We’re seeing a cornucopia of unbelievable events related to crude oil. Yesterday, we just saw the WTI futures front-month (May) trade for a negative value. This is a phenomenon driven by what I explained in my article titled “Why WTI Crude Is Crashing So Much Today.”

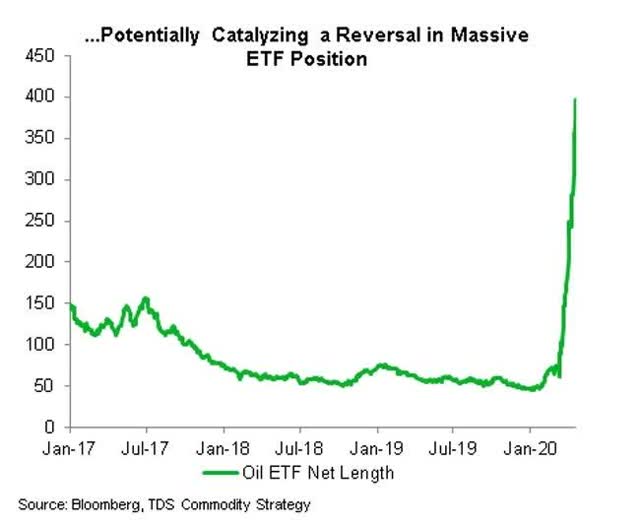

Earlier on, we had also seen the following happen regarding retail participation in the United States Oil Fund (USO) ETF:

Source: Bloomberg, TDS Commodity Strategy, Makros Research Twitter

This was an extraordinary event. Suddenly, the investment world, likely driven by retail players (since the same effect was seen at Robin Hood), decided to plunge head-on into USO. This happened even though most of this retail investment world doesn’t actually understand USO and what it invests in.

USO doesn’t actually invest in crude. Not in physical crude, anyway. What it does is it buys futures. But futures keep maturing, so USO needs to keep on selling its front-month holdings and rolling over the fund into the next futures maturity.

This, however, is a huge problem for USO. For instance, consider what’s happening as I type this:

- June 2020 futures, where just 2 days ago USO has more than 80% invested, are trading at $11.22 per barrel. Meanwhile, July 2020 futures are trading at $18.67.

- Now, USO has to “slowly” sell away from June 2020 futures into July 2020 futures. USO has said it would do so fully by May 5. So USO will be selling oil at $11.22 and buying oil at $18.67. This means that for USO, oil will be going from $11.22 to $18.67 without it gaining anything.

- But now what would happen if oil (July 2020) went back to, say, $15 per barrel? The investor “on the outside” would be seeing oil going from $11.22 to $15. “Wow, nice 34% gain!” But for USO, oil would in effect (partially) be going from $18.67 to $15. A 20% loss. This will repeat over and over, as long as oil is in contango. That is, as long as more distant oil future maturities are higher than closer oil future maturities.

The dynamics above mean a reasonable investor cannot consider USO as a good proxy for investing in crude. So this means a lot of unreasonable investors are piling into it. Now, these could still make money, if against such unfavorable odds crude had a fast enough rally “and they got out.” But that outcome was, and still is, unlikely. Not because of an idea of where crude might go (it should stabilize higher than it is now), but because of the massive rollover losses USO sustains.

Anyway, this brings us to another development.

Yesterday, USO froze the creation of new USO units. This is a critical development. The creation and redemption of ETF units is what keeps USO in line with its NAV (Net Asset Value). That is, this is the mechanism which assures that when you buy USO, you’re paying a price that’s similar to what the assets USO holds are worth. It is, literally, what keeps USO attached to the (harsh) realities of what it holds.

How does the creation and redemption of USO units keep it roughly in line with what it’s worth? Well, when market players bid USO over its NAV per share, authorized dealers can purchase the underlying assets in the market, and then sell baskets of these assets to USO in return for new USO units at NAV, which they then sell into the market reaping the profit differential and pushing USO down closer to its NAV.

So what happens if USO no longer allows the creation of new units? Well, then market players, crazed with desire to own crude through USO exposure, can bid USO well over its NAV without this counter-force impeding USO from detaching from NAV.

In short, since USO unit creation is now frozen, USO is free to trade at ever higher, irrational, premiums to NAV. It is free to detach from reality. And that detachment started immediately. Yesterday USO closed at $2.81. Its NAV per unit at close? $2.06. So yesterday USO already created a massive 36.4% premium to NAV. The detachment from reality already started.

This is not a unique event, though. Years back, the same thing happened in natural gas through the GAZ ETN. I wrote about it at the time. That premium, from memory, went as high as 100%. Also, it became very hard to sell short the ETN and short fees exploded.

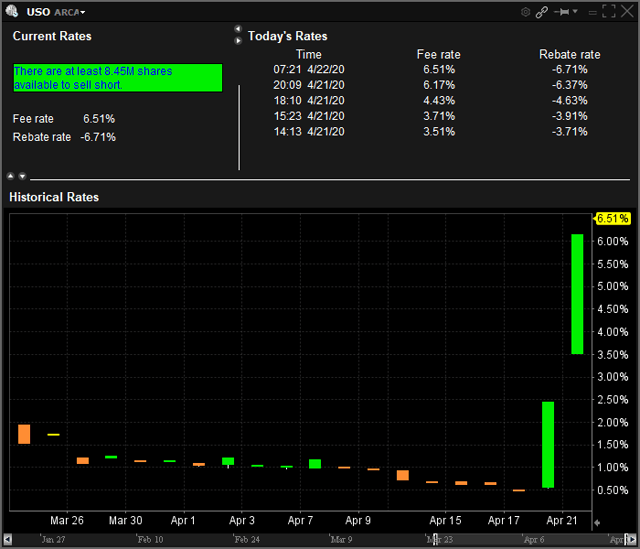

As for USO, there are still many units available to sell short, but short fees are already climbing quickly (though still low for a situation like this):

Source: Interactive Brokers

There are still 2 forces acting against this detachment from reality:

- The fact that USO is still a very large ETF. As of yesterday, 1.45 billion units existed and their market capitalization was $4.1 billion. USO's large size works as a shock absorber in letting things getting wildly out of hand (though in this crypto age we know things can get much crazier).

- The fact that there are still shares available to borrow and sell short. As long as this is the case, short-sellers can fight the irrationality. However, this can turn from a shock absorber to an amplifier. If the borrow is exhausted and short fees go wild (think 30-50-100%), then this can turn into a short squeeze.

That said, the detachment from reality is now with us, and it could get larger.

At all times, there will also be a sword of Damocles hanging over "the irrationals" purchasing USO over NAV. The issuance of new USO units can happen at any time. USO froze new issuance because it exhausted the previous registration, but it has filed for the ability to issue up to 4 billion units. If this is allowed, as soon as it is allowed, the market will be flooded with new USO units forcing it back into its NAV (bold is mine):

In the Form 8-K filed on April 20, 2020 (“April 20 Form 8-K”), United States Oil Fund, LP (“USO”), indicated that it would announce through a current report on Form 8-K when USO has determined to temporarily suspend the issuance of additional Creation Baskets. Today, USO issued all of its currently remaining registered shares. The registration statement that USO filed on April 20, 2020 with the Securities and Exchange Commission (“SEC”) to register an additional 4,000,000,000 shares has not been declared effective. As a result, USCF management is suspending the ability of the USO Authorized Purchasers to purchase new creation baskets until such time as the new USO registration statement for the additional shares has been declared effective by the SEC. The ability of Authorized Purchasers to redeem Redemption Baskets during the suspension of the sale of Creation Baskets will remain unaffected. In addition, trading of USO shares on the NYSE Arca, Inc. will not be discontinued as a result of the suspension of sales of Creation Baskets.

USO will issue a subsequent current report on Form 8-K to announce the effectiveness of the above-mentioned registration statement offering the additional, new shares as well as USO’s ability to resume offering Creation Baskets to its Authorized Purchasers.

Conclusion

For a rational investor, it makes no sense to buy USO to bet on crude’s recovery. Two large reasons tell us this:

- The underlying rollover dynamics, which in the present market means USO is sustaining large losses every month. Also, most (55%) of what USO already holds right now (July contracts) are already over $18.

- The fact that USO now trades at a large premium to its underlying NAV.

However, it should be recognized that right now USO is detached from reality. That this fact is recent. And that the detachment could grow larger (and has often grown larger in the past). We’re not yet at the stage of a significant short squeeze, but if the market keeps bidding USO shares in the face of no new issuance such could happen in the future.

At the same time, this discrepancy between USO's market price and its NAV can end suddenly as soon as the 4 billion new unit registration is made effective. When that happens, USO will reattach to reality with a vengeance, by eliminating most of its premium in a single session, likely through a significant drop in the USO market price (that said, the creation of new units will also immediately put upward pressure on the underlying assets, given USO's size).