TxMetrix 201: In the Absence of AnythingMany people believe that a black hole represents nothing. In fact the opposite is true. If you took any massive object in the Universe and compressed it into a small enough volume, you could transform it into a black hole. Mass curves the fabric of space, and if you collect enough mass in a small enough region of space, that curvature will be so severe that nothing, not even light, can escape from it. The boundary of that inescapable region is known as an event horizon, and the more massive a black hole is, the larger its event horizon will be.

Conclusion: A black hole is in fact not a hole. It is gravitational singularity (or space-time singularity). It is a location where the quantities that are used to measure the gravitational field become infinite in a way that no longer depends on a coordinate system. In other words, it is a point in which all physical laws are indistinguishable from one another, where space and time are no longer interrelated realities, but merge indistinguishably and cease to have any independent meaning.

It’s pretty simple $hit really.

And the stock market is going to crash next, right? Maybe, maybe not. How about the US dollar collapse as well? Again, maybe, maybe not. For something to crash, it must go off of a planned trajectory in a sudden and unexpected fashion.

So many investors talk about the collapse of the US dollar. As measured by the U.S. Dollar Index (DXY or informally, the "Dixie"). But the DXY is an index (or measure) of the value of the United States dollar relative to a basket of foreign currencies. It is a weighted geometric mean of the dollar's value relative to following select currencies:

- Euro (EUR), 57.6% weight

- Japanese yen (JPY) 13.6% weight

- Pound sterling (GBP), 11.9% weight

- Canadian dollar (CAD), 9.1% weight

- Swedish krona (SEK), 4.2% weight

- Swiss franc (CHF) 3.6% weight

Every single one of these currencies is controlled by a Central Bank that works tightly with the US Fed on behalf of our Western Financial Order. The index itself is a simply a reflection of what these Central Banks have agreed to set as the weighted average of the respective fiat currencies. They print, they talk, and they adjust. There is no black hole, no void, no lack of control.

In fact the opposite is true. It is a highly controlled artificial representation of what these banks have agreed the fiat currencies to be. Therefore, a $US crash cannot occur as defined by the “Dixie”. Why even bother to look at what represents a mathematical manipulation designed for our own consumption? And as an added insurance, they are engineering the digital currency

CBDC system that removes all paths of escape. A gift that only technology can provide.

So, what about the market? Well, the market is mistakingly viewed as a rational indicator of the economy, and of its future. But this idea that the market is an indicator of the future and closely linked to the real economy is mostly a myth. Before a market crash, is it rational to be valuing stocks so high? It depends on what the market indices really represent.

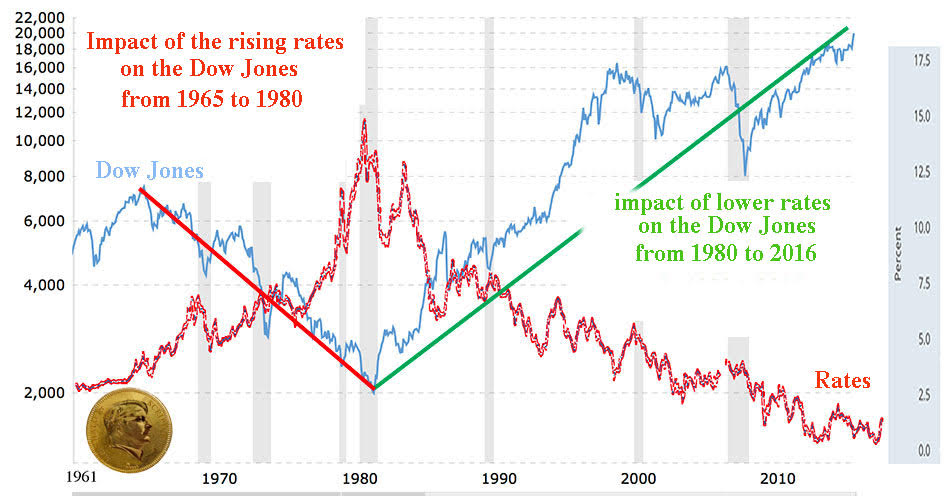

https://goldbroker.com/media/image/cms/media/images/caracas-syndrome/impact-rising-rates-dow-jones-1965-1980.jpg

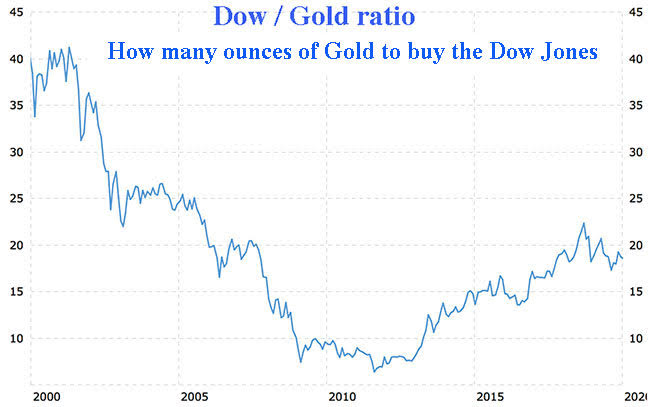

https://goldbroker.com/media/image/cms/media/images/caracas-syndrome/impact-rising-rates-dow-jones-1965-1980.jpg The rise in the market has become geometric with the massive monetary injections from the various central banks. In reality, the more money is created, the more money devalues. If you take the Dow Jones value expressed in ounces of gold, the stock market has halved since 2000. The rise in the stock market on Wall Street is therefore an optical illusion, like that of the Black Hole.

https://goldbroker.com/media/image/cms/media/images/caracas-syndrome/dow-gold-ratio.jpg

https://goldbroker.com/media/image/cms/media/images/caracas-syndrome/dow-gold-ratio.jpg The

Caracas Syndrome is not an indicator of wealth, despite the almost infinite melt up of the respective stock market. It is an illusion. However, a crash does in fact exist. But it’s moral, societal, and life-style in nature. A rabid

Cantillon Effect that kills everything around it but the top 1%. The

GINI Coefficient goes to 1. The Crash consists of all things but the markets themselves, and the endless amount of increasingly worthless fiat currency that fuels them.

The market is a DEBT METER. It is not an economic meter. And that is the gravitational singularity. Debt is the central mass that draws all things towards it. It will not crash if settlement is via a "digital printing press". There is only an eerie

Spaghettification effect.

Even Crypto cannot survive in this system of control. It will be curtailed and taxed, and even labeled as contraband in some cases. All value will be defined as the available services and privileges that this prison system offers to its inmates.

Every Crisis that is created will be solved. And everyone will be so grateful and give Thanks.

This is the way the world ends, Not with a bang but a whimper.

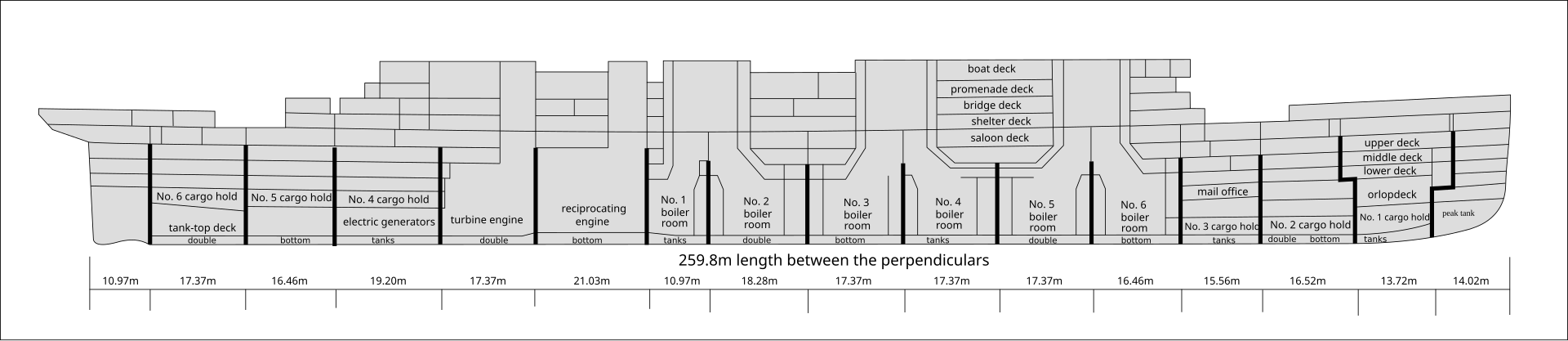

But, as always…….see if you can spot the flaws in the design. They are always there and overlooked.

https://upload.wikimedia.org/wikipedia/commons/thumb/a/ae/Titanic_structure_en.svg/1920px-Titanic_structure_en.svg.png

Tx