It's been a rough few months for the Gold Juniors Sector (GDXJ) due to volatility in precious metals prices, but Ascot Resources (OTCQX:AOTVF) has held up quite well during the carnage, sitting less than 20% from its 52-week highs. Just last week, the company announced that it has secured a US$105 million Construction Finance Package for its Premier Gold Project in British Columbia, and this has de-risked the path to production substantially. However, despite being one of the few names among its peer group to be nearly fully financed, Ascot trades at a reasonable valuation of below US$90.00/oz. Based on this relative undervaluation and de-risked investment thesis following the Construction Finance Package announcement, I continue to see further upside ahead.

(Source: Company Presentation)

(Source: Company Presentation)

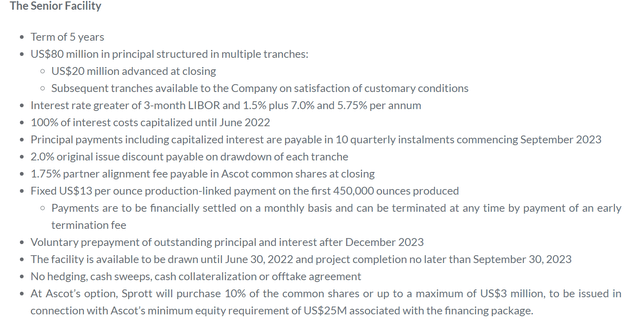

Ascot Resources has had a busy year thus far at its Premier Gold Project in British Columbia, with exceptional drill results released from Silver Hill, the Day Zone, and Premier West, as well as an impressive Feasibility Study announced in Q2. However, the most recent news is by far the most exciting - a US$105 million Construction Finance Package with two reputable lenders announced last week. As noted in the press release, Sprott Private Resource Lending has advanced US$20 million as part of its US$80 million Senior Facility offered to Ascot, with the money available to be drawn until June 30th, 2022. Voluntary prepayment of both outstanding principal and interest is available after December 2023. There were no hedging, cash sweeps, cash collateralization, or offtake agreements included in the deal, a positive sign.

(Source: Company News Release)

(Source: Company News Release)

Meanwhile, Beedie Capital has also participated in the Construction Finance Package, offering US$25 million in principal in two tranches, with US$10 million advanced at the closing of the deal. The deal's interest rate is 8.0%, which is quite attractive, with a 3.0% standby fee on undrawn amounts that is accrued until the maturity date. Finally, all or a portion of the Initial Advance (US$10 million) and Subsequent Advance (US$15 million) can be converted into Ascot common shares at the option of the lender.

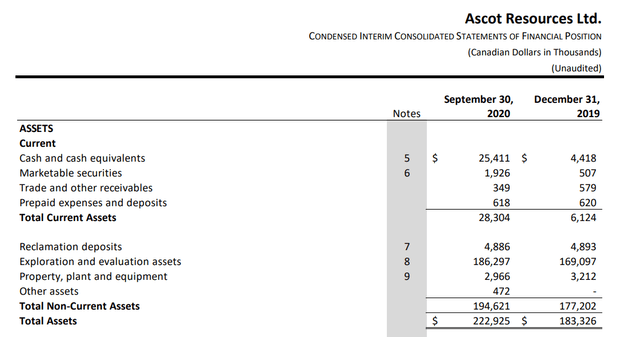

(Source: Company Financial Statements)

(Source: Company Financial Statements)

These two deals are a very positive development for Ascot as the company is now sitting on over US$40 million in cash after receiving its advance payments (cash balance was ~C$25 million at the end of Q3 or ~US$18 million). Also, I had initially expected the US$106 million upfront capex to be paid with 50% debt and 50% shares, which would have led to the share count growing from ~275 million shares to over ~325 million shares, assuming a share price of US$1.00. However, the fact that most of the financing was completed with debt suggests that Ascot could actually head into production with between 295 and 300 million shares outstanding, which would be exceptional as it's very minimal dilution for shareholders. Typically, we see a minimum of 20% to 30% dilution to build a mine, even after accounting for the debt, which must also be added to the balance sheet. In summary, this package is a great sign and de-risks Ascot's path to production significantly. Based on a construction period of only 40 weeks, it is possible that Ascot could be producing gold as early as H2 2022. Importantly, this increased cash balance allows Ascot to order long-lead-time equipment, begin pre-construction activities, advance permitting, and refinance its ~US$10 million convertible note.

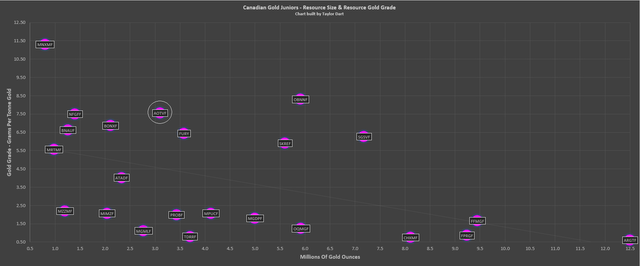

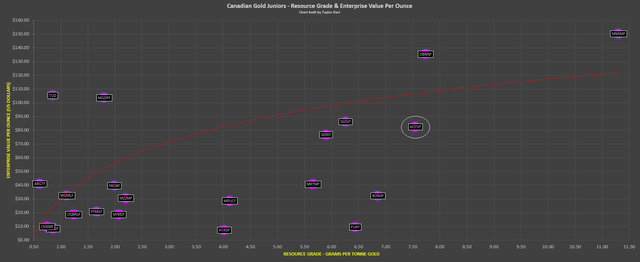

So, how does Ascot stack up against its peers now that it's nearly fully financed to begin construction? Let's take a look:

(Source: Author's Chart)

(Source: Author's Chart)

Before taking a look at the valuation, it's worth pointing out where Ascot Resources sits among other Canadian gold juniors. If we look at the chart above, we can see it's in a tiny group of companies with a 3+ million-ounce gold resource at an average grade above 5.0 grams per tonne gold. In fact, there are only four juniors in Canada that fit these criteria, and they are Fury Gold Mines (FURY), Skeena Resources (OTCQX:SKREF), Osisko Mining (OTCPK:OBNNF), and Sabina Gold & Silver (OTCQX:SGSVF). However, Fury Gold Mines has its ounces spread across three projects in Canada (Eau Claire, Committee Bay, and Homestage Ridge), so technically, there are only four names in this group, including Ascot. Currently, Ascot Resources has ~3.1 million ounces at an average grade of 7.55 grams per tonne gold, as shown below. I have not included the silver (SLV) ounces in this resource calculation, as it represents a minimal resource currently.

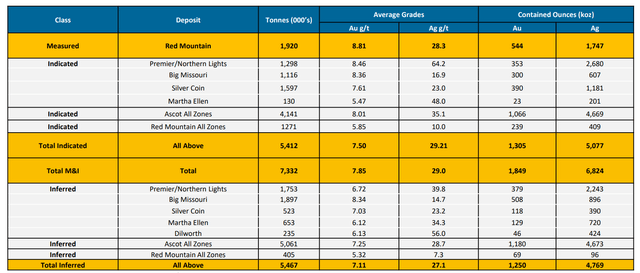

(Source: Company Presentation)

(Source: Company Presentation)

Large high-grade gold projects typically command a premium in the market, especially if they're in a safe jurisdiction like Canada. However, this premium gets even larger when a company is de-risked with most of its financing completed. This opens up the potential to go into production vs. simply hoping a suitor acquires them. Generally, the former option is much better for investors over the long-run. While a takeover is beneficial in the short term, investors in the acquired company typically don't realize the full value of the project. Therefore, while it's great to invest in a takeover target, it's actually better if they don't get taken over in most cases. The exception to this is cases where it's a very complex gold deposit. In that case, it's sometimes better to get the money upfront in a takeover than take the risk on what production looks like vs. the Feasibility Study projections. Given that Ascot has now transitioned into the 'funded' phase with every peer in this group not currently funded for construction, I have upgraded my fair value for Ascot's ounces to US$110.00/oz. Let's see where Ascot stacks up currently:

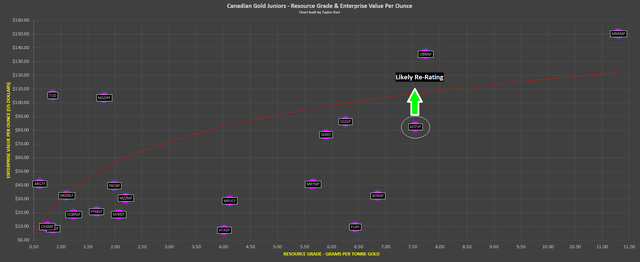

(Source: Author's Chart)

(Source: Author's Chart)

If we look at the chart above, we can see that stocks above the red trendline are generally overvalued relative to their peer group, while stocks below the trendline are considered as undervalued. In some cases, there are exceptions, such as Marathon Gold (OTCQX:MGDPF), which is high-grade in terms of the industry average for deposits amenable to open-pit mining. Hence, it receives a large premium relative to peers. However, generally most low-grade gold explorers trade below US$50.00/oz, and most high-grade gold explorers trade above US$80.00/oz, with fair value for high-grade projects increasing substantially to above US$100.00/oz if they're fully funded. Currently, we can see that Ascot trades in line with other high-grade juniors like Skeena Resources and Sabina Gold & Silver, at a valuation per ounce in the US$70.00-US$85.00 range. However, Ascot is now nearly fully funded for the construction of its Premier Gold Project, and the stock is trading at below US$85.00/oz, which lies 20% below the trendline, and 20% below my conservative fair value of US$110.00/oz. Therefore, a re-rating is now overdue.

(Source: Author's Chart)

(Source: Author's Chart)

If we multiply a fair value of US$110.00/oz by 3.1 million ounces of gold, we come up with a market cap for Ascot of US$341 million vs. a current market cap of US$245 million with 275 million shares outstanding currently. Therefore, I would argue that there's still quite a bit of upside to this story, even after the stock's 30% year-to-date return and more than 200% increase since the March lows. However, it's important to note that Ascot will likely need to sell some shares to complete its financing. To be conservative, we will assume that we see 11% dilution from now until construction, which would translate to an updated share structure of 300 million shares. If we divide the fair value of US$341 million (~3.1 million ounces x US$110.00/oz) by an updated share count of 300 million shares, we get a fair value of US$1.14 per share. This represents nearly 30% upside from current levels, suggesting that there's no reason to be selling out positions just yet.

So, why is Ascot not a buy if conservative fair value at US$1.10?

Personally, to bake in enough of a margin of safety for new positions, I prefer a 30% discount to fair value, which would translate to a share price of US$0.80. This hefty discount I require is because mining stocks are extremely volatile. I want to be buying as low as possible to account for that volatility relative to my target price. For this reason, while I remain bullish on Ascot, I believe the best way to get involved in the stock is on dips, preferably below US$0.79.

(Source: Company Presentation)

(Source: Company Presentation)

The recently announced Construction Finance Package is a very bullish development for Ascot, and we now have a significantly increased probability of first gold in H2 2022. Therefore, I have updated my fair value for Ascot's ounces from US$90.00/oz to US$110.00/oz, which leads to a conservative fair value of US$1.14 per share. Given Ascot's high-grade project in a Tier-1 jurisdiction, I continue to see the stock as a Hold even after this year's advance. However, if we were to see a pullback below US$0.79, I believe this would be a low-risk buying opportunity. For now, I continue to see two other names in the sector with more than 50% plus upside to fair value, so that's where I am focusing currently.

Disclosure: I am/we are long GLD, MGDPF, SKREF. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.