GREY:SHIFF - Post by User

Post by

classicacton Apr 12, 2021 2:39pm

118 Views

Post# 32978713

Small caps getting crushed everywhere, TSF no different!

Small caps getting crushed everywhere, TSF no different! Morgan Stanley says small-cap breakdown foretells reopening pain: At the Open

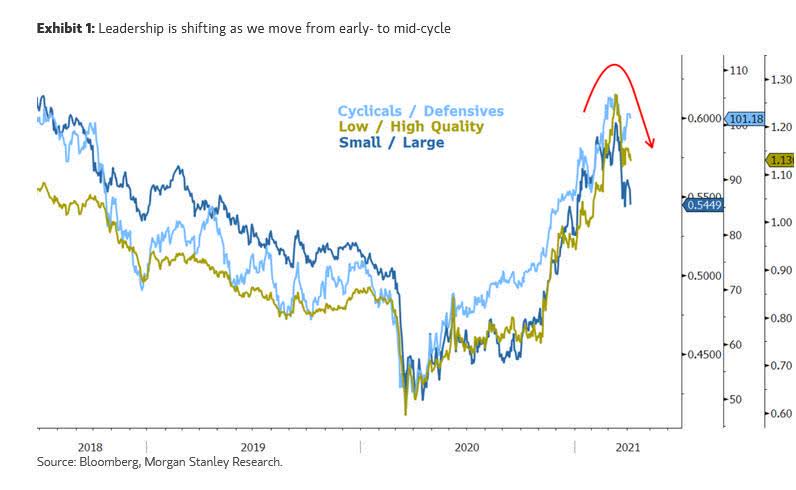

- The breakdown in small-cap stocks suggests that execution risks that could mean a more difficult economic reopening than the market is anticipating, Morgan Stanley says.

- This morning, the Russell 2000 (NYSEARCA:IWM) is down 0.1%, a little better than the drop in S&P futures (SPX) (NYSEARCA:SPY), off 0.2%. Nasdaq 100 future (NDX:IND) (NASDAQ:QQQ) are the weakest, down 0.3%, with Dow futures (INDU) (NYSEARCA:DIA) off 0.2%.

- But the Russell has underperformed the S&P by 8% since it peaked March 12, Morgan Stanley Chief Equity Strategist Michael Wilson writes in a note published on ZeroHedge.

- "While this follows a period of historically strong outperformance, when relative strength like this breaks down, we take notice," Wilson says. "Furthermore, some of the cyclical parts of the equity market we have been recommending for over a year are starting to underperform, while defensives are doing a bit better."

- "In my view, the breakdown of small caps and cyclicals is a potential early warning sign that the actual reopening of the economy will be more difficult than dreaming about it," he adds. "Small caps and cyclicals have been stellar outperformers over the past year. In essence, they were discounting the recovery and reopening that we are about to experience. However, now we must actually do it and with that comes execution risk and potential surprises that aren’t priced."

- Morgan Stanley downgraded small-caps a month ago and two week ago advised investors to add higher-quality names to their portfolios.

- It's now cutting Consumer Discretionary (NYSEARCA:XLY), a "classic early-cycle winner," to Underweight and boosting Consumer Staples (NYSEARCA:XLP) to Neutral to increase quality and reduce beta.

- With upcoming earnings, Morgan Stanley warns that supply bottlenecks could hit 2Q outlooks in margins and costs.

- But Credit Suisse says today that easy comps, economic reacceleration and a rebound in commodity prices is "driving this unprecedented surge in profits, which reaches its apex in 2Q21."

- "Discretionary EPS is forecasted to grow (100%+), the most of any sector, on a rebound in Autos (500%+), Softline Retail (200%+) and Durables & Apparel (100%+)," Credit Suisse analysts led by Jonathan Golub write. "Gaming, Lodging & Leisure remains a sore spot (-200%+)."

- Another red flag for Morgan Stanley is the underperformance of IPOs and SPACs, which is generally leading indicator for broader market weakness, Wilson says.

- It's a "signal that the excessive liquidity provided by the Fed is finally being overwhelmed by supply."