and 3.94 g/t gold over 12 meters. Due to the close proximity to Ana Paula, this exploration program, if successful, could provide more ounces to the mine plan.

Conclusion

The news is very positive, as it seems that there is a high probability that Alio Gold will be able to improve the production profile of the Ana Paula mine notably. Moreover, the process should be relatively quick and the CAPEX shouldn't be too high, as the underground operation should utilize the excess mill capacity. Further upside potential is provided by the new exploration program focused on an exploration target in a close proximity to Ana Paula. Alio Gold seems to be in a good shape. The Ana Paula feasibility study is still expected in Q2 2018, with first gold production in late 2019 if everything goes well. Moreover, the San Francisco mine should be able to generate some nice cash-flow at the current gold price, which means that the Q3 financial results should be quite interesting.

Disclosure: I am/we are long ALO.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.