Lithium Energi Exploration Inc. (LEXI:TSX.V; LXENF:OTCQB; L09:FSE) controls 100% of a very large lithium (Li) brine land position—128,367 hectares (ha), in and around the Antofalla salar in northwestern Argentina. Note: Including an exclusive Right of First Refusal (ROFR) on three additional concession blocks totaling (113,500 ha), LEXI effectively controls 241,867 ha in the heart of the "Lithium Triangle."

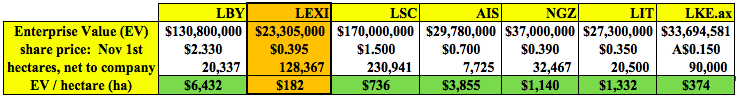

If management were to exercise the ROFRs on all three areas, it would control the single largest Li-brine land package in Argentina. Larger than LSC Lithium's (TSX-V:LSC) 230,941 net ha, and larger than Albemarle Corp.'s (NYSE:ALB) neighboring holdings, albeit ALB's property is right in the midsection of the Antofalla salar. NOTE: (LEXI's land is in the northern and southern parts of the same salar. LSC's Enterprise Value (EV) = $170 M, LEXI's EV = $23 M.

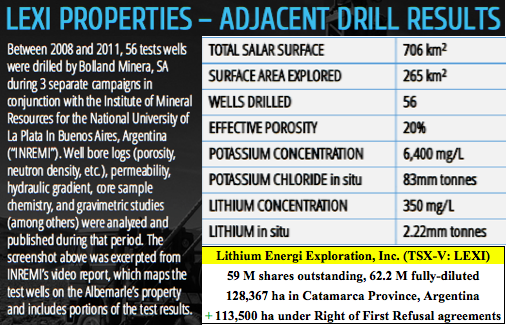

Although the properties are green field, the Antofalla salar has had historical exploration done on about a quarter of it (drilling adjacent to LEXI's land holdings. Results (described in image on above left) were promising enough to get Albemarle to dive in head first.

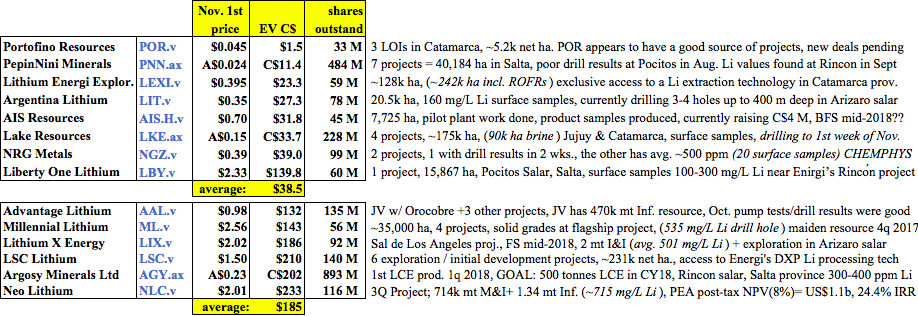

There are 14 Li brine juniors (11 TSX-V-listed, 3 Australian-listed) with all, or substantially all, of their projects/properties in Argentina. Each has attributes that help it stand out in the crowd. For example, Millennial Lithium (TSX-V:ML) has a maiden mineral resource coming out this quarter on its flagship project that's adjacent to Orocobre's (ASX:ORE) Olaroz mine and Lithium Americas' (TSX:LAC) world-class Cauchari project.

Neo Lithium (TSX-V:NLC) has a high-grade project (714 mg/L Li) with very good brine chemistry.Just this week it released a Preliminary Economic Assessment (PEA). In terms of project development, ML & NLC are far more advanced than LEXI, but they have an average EV of ~$150 M, ~6x that of LEXI's EV.

What does Lithium Energi have that allows it to stand out? First, it has by far the most property bang for the buck of any Li brine player in the country, but to be fair it has only locked up early-stage properties so far. Second, LEXI has aligned itself with a new technology provider, (new to the Li brine extraction arena, but not new to commercial metals separation operations).

Third, LEXI is led by Steve Howard & Omar E. Ortega, both successful, highly skilled entrepreneurs, who know how to run and fund businesses. Fourth it has one of the best capital structures of the group, just 62.3 million fd shares (compared to an average of roughly 90 million fd, in-the-money shares among the 11 TSX-V-listed peers). Finally, it has the 3rd lowest market value among the 14 juniors listed above.

In the above chart, the average EV/ha ratio = C$2,007/ha. LEXI is the lowest by far at C$182/ha.

New technology is exciting for the end users who benefit from it, but new technologies in complex industrial settings are fraught with risk. For example, scaling up from lab or pilot-scale to commercial-scale is often a major challenge. That's exactly the problem facing a dozen or more proposed Li extraction technologies from public companies like Lithium Australia (ASX:LIT), Neometals (ASX:NMT), POSCO (NYSE:PKX) and Lepidico (ASX:LPD) and private companies including Tenova Bateman & Enirgi Group.

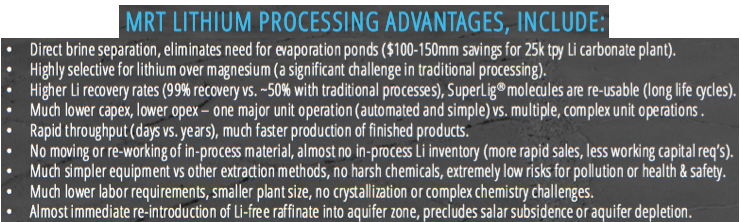

In August, LEXI executed an agreement with privately held IBC Advanced Technologies (IBC), to utilize a metals separation technology known as Molecular Recognition Technology (MRT) for highly selective lithium extraction. From testing to commercial operations, MRT has repeatedly been proven as one of the most advanced, efficient, and eco-friendly refining technologies in the world for segregating metals in both mining and recycling applications with up to 99.99% purity. NOTE: (MRT is not yet proven at commercial-scale for Li extraction from brines).

Actually, that's (both) 99%+ purity AND 99%+ recoveries of Li, from a single run through a closed loop system. Yes, I know it sounds too good to be true compared to the state of the art, but those figures come from actual lab-scale results of MRT Li extraction from brines.

At this point, readers are either blown away by the implications of this new application of MRT for Li extraction, or they are skeptical. I was highly skeptical for a long time, largely because a lot of other technologies have failed (so far) to reach commercialization. Importantly, although MRT is unproven for Li extraction at commercial-scale, it is 100% proven in other industrial settings such as PGMs & Copper refining. IBC has been designing industrial-scale MRT plants for three decades.

LEXI is finalizing plans to construct a small, but commercial-scale plant that will produce either Li carbonate or hydroxide (depending on client needs) at a rate of 1,000 metric tonnes (mt)/yr. Conceived as more than just a "pilot or demo plant," management is calling this effort Module 1 (M1).

Once the world sees this plant in successful operation, management hopes to be able to fund (with a strategic funding partner, plus internally generated cash flow) a ramp up to 5–25 times (depending on demand & funding) that initial throughput of 1,000 mt/yr, within 1–2 years.

Timing for the design, permitting, funding & construction of M1 is estimated at 2 years, but the clock hasn't started ticking yet. I imagine that, subject to permitting & funding, M1 should be in production by 1h 2020. Due to significant economies of scale, ramping up from 1,000 mt/yr to 25,000 mt/yr, would not cost 25 times as much! It would likely be less than 10 times the cost of LEXI's M1 plant.

Readers should note that there's no meaningful commercial-scale production (yet), anywhere in the world, of any Li compounds, from an accelerated Li extraction technology. This is truly the Holy Grail for Li producers, the ability to quickly, cost effectively, and efficiently produce lithium products in a very green process, with minimal waste. Even better, MRT is modular, offering a high level of operational flexibility and growth.

"With MRT's proven record in separating platinum group metals, rare earths & alkali metals, we believe that IBC's designer molecules, applied to selective lithium extraction, will significantly expedite LEXI's path to production in Catamarca Province,"noted LEXI's CEO, Steven Howard, adding that "the remarkable success of IBC's chemical engineering team in the arena of engineering and manufacturing complex, ligand-based components, is evidenced by IBC's extensive development and commercialization of separation systems at mining and industrial sites around the world."

Under the Agreement, IBC is responsible for completing basic engineering specifications and drawings, process design & throughput calculations, brine testing & ligand selections for the MRT plant. LEXI has the exclusive right of first refusal to obtain site license(s) to use MRT for the separation, recovery, refining and purification of Li from brine prospects in territories comprising approx. 20,000 sq. km (7,500 square miles) in two areas of Catamarca Province, specifically including all of the areas in and around the salars of Antofalla, Hombre Muerto, and Pipanaco.

Regarding the Agreement, IBC's President, Steven Izatt stated,

"We believe LEXI's management team and extensive property package provide a great foundation to build a significant, lithium processing presence for MRT in Argentina." Izatt added, "At IBC, we have spent nearly 30 years in MRT research and have installed commercial applications at client operations all over the world. Our belief is that MRT will emerge as one of the preeminent separation technologies for lithium, due to its unparalleled advantages in reducing time to market, capital & operating costs, and adverse environmental impacts."

For a somewhat technical, but I believe necessarily so, explanation of MRT, I turned to IBC President Steve Izattwith the open-ended question, "How is Ion Exchange different from MRT?" His answer follows, a direct quote,

"Ion Exchange (IX) is an entirely different technology than MRT, there are fundamental differences in the mechanisms of action. The key difference between IX and MRT is that IX functions, as the name implies, by exchanging plus & minus charged ions. IX only 'sees' one thing—the charge of an ion (plus or minus, and how many) resulting in low selectivity for Li over other ions. MRT, on the other hand, functions by recognizing multiple parameters of an ion—its unique geometry and electronic structure—making it possible to design high selectivity for Li into the MRT ligand."

"In the case of Li, the positive Li ion is attracted to a negative charge on the IX bead. The problem here for IX is that the negatively charged bead also attracts anything close to Li on the periodic table—i.e., Mg, Ca, Na, K, that carries a positive charge. IX is even worse with Mg and Ca because these have two plus charges so they are doubly attracted to the IX resin."

"The efficient and 99%+ separation of Li from Mg, Ca, Na & K is one of the most difficult processes that must be made to obtain pure Li from brines. Like Li, Na has a + charge, leading to difficulty in making a complete separation of Li from Na in brine using IX. Since IX can only get a fraction of the Li in each run of the process, and the fraction it gets is contaminated with Mg, Na, K & Ca, many additional separation steps are then required. This additional processing can be very expensive in the use of labor, space, time & chemicals, and results in the generation of large amounts of waste.

"The selectivity and binding affinity of Li for the specific MRT bead designed to selectively capture Li are orders of magnitude higher than those for the IX bead. This means that MRT can capture 99%+ of the Li, (virtually free of Mg, Ca, Na, K). Release of the Li from the MRT bead is very efficient since the MRT ligand doesn't need to exchange ions (a slow and inefficient process), but can simply "turn off" the binding mechanism, freeing the Li ion, by using a small volume of relatively dilute, (not concentrated), acid. The collected Li is concentrated one-hundred fold or more over its concentration in the feed solution by this process. This concentration feature is not possible with IX."

Readers beware, no matter what I say or think about MRT, and no matter how remarkable MRT's success has been in commercially separating other metals, there's the real risk that MRT might not "work" for Li extraction on a large scale. However, I see no reason why it won't work, and in any event, the same risk applies to peer Li extraction methodologies, all of which promise what appear to be less impressive recoveries and purity compared to MRT.

Jack Lifton is a Founding Principal of Technology Metals Research, LLC and sits on LEXI's Advisory Board. He's a consultant, author and lecturer on the market fundamentals of "technology metals," a term he coined to describe those strategic rare metals whose electronic properties make our technological society possible.

Educated as a physical chemist specializing in high-temperature metallurgy, Jack was first a researcher before becoming both a marketing & manufacturing executive. I asked Jack for his thoughts on MRT for use in the world of Li brine extraction:

"When LEXI's MRT Li production plant (Module 1) begins operations in 2020, a line will have been drawn between traditional inefficient, polluting, time consuming methods of extracting Li from brines, and IBC's 21st century MRT approach. MRT is not only a completely green process, it is far and away the most efficient and cost-effective technology, useful over a wide range of brine chemistries. An average deposit processed with MRT becomes, in effect, a superior deposit."

With Li prices so strong, speed to market with the aid of new technology needs to be looked at with a fresh set of eyes. Yes, the technology angle is risky for LEXI, and all companies pursing an accelerated technology path, but so is the risk of being too slow to market!

Consider Neo Lithium, the company that just put out a PEA. They have a terrific high-grade resource, a 20-yr mine life and a US$1.1 billion NPV. First production is slated for 2021, and the PEA shows it taking three years—from 2021-2023—to reach nameplate capacity. That's a minimum of seven years until Neo's project is in full production.

By contrast, LEXI's M1 plant (1,000 tonnes LCE/yr) could reach production 12-18 months ahead of Neo Lithium, and could be producing 20k to 25k LCE/yr, 1-2 years before Neo reaches 35k LCE/yr throughput. Neo's stated all-in cap-ex is US$ 589 million, or US$16.8 million per thousand mt/yr of production. LEXI's MRT plant, once scaled up to 20k to 25k LCE/yr, is expected to cost considerably less, perhaps on the order of half as much, per thousand mt/yr.

Argentina's Antofalla Salar, Large, Deep, Untapped

As a reminder, all of LEXI's 128,367 ha is in and around the Antofalla salar, which straddles the provinces of Catamarca & Salta.

Antofalla is one of the largest basins in the region, over 130 km long, 5 to 10 km wide and up to 500 m deep. Less than 8 km northeast of LEXI's Laguna Caro concessions, FMC Corp. (NYSE:FMC) operates its Fenix mine in Salar de Hombre Muerto—Argentina's largest lithium extraction operation. There has been historical drilling in the Salar, but not on LEXI's controlled property.

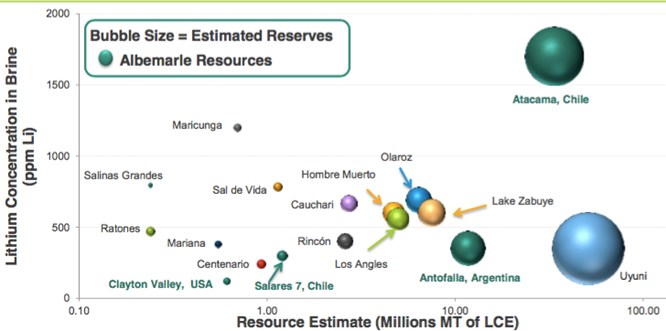

The chart below (from its March 16, 2017 Investor Day Presentation) is an important one for Albemarle Corp. (NYSE:ALB), the largest Li products producer in the world. As can be seen in the chart, Albemarle estimates that Antofalla is the third largest resource in the world and single largest in Argentina.

Conclusion

Lithium Energi Exploration Inc. (TSX-V:LEXI; OTCQB:LXENF; Frankfurt:L09) is an early-stage Li player in Argentina, but is on the right track with a very large Li brine land package, exclusive access to a cutting-edge Li extraction technology and a strong management team. In my articles, I've largely stopped talking about the growing demand for lithium products, it goes without saying.

Readers are encouraged to look at the 14 juniors on the chart at the top of the page. How many could potentially be in small-scale commercial production by 2020 and producing up to 20-25k mt of LCE by 2021 or 2022? In my opinion, just 4 others have line of sight towards near-term production, i.e.,by early next decade. I include Neo Lithium in that small group. The average EV of the 4 I have in mind is about $160 M. By contrast, sexy LEXI, with a lean and mean EV of just $23 M, offers compelling risk/reward.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis, and he is a Chartered Financial Analyst (CFA). He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Lithium Energi, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Lithium Energi are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares and/or stock options in Lithium Energi and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page