Curaleaf (OTCPK:CURLF) reported earnings after the bell on Tuesday, delivering typically strong results. Due to the federal criminality of cannabis as a controlled substance, many investors might not be familiar with cannabis investment plays based in the United States. Unlike Canadian operators like Canopy Growth (CGC), in which investors are merely hoping for an eventual presence in the United States, there are operators like CURLF which already own medical dispensaries or even retail dispensaries in states which have already legalized adult use.

While CURLF might not have the same margin profile as peers, investors may be attracted to its large footprint, which gives it exposure to potential upside from future adult-use legalization efforts. I rate shares a strong buy with 100% potential upside.

The Largest Cannabis Company In America

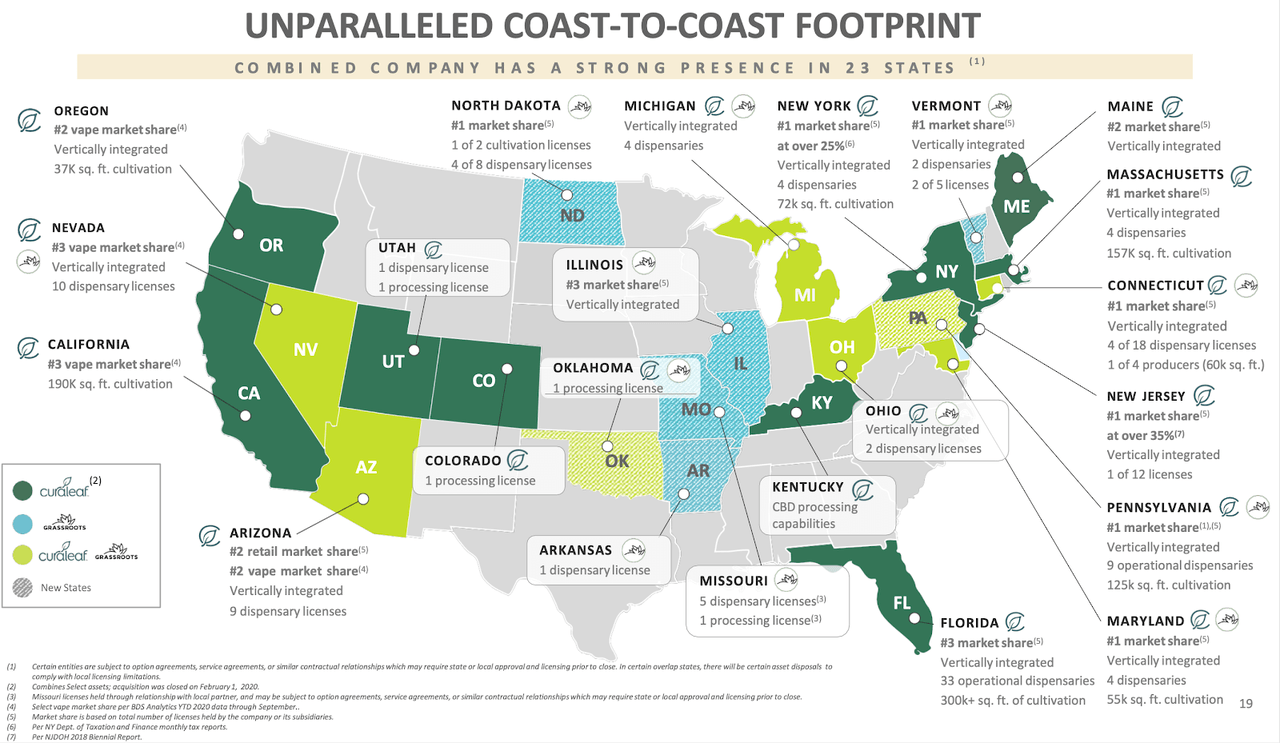

As of the present day, CURLF has the largest cannabis footprint in the country, with a presence in 23 states:

(Investor Presentation)

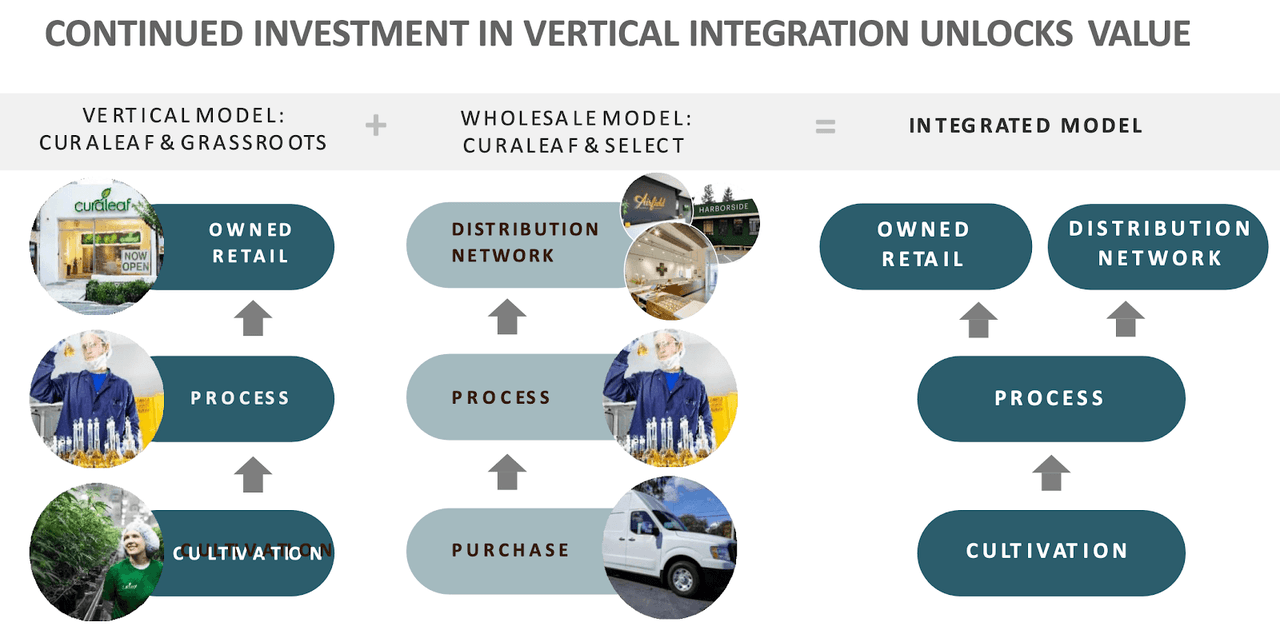

In most of its markets, CURLF is a vertically integrated operator, meaning that it cultivates and processes its cannabis and finally sells the product in its own dispensaries:

(Investor Presentation)

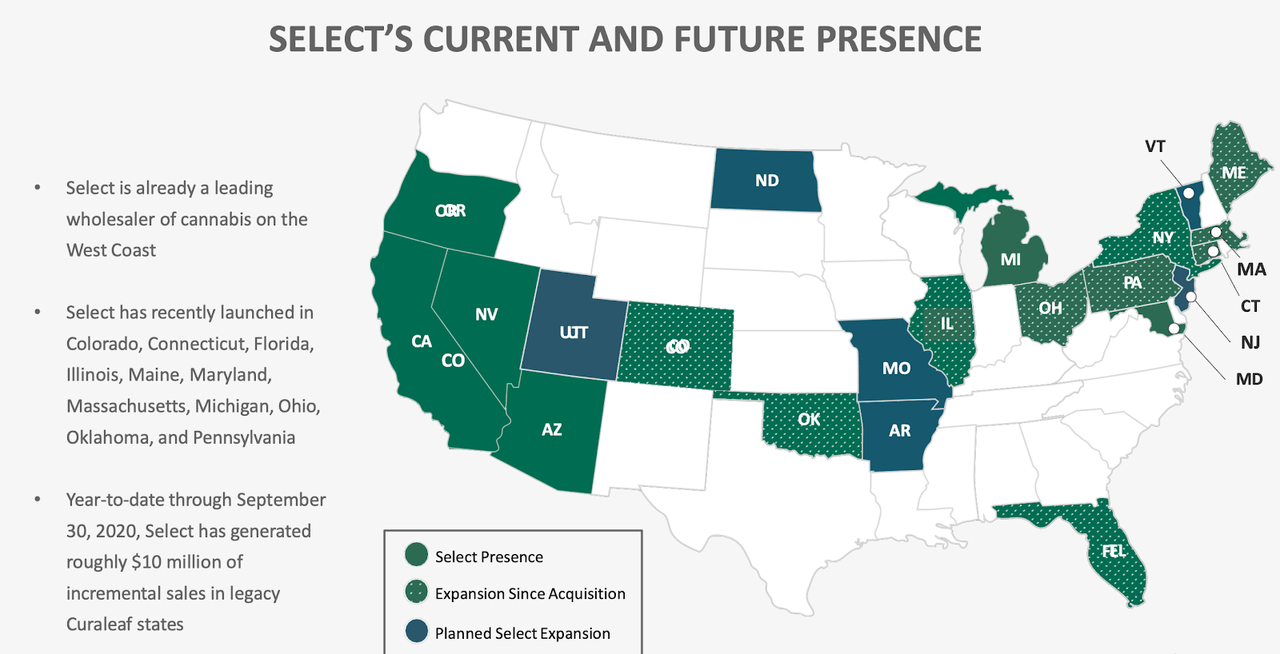

CURLF also is a leading wholesaler of cannabis in virtually all its markets:

(Investor Presentation)

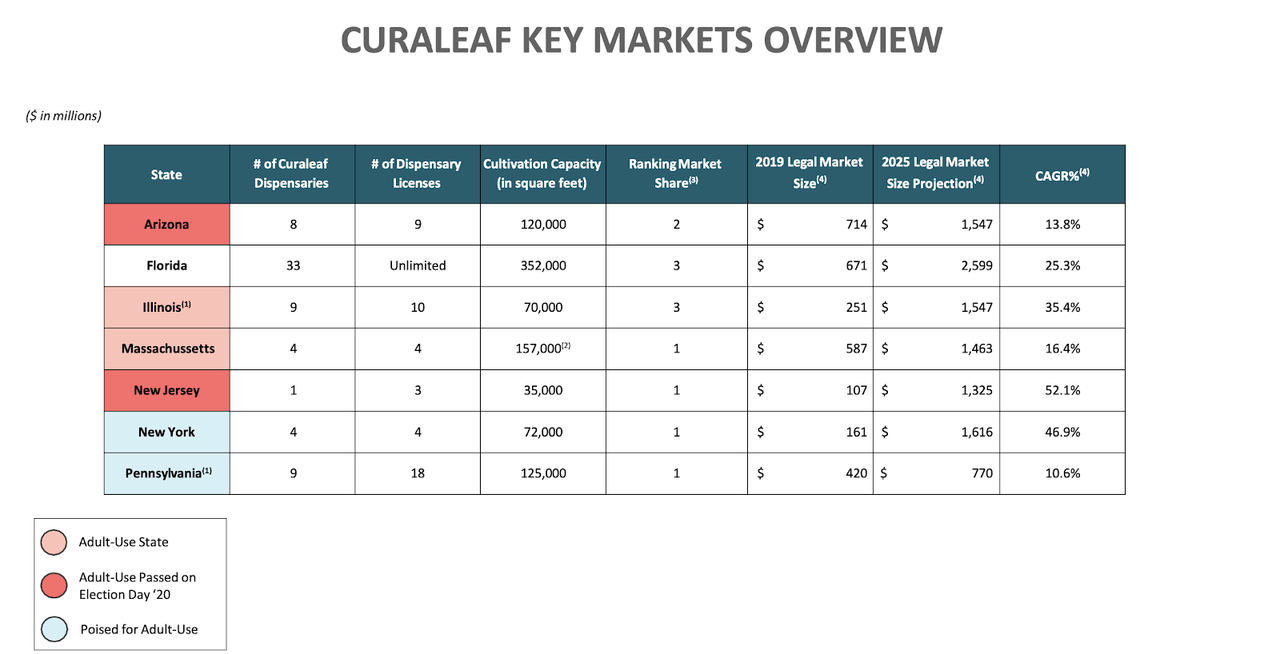

As we can see below, CURLF has a major presence in many states which have either already legalized adult-use or are anticipated to legalize adult use.

(Investor Presentation)

CURLF reported results on Tuesday which were quite strong. Revenue grew 26% sequentially and 205% year over year to $230.3 million. Growth has been primarily driven by acquisition activity. Gross margin of 48% was slightly lower than 50% last quarter, but was significantly higher than 38% in the prior year. It’s worth noting that Green Thumb (OTCQX:GTBIF), a company I have highlighted to subscribers as my top pick in the sector, had gross margins of 55.4% as of the latest quarter.

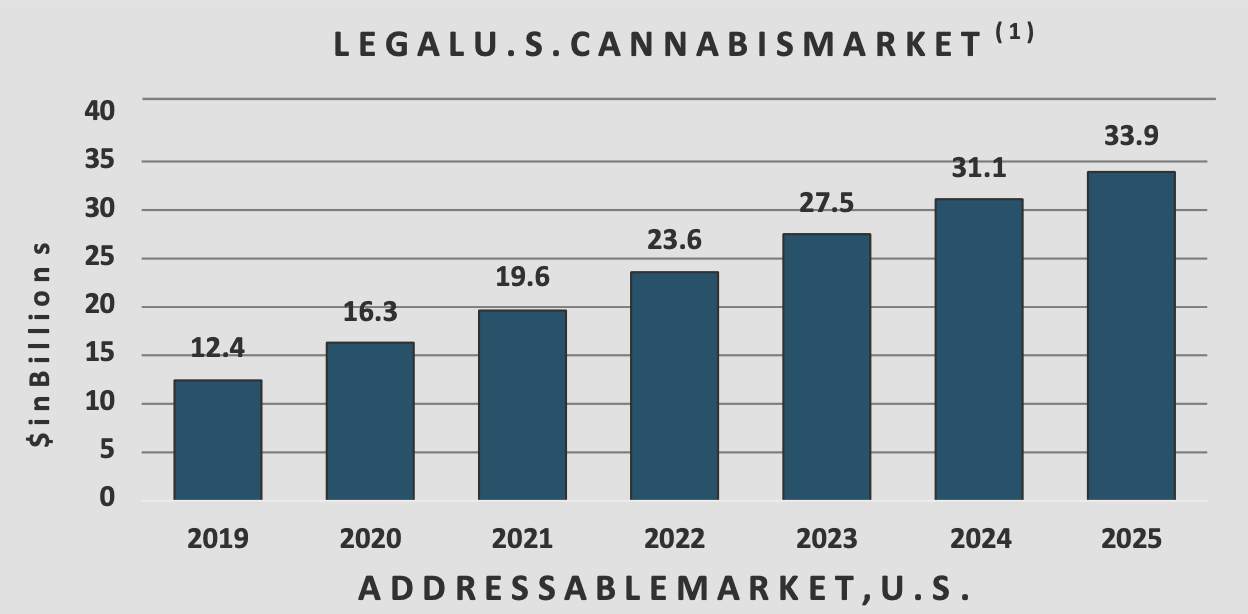

The wind is at CURLF’s back. The legal U.S. cannabis market is projected to grow at an aggressive double digit compounded rate over the next several years:

(Investor Presentation)

Furthermore, there’s hope for regulatory reform. Because Democrats have taken control of the Presidency, House of Representatives, and Senate, there is renewed hope that our legislators may be able to decriminalize cannabis once and for all. It is likely that states will still be able to determine for themselves if and when they choose to legalize cannabis, but federal decriminalization of cannabis has the potential to remove “280E taxes,” which limit tax deductions to the cost of goods sold.

This means that unlike any other corporation, U.S. cannabis operators currently are unable to deduct expenses like employee wages and interest expenses from taxable income. Consider that in the latest quarter, CURLF had a net loss of $35.3 million, but income before income taxes was $2.7 million. Once 280E taxes are removed, CURLF would suddenly become profitable.

Balance Sheet Analysis

As of the latest quarter, CURLF had $73.5 million in cash versus $285 million in debt and $270 million in lease liabilities. Since the end of the quarter, CURLF raised $240.6 million through the issuance of 19 million shares. Even accounting for its extremely recent $286 million acquisition of EMMAC Life Sciences, which was financed with 15% cash, CURLF should have approximately $316 million in cash. The growing cash balance should be warmly welcomed, as CURLF has historically maintained a net debt position due to aggressive acquisition activity.

Considering that CURLF has arguably proven itself as a leading cannabis operator, I expect the company to have access to the capital markets in the future and am hopeful that the company can further bolster the balance sheet with future equity offerings. In particular, I think shareholders should welcome the fact that CURLF financed the EMMAC acquisition primarily with stock, as this kind of financing reduces the impact to leverage while still remaining highly acquisitive to the top line.

Valuation and Price Target

Based on 660 million diluted shares outstanding, CURLF trades at 17 times trailing sales. Analysts expect CURLF to earn $1.26 billion in revenue over the next 12 months. Shares trade at only 8.5 times that number. I can see CURLF being able to grow its top line at a compounded growth rate of 30% annually over the next decade. My 12-month fair value estimate is $32, representing 17 times forward sales. The main catalysts are continued growth, removal of 280E taxes, and execution on integrating acquisitions to the bottom line. Shares have 100% potential upside to that target.

Risks

-

There is no guarantee that medical dispensaries will succeed after legalization in the state. While it is reasonable to assume that medical dispensaries would be able to transition to selling retail cannabis once adult-use sales are legal, it is also possible that certain states decide to implement restrictions on such sales. That said, wouldn’t states want established operators to set a strong example for retail sales?

-

Regulatory changes might not materialize. Perhaps our senators will be too preoccupied with passing COVID-19 stimulus packages and won’t have time to pass any cannabis reform. Such a scenario would be an obvious hit to the cannabis bull thesis, but cannabis reform is likely a question of “when” not “if,” and there may ironically be positives to delayed reform. If 280E taxes aren’t removed, then CURLF should be able to continue acquiring dispensary licenses cheaply because smaller operators do not have the scale to operate profitably.

-

If margins compress in the future, then the valuation proposition may be negatively affected. I expect continued legalization to lead to a substantial re-rating of U.S. cannabis names, but over the long term, it could also increase supply and put pricing pressure on these firms. In many of the states which CURLF operates, cannabis licenses are limited which puts a natural limit on supply. If these states decide to lift their caps on licenses, then CURLF might not be able to maintain its current profit margins.

-

CURLF may be empire-building. The company has prioritized aggressive top line growth over profitability. If CURLF is unable to drive synergies and execute, then it may end up with a bloated cost structure and nothing much to show for it - very similar to Canadian cannabis operators like CGC. It’s worth noting that just prior to releasing earnings, CURLF announced that it was entering the European market with a $286 million acquisition of EMMAC Life Sciences. Time will tell if management can handle all the acquisition activity.

Conclusion

CURLF offers a simple investment thesis: by buying the stock, you get exposure to the largest cannabis footprint in the country. The current regulatory backdrop has enabled CURLF to acquire its way to a large footprint, and regulatory reform may significantly boost its profitability. Trading at 8.5 times forward revenues, CURLF appears too cheap in light of the highly bullish forward prospects for the U.S. cannabis industry. I rate shares a strong buy with 100% potential upside.