A new sales agreement has GMP Securities analyst Martin Landry feeling bullish about ICC Labs (TSXV:ICC).

A new sales agreement has GMP Securities analyst Martin Landry feeling bullish about ICC Labs (TSXV:ICC).

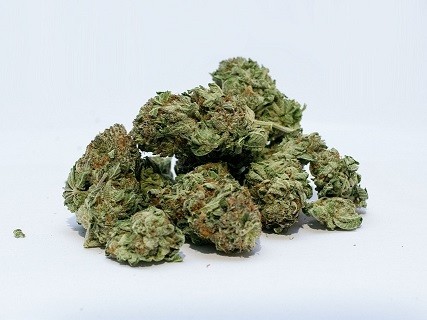

On Tuesday, ICC Labs announced that its subsidiary Tersum SA will export cannabidiol crystal to Avanti Rx Analytics a subsidiary of Nuuvera Inc. Avanti, the company explained, holds a dealer licence under the Controlled Drugs and Substances Act (Canada) and its regulations overseen by Health Canada.

“We are pleased to enter into this sale agreement with Nuuvera and look forward to establishing an important relationship with significant Canadian players in the cannabis space,” commented Alejandro Antalich, chief executive officer of ICC Lab. “This agreement further validates our active pharmaceutical ingredient platform on an international scale and positions ICC Labs for additional distribution opportunities. ICC Labs expects to produce its API’s under the Good Manufacturing Practices regulations and guidelines to ensure product specifications, safety and consistent efficacy. The sale and export to Avanti will increase our presence in the Canadian market.”

Landry says this is a positive development.

“We estimate ICC’s previously announced sales agreements in Mexico and Brazil could generate ~US$5-6m in revenue in 2018,” the analyst says. “Combining these agreements with the Avanti Rx announcement suggests a potential total sales value of $8-10m for ICC in 2018. This would account for ~50-60% of our $16m revenue forecast for ICC in 2018, with only one month into the year. While subject to regulatory approvals, we view ICC’s agreement with Avanti Rx positively, as it further validates the path for CBD-extract products to be imported into Canada through Licensed Dealers. With several LPs recently being awarded LD licences, this bodes well in our view for ICC’s potential to penetrate the Canadian CBD market. We note that once imported through LDs, ICC’s CBD extracts could be subsequently channeled to other LP customers. Despite the above, we are leaving our forecasts unchanged for the moment, as the sales contracts announced so far by the company represent 50-60% of our expected revenue forecast for 2018.

In a research update to clients today, Landry maintained his “Speculative Buy” rating and one-year price target of $2.50 on ICC Labs, implying a return of 74.8 per cent at the time of publication.