Photo by svedoliver/iStock via Getty Images

Photo by svedoliver/iStock via Getty Images

We're finally nearing the start of the Q1 Earnings Season for the Silver Miners Index (SIL), and Excellon Resources (EXN) is one of the first companies to report its results. Overall, the company had a solid quarter with silver and zinc production up more than 10% year-over-year. This strong performance coupled with much higher metals prices should translate to a multi-year high for revenue and a much better year for the company. However, while the business is improving due to higher metals prices, I still see the stock as uninvestable, given that mining is reliant solely on mineral resources. Therefore, I would view sharp rallies as selling opportunities.

(Source: Company Presentation)

(Source: Company Presentation)

Excellon Resources released its preliminary Q1 results last week and had a solid quarter, reporting quarterly production of ~516,700 ounces silver-equivalent ounces [SEOs]. While this translated to a slight decrease year-over-year due to the outperformance of silver vs. base metal prices in the calculation, metals production was actually up across the board for silver, lead, and zinc. This increase in production combined with higher metals prices should translate to a much stronger H12021 for the company, especially considering that it's lapping the COVID-19 related shutdown in Q2. Let's take a closer look below:

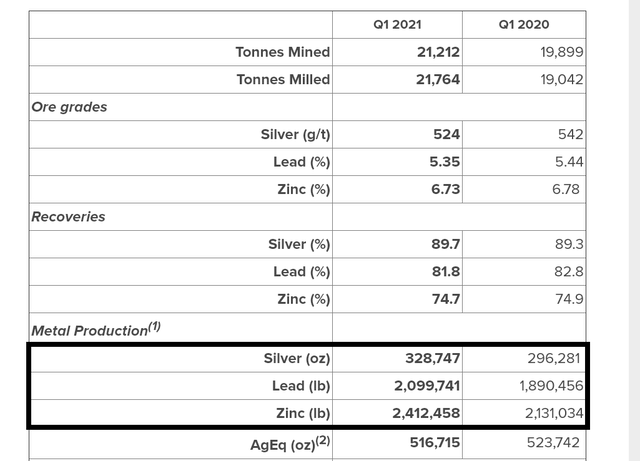

(Source: Company News Release)

(Source: Company News Release)

As shown in the table above, Excellon reported an 11% increase in silver (SLV) production in Q1 to ~328,700 ounces. From a base metals standpoint, it was a great quarter as well, with lead and zinc production up 11% and 13%, respectively. This improved performance was due to much higher throughput in the period, with ~21,800 tonnes milled in Q1, up from ~19,000 tonnes last year. This ~15% increase in throughput more than offset the lower grades across the board, with silver grades down just over 5% to 524 grams per tonne silver. Combined with much higher metals prices in Q1, Excellon is set up for a blow-out quarter.

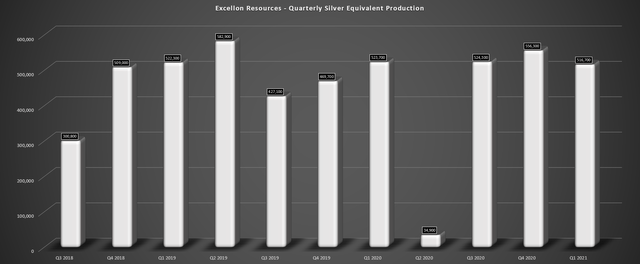

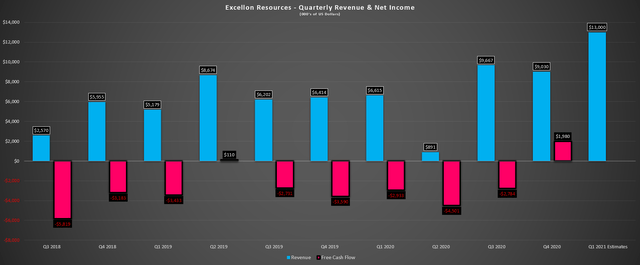

(Source: Company Filings, Author's Chart)If we look at the chart above, the trend in SEOs produced has been relatively flat despite the improvements, which would otherwise translate to no real change to Excellon's profitability. However, with the company's average realized silver price soaring from $15.04/oz in Q1 2020 to $26.32/oz in the most recent quarter, we could see a significant boost in revenue, helped by what's likely to be higher sales volumes. Over the past two years, Excellon has been unable to get past the ~$10 million revenue mark in any quarterly period, but this looks set to change in Q1.

(Source: Company Filings, Author's Chart)If we look at the chart above, the trend in SEOs produced has been relatively flat despite the improvements, which would otherwise translate to no real change to Excellon's profitability. However, with the company's average realized silver price soaring from $15.04/oz in Q1 2020 to $26.32/oz in the most recent quarter, we could see a significant boost in revenue, helped by what's likely to be higher sales volumes. Over the past two years, Excellon has been unable to get past the ~$10 million revenue mark in any quarterly period, but this looks set to change in Q1.

(Source: Company Filings, Author's Chart)

(Source: Company Filings, Author's Chart)

If we assume that Excellon sells ~510,000 SEOs in Q1 at an average price of $26.00/oz, we should see revenue come in at ~$13 million or higher, translating to more than 80% growth year-over-year. As shown above, this higher revenue and improved margins in Q4 2020 led to the first quarter in over a year of free cash flow, and I would expect that the company could generate more than ~$9 million in free cash flow in FY2021 if the silver price can stay above $26.00/oz. This would be a massive improvement from FY2020, when the company reported a negative free cash flow figure of ~$8.2 million, which led to additional share dilution.

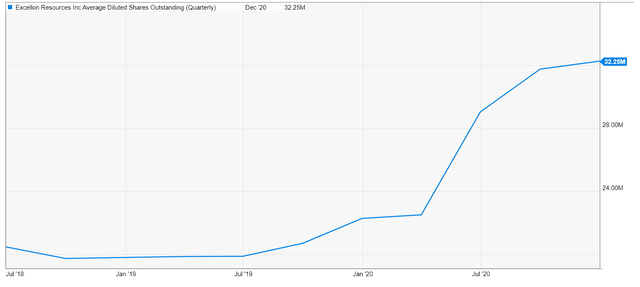

(Source: YCharts.com)

(Source: YCharts.com)

Given that Excellon is set to begin generating free cash flow and is working on continued optimizations to drive higher margins, why not buy the stock?

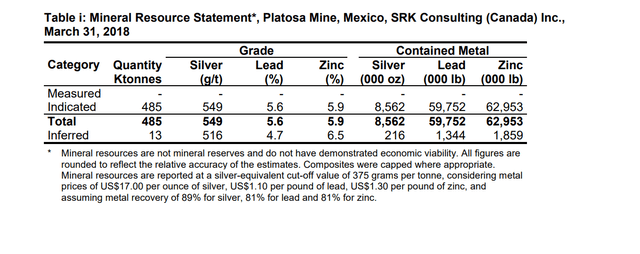

While there's no question that Excellon should see margin improvement and positive free cash flow this year, the company has a declining resources base, with no recent update to its resource at its Platosa Mine. As it stands, mining based on mineral resources is a riskier proposition for investors, with resources having lower confidence levels than reserves. However, the last time we got a glimpse at resources was in 2018, and the company has mined over ~190,000 tonnes since of its ~485,000-tonne resource base. Until we get an update on this resource base, it's unclear what Excellon's mine life is, so I would assume any free cash flow will be funneled towards resource and ideally reserve replacement. Therefore, it's not really 'free cash flow' as it needs to support Platosa's long-term mine life.

(Source: Company Presentation)

(Source: Company Presentation)

Some investors might be comforted by the fact that Platosa has returned some decent intercepts over the past few months, like 6.5 meters of ~1,293 grams per tonne silver-equivalent and 8.9 meters of ~1,422 grams per tonne silver-equivalent. These are undoubtedly exceptional intercepts for a property that's currently mining a grade of below 1,000 grams per tonne silver-equivalent. However, until we see a new resource (and ideally reserve) on the property, it's tough to have confidence in this story. Generally, single-asset miners are already a very risky bunch as they have all their eggs in one basket if there's a major issue at any single mine, but a single-asset miner relying on strictly resources is a higher risk proposition.

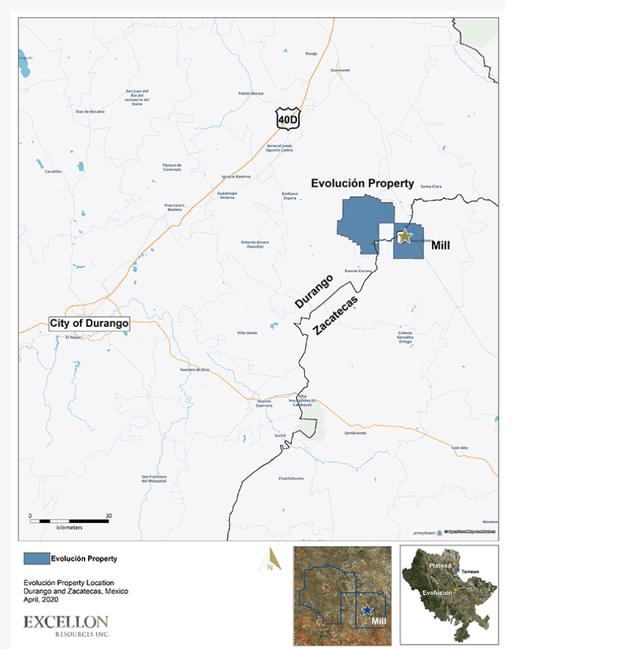

(Source: Company Presentation)

(Source: Company Presentation)

Some investors might be comforted because the company's Evolucion Project is sitting on ~65 million SEOs in Mexico based on last year's resource update. However, it's important to note that Evolucion's resource is much lower grade than Platosa at ~170 grams per tonne silver-equivalent, and the processing capacity at Miguel Auza is just 800 tonnes per day. Therefore, the company would see a significant decrease in production if it were to rely on strictly Evolucion material to feed the mill. Besides, there is no reserve yet at Evolucion, so investors are relying on resources here as well. In terms of Kilgore in Idaho, the project is still in the PEA stage, and I would imagine the actual capex bill will be closer to $100 million (2019 PEA: ~$83 million), so it must be funded with mostly share dilution, not debt, and it's nowhere near a construction decision.

Based on ~36 million shares fully diluted, there is no question that Excellon is cheap as a producer with a market cap of roughly ~$100 million. This leaves it trading at barely 2x FY2021 revenue and potentially an ~8% Y2021 free cash flow yield. However, with mining reliant on resources, no clear path to funding Kilgore without significant dilution, and some of the highest costs in the industry (Q4 2020: $21.19/oz) even after optimizations, I think most of the discount is justified. Therefore, I believe there are much better opportunities elsewhere in the sector, and I see GoGold Resources (OTCQX:GLGDF) as a much better way to play the sector on dips.