Source: Wesdome Gold image: Kiena Complex.

Investment thesis

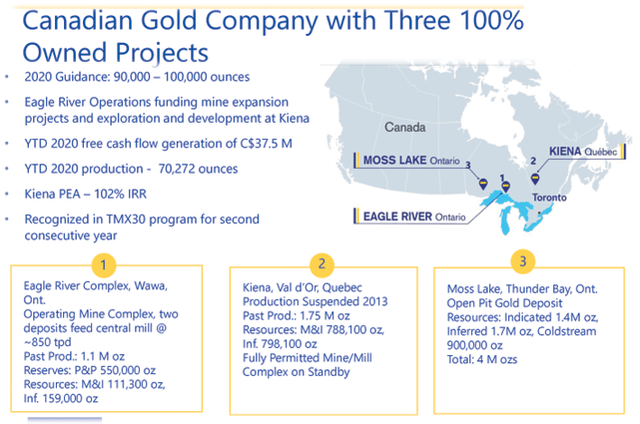

The Canadian Wesdome Gold Mines Ltd. (OTCPK:WDOFF) is a small gold producer focused on Canadian assets.

The company released its preliminary fourth quarter results on Jan. 14, 2021. The full-year production was 90,278 Au Oz, meeting the low end of the 2020 guidance as shown below.

Source: Presentation

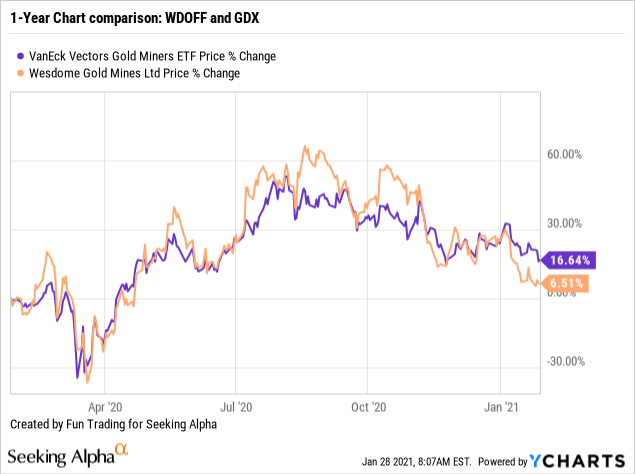

The stock has underperformed the VanEck Vectors (NYSEARCA:GDX). The situation is accelerating since December.

Data by YCharts

Data by YCharts CEO Duncan Middlemiss said in the press release:

Despite the stoppage of some exploration work during the year due to the pandemic, 2020 was a successful year for exploration. Significant drilling was completed on the newly discovered Falcon Zones and will meaningfully contribute to the upcoming resources and reserves update... Kiena exploration was also very successful, and despite a significant reduction in the 2020 drilling program, we were able to increase the A Zones indicated resources by 77% in preparation for the ongoing PFS. The PEA completed in June demonstrated robust economics, low pre-production capital, and a short timeframe to commercial production.

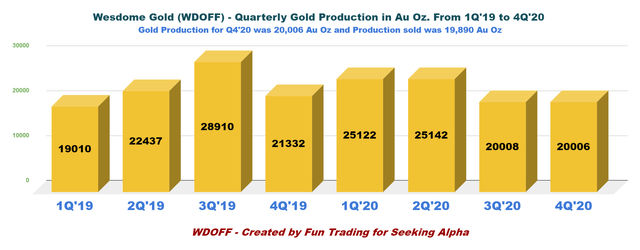

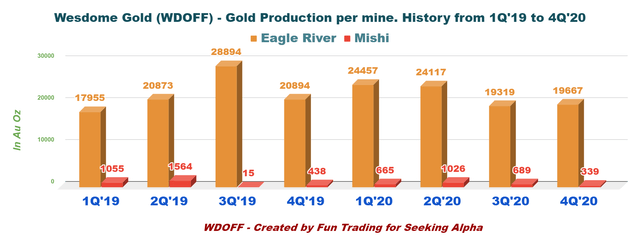

Quarterly production analysis

Wesdome Gold produced 20,006 Au oz in the fourth quarter of 2020 (please see charts below). The full-year 2020 production was 90,278 ounces, meeting the low end of our unadjusted 2020 production guidance.

Eagle River complex presents many potentials for growth, and the company expects an increase to 800 TPD, which is the mill capacity. The Falcon 7 zone's drilling has been completed and will contribute to the mineral resources in 2021.

Below is the detail per mine, including in the Eagle River complex.

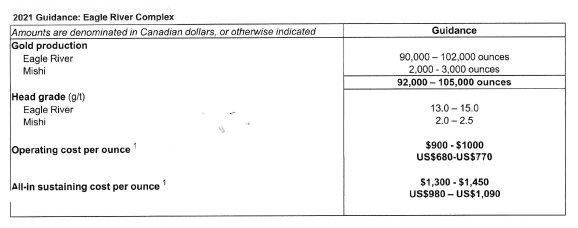

The company indicated Guidance for 2021.

Guidance for 2021 increased to 92K Oz - 105K Oz (not including Kena restart) from 90K Oz - 100K Oz in 2020. Head grade is at Eagle River is expected to go down from 15-16.7 G/T to now 13-15 G/T while Mishi remains basically the same.

Source: Company Pr

Furthermore, the company expects 15K – 25K ounces at Kiena (based upon a positive restart decision).

- Subject to positive PFS and approval milestones, Kiena has the potential to ramp up to commercial production in a short four- to six-month timeline.

- Kiena has the potential to contribute 15,000 – 25,000 ounces of production at a head grade of 12.0 grams per tonne, reducing overall operating and AISC costs commencing with a blend of the lower grade S-50 Zone and high grade A Zones

- The company is embarking upon its most ambitious exploration program at both Eagle River and Kiena with $16M forecast to be spent at Eagle and $16M at Kiena

- Reconciliation of the Kiena Deep A Zone bulk sample extracted in Q4 of 2020 with additional processing remaining into Q1 2021

The Kiena Project in Val d'Or, Quebec, is advancing.

- Full drilling and development capacity resumed in June. The company sold 1,500 ounces to date from the bulk sample at the Kiena Deep A Zone Kiena Mine in Val d’Or, Quebec. Revenue of $2.8 million with additional processing remaining and full reconciliation ongoing.

- Wesdome published Kiena Preliminary Economic Assessment (“PEA”), and advanced Pre-Feasibility Study (“PFS”) is expected to be published in Q2 2021 based on an updated resource estimate completed in December 2020 (Indicated resources increased by 77% to 717,400 ounces).

Reminder: Kiena LOM is expected to be 8 years with AISC at $674 per ounce. After-tax NPV (discount rate 5%) $416 million.

Source: Presentation

Conclusion and technical analysis

Wesdome Gold Mines Ltd. is a good and no-surprise Canadian gold producer with great potential (Kena near completion project).

I like the financial profile here. The company has no long-term debt (including short-term) and a great cash position that should be growing with a gold price between still over $1,800 per ounce.

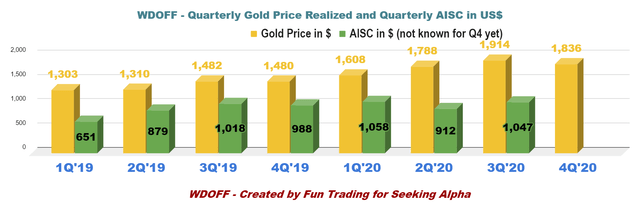

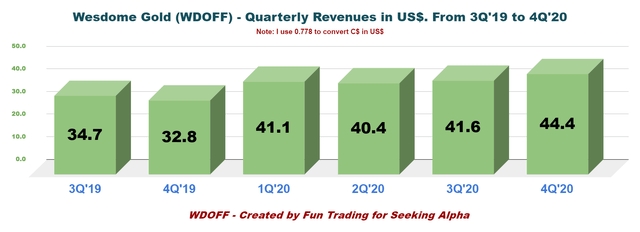

The company indicated a 2020 Revenue from gold sales of C$215.3 million, a 31% increase over 2019 at an average realized sale price of C$2,360 per ounce (2019: C$1,853). Revenue in $US is estimated at $167.5 million.

I estimated a quarterly free cash flow of about $5 million in Q4'20.

Technical Analysis

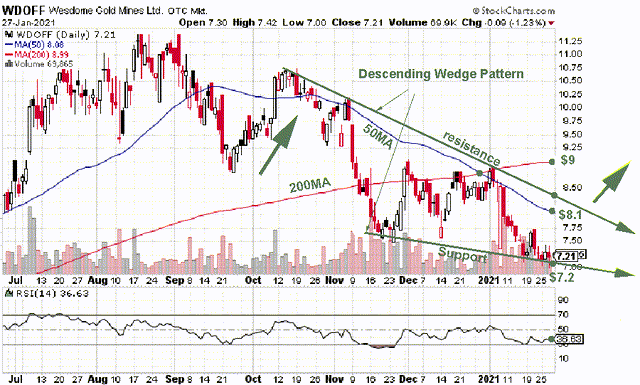

WDOFF forms a descending wedge pattern with resistance at $9.50 and support at $7.00-$7.25. The strategy is to buy at support and sell at resistance. This means buying between $7.00 and $7.25.

WDOFF forms a descending wedge pattern with resistance at $9.50 and support at $7.00-$7.25. The strategy is to buy at support and sell at resistance. This means buying between $7.00 and $7.25.

Descending wedge patterns are generally bullish when entered from the support side, which is the case here.

The sell zone should be around $8.10-$9.50, where it would be reasonable to sell a part of your position but no more than 40%.

Watch gold like a hawk.