The two small Canadian oil producers TORC Oil & Gas (OTCPK:VREYF) and Cardinal Energy (OTC:CRLFF) recently released their next-year capital program. Both companies plan to hold their production flat and generate ample free cash flow that will largely cover their dividend at a WTI price of US$55 per barrel.

These producers look similar, but the market offers a much different risk/reward ratio that favors Cardinal Energy.

Image source: Jp26jp via Pixabay

Image source: Jp26jp via Pixabay

Note: All the numbers in the article are in Canadian dollars unless otherwise noted.

Comparable small Canadian oil producers

Even if both companies produced 88% of liquids and 12% of gas during the last quarter, their product mix actually differs. TORC Oil & Gas produced 82% of light oil and 6% of NGL. In contrast, Cardinal Energy has more exposure to Western Canada Select (WCS) prices with 44% of heavy oil production, 39% of light oil, and 5% of NGL.

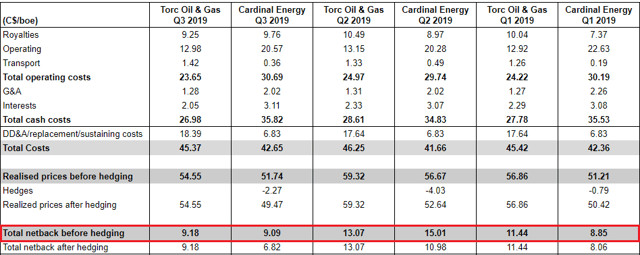

Thus, given the discount of WCS prices compared to light oil prices, Cardinal Energy realizes lower prices than TORC Oil & Gas. But given Cardinal Energy's lower total costs, which include sustaining capital, both companies have been generating a comparable total netback over the last three quarters (highlighted in red in the table below).

Source: Author, based on company reports

And from a scale perspective, both companies are similar. TORC Oil & Gas plans to sustain its 28,300 boe/d production into 2020 and Cardinal Energy's production is expected to slightly increase to a range of 20,500 boe/d to 20,800 boe/d.

2020 Capital programs

Assuming a WTI price of US$55 per barrel, the TORC Oil & Gas management forecasts C$105 million of free cash flow while holding its production flat.

Source: TORC Oil & Gas December 2019 presentation

TORC's next-year plan doesn't mention anything about asset retirement obligations (AROs), and it is not clear whether the company's run rate cash flow in the table above includes these costs, but I assume it does (ARO costs amounted to C$1.8 million for the first nine months this year).

With the same WTI price assumption of US$55 a barrel, Cardinal Energy's free cash flow is expected to reach C$54.5 million with a small increase in its production. This estimate takes into account the midpoint of management's guidance in the table below and C$7 million of ARO.

Source: Cardinal Energy press release

A significant difference in risk/reward ratios

Since both companies released a capital program that corresponds more or less to a flat production, comparing them becomes easier.

Based on EV/funds flow ratio, Cardinal Energy is slightly cheaper than TORC Oil & Gas. But this ratio excludes the impact of capital requirements. If you compare free cash flow yields, which include sustaining capex, Cardinal Energy's free cash flow yield of 20.80% becomes much more attractive than TORC's free cash flow yield of 11.89%.

| COMPANY | EV/FUNDS FLOW (2020) | FCF Yield (2020) |

| Torc Oil & Gas | 4.25 | 11.89% |

| Cardinal Energy | 4.00 | 20.80% |

Source: Author, based on 2020 capital programs and stock prices on Dec. 11.

When you compare free cash flow yields, you should also take into account TORC Oil & Gas' lower debt load. With its 2020 capital program, Cardinal Energy's management forecasted the net debt to adjusted funds flow ratio to decrease to 1.7 by the end of 2020. But TORC's lower debt of 1.25 at the end of last quarter corresponds to a safer balance sheet.

Source: Author, based on company reports

The flowing barrel valuations confirm Cardinal Energy's discount compared to TORC Oil & Gas. The market values Cardinal Energy at a flowing barrel of C$24,685/boe/d compared to the much higher TORC Oil & Gas' valuation of C$44,256/boe/d.

Source: Author, based on company reports

A part of the difference is due to the higher TORC light oil production compared to Cardinal Energy's production that includes heavy oil. But both companies generated similar total netbacks over the last several quarters because of Cardinal Energy's lower total costs structure. Thus, TORC Oil & Gas' high premium doesn't seem to justify.

If you look at the reserves, Cardinal Energy seems much cheaper as well. For instance, the market values TORC's proved reserves at more than twice the price of Cardinal Energy's proved reserves.

Source: Author, based on estimated 2020 production and year-end 2018 reserves reports

Again, such a high valuation difference doesn't seem to justify even if you take into account Cardinal Energy's heavy oil reserves compared to TORC Oil & Gas' light oil reserves.

Takeaway

TORC Oil & Gas with its low debt and its light oil production that offers a 11.89% free cash flow yield at a WTI price of US$55/bbl looks attractive. But the market values the company at a significant premium to Cardinal Energy, even when you take into account Cardinal Energy's heavy oil production and higher debt.

Thus, prudent investors will prefer TORC Oil & Gas. But the risk/reward ratio seems much more favorable to Cardinal Energy.

Note: If you enjoyed this article and wish to receive updates on my latest research, click "Follow" next to my name at the top of this article.

Disclosure: I am/we are long CRLFF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.