excellent report on Arcology The cryptocurrency market is showing no signs of slowing down in 2021.

Although the price of bitcoin has stagnated over recent weeks, other digital currencies are still soaring to new highs as investors plow into alternatives, hoping to catch massive gains mirroring that of the crypto mania four years ago.

Five of the world’s 10 largest cryptocurrencies hit new record highs over the past week.

By midnight Monday, the global crypto market had hit a record market capitalization of just above $2.5 trillion, reflecting more than $200 billion in added value over that period despite bitcoin, which commands nearly half of the market, falling by 1%.

Ethereum Breaks Record

The biggest winner was ether, the world’s second-largest cryptocurrency behind bitcoin, which blasted past the $4,000 mark on Monday to hit a new high.

As the digital token of the ethereum blockchain, ether has seen parabolic gains recently as investors look to cryptocurrencies beyond bitcoin for even bigger returns. Since the beginning of April, ether has gone up by more than 40%, adding some $130 billion to ethereum’s market value during that period.

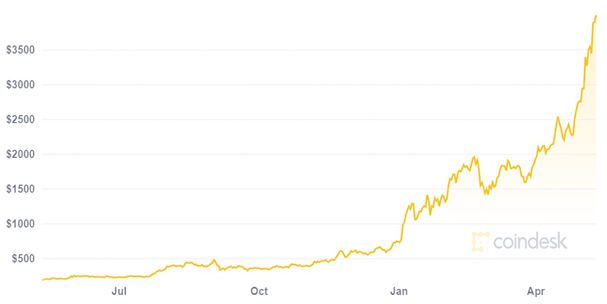

Ether has increased by more than 1,700% over the last 12 months. Source: Coindesk

Ether has increased by more than 1,700% over the last 12 months. Source: Coindesk Analysts including those at JPMorgan attribute ethereum’s ascendancy to a growing interest from institutions and at-home traders. Unlike bitcoin, which is viewed by its proponents as a store of value akin to gold, ethereum is built to be the infrastructure for a kind of decentralized internet that’s not maintained by central authorities.

It forms the basis for an increasingly popular crypto trend known as DeFi (short for “decentralized finance”), which refers to peer-to-peer platforms that facilitate lending outside traditional banking institutions.

The European Investment Bank, the European Union’s lending arm, recently announced its first-ever digital bond (about $120 million in two-way notes) on the ethereum blockchain, demonstrating a bullish institutional use case for decentralized platform in finance.

Ethereum is also benefiting from the rise of NFTs, or non-fungible tokens, which have become a hot topic of interest in mainstream media. NFTs are digital assets designed to represent ownership of unique virtual items like art and sports memorabilia that can be traded across the blockchain network. Many believe NFTs could eventually replace the traditional collectibles market and become the next frontier of investing.

The growth in markets like NFTs and DeFi has been “mind-boggling,” Jean-Marie Mognetti, chief executive of asset manager at CoinShares, recently told The Wall Street Journal. “Ethereum as a network is what makes this all possible.”

However, as its popularity grew, the boom in activity has further congested the ethereum network, which has long been plagued by its inability to scale to meet demand.

Research by Dune Analytics showed 2%-5% of transactions on ethereum-based decentralized exchanges had resulted in failures due to complications such as slippage or insufficient “gas” prices — fees required to successfully conduct a transaction on the ethereum blockchain. These transaction failures could cost users millions of dollars every day, the study shows.

“DeFi is destined for meteoric growth, but that growth inherently comes with risk,” Alex Wearn, chief executive officer at crypto exchange IDEX, said in a Reuters report. “These major problems limit the appeal of these products for a wider audience and ultimately hinder the ecosystem’s growth.”

Arcology Solution

One company that aims to address the common problems faced by blockchain networks is Arcology, a blockchain company 30% owned by Codebase Ventures Inc. (CSE: CODE) (FSE: C5B) (OTCQB: BKLLF).

Inspired by the challenges associated with ethereum’s mass adoption, the Arcology team is developing a radically new blockchain ecosystem designed to scale at unprecedented speed by reducing costs and increasing enterprise capabilities.

“Arcology is focused on the overall importance and significance of blockchain. Our efforts to design and test the technology have been ongoing toward becoming the blockchain solution that results in mainstream adoption,” the company previously stated.

According to the Arcology team, widespread adoption of blockchain technology hinges on overcoming the scalability issue (i.e. the limited number of transactions a network could handle).

Ultimately, Arcology wants to compete with market leaders like ethereum that employ smart contracts to host decentralized apps for finance, gaming and other commercial sectors, but with superior performance and user experience.

Financial institutions typically require a standard of approximately 250,000 transactions per second (TPS), which the company sees as a key figure and a real-world target for its new blockchain technology. At the moment, the throughputs of major blockchains like bitcoin (7 TPS) are far less than what is required.

To reach that goal, the team at Arcology has already launched two successful testnets, as well as its own version of CryptoKitties, the most popular game on the ethereum blockchain.

Test results of Arcology’s network so far have been very promising, with the CryptoKitties game significantly outperforming the original version by a factor of 1,000-to-one.

DSToken Showcase

This week, Arcology’s technical team successfully completed another showcase – an optimized version of DSToken, used by some of the most popular ethereum-based applications such as MakerDAO’s DAI.

This is a great first step towards interoperability, opening up the possibility for complex decentralized applications (DApps) to be redeployed from their existing blockchains directly onto Arcology without the need for updates or changes to the code repository, the company said.

Once optimized and running on Arcology, these DApps will not only run much faster and efficiently on Arcology’s native chain, but the fees will be much more affordable and inclusive to new and existing users.

“One of the situations that many developers are facing with Ethereum today is the frustration of failing to meet growing popularity,” Arcology’s founder Laurent Zhang stated in the May 7 news release.

Arcology’s technical team is currently running internal speed tests with their optimized version of the DSToken, which could reach speeds of up to 28,000 TPS at full capacity. When compared to ethereum’s average of 15 TPS, this massive improvement to speed and efficiency comes at a time where users are eagerly looking for better alternatives.

Zhang believes that over time, his company will be able to seize a sizable percentage of this market once fully operational, as they focus on lowering the barrier of entry for users and building a strong developer community.

“With its scalability and cost advantage, Arcology is able to target areas of the blockchain ecosystem that weren’t accessible to ethereum users due to the high fees and network congestion. We do not hope to replace ethereum, we aim to bring accessibility to users and developers alike, expanding market opportunities,” Zhang added.

With another successful showcase completed, Arcology is now one step closer to releasing a public testnet, allowing developers and blockchain enthusiasts to interact with the latest generation of blockchain — a blockchain with a vision to make high fees and congestion a thing of the past.

NFT Going Mainstream

As mentioned earlier, NFTs are widely considered to be the “next big thing” in crypto space after DeFi. Many NFT platforms are seeing big investments from DeFi-focused funds.

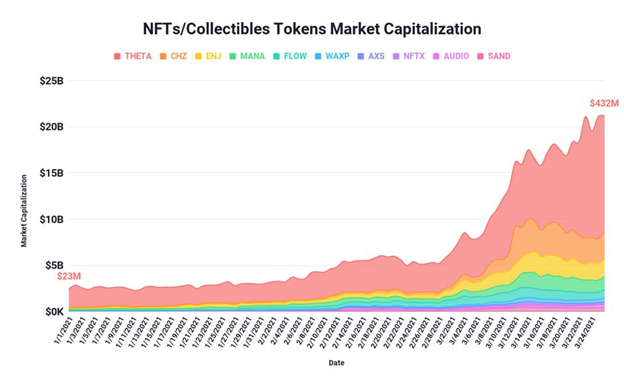

In the first quarter of 2021, the combined market cap of major NFT projects has increased by nearly 1,800% – and it’s still growing exponentially to this day.

NFT tokens market capitalization. Source: BitDealer

NFT tokens market capitalization. Source: BitDealer The explosive valuation of NFTs has also led to skyrocketing sales volume of NFT marketplaces. The major NFT marketplaces saw their sales rise from anywhere between 50-fold to 100-fold during the first three months of the year.

Social NFT Platform

With that in mind, Codebase Ventures also moved swiftly into the NFT space, having invested in InstaCoin Technologies Ltd., a UK-based startup that positions itself as the world’s first self-serve social NFT platform. Codebase’s total investment comes to £100,000, giving the company a 50% share of the new NFT venture.

“Code has worked with the principals behind InstaCoin through our existing TRAD3R investment, and we continue to be very excited by their innovative approach within the blockchain ecosystem,” Codebase’s president and CEO George Tsafalas stated in a press release.

“Our existing relationship put us in a position to seize this opportunity, which allows Code to establish a 50% equity position at an early stage of the venture that aims to democratize NFT’s rather than focus primarily on multi-million dollar individual components.”

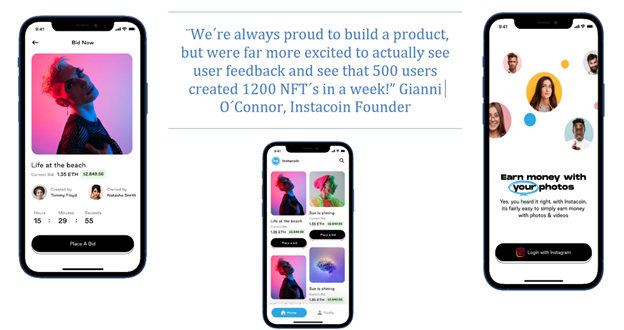

The InstaCoin platform is designed to allow users to connect their social profiles to the blockchain and create instant NFT tokens from their own content. Followers and fans connect in the open market for immediate sales.

With a one-off cost of $1 per NFT, this simple streamlined model will aim at targeting the millions of existing social media users to create sales and drive revenue instantly, as well as a lifetime commission model from the secondary markets.

The firm behind InstaCoin, previously known for TRAD3R, has already achieved success with a social trading platform with millions of users across the world.

“After we built TRAD3R, we already understood what it meant to take complex stock trading and make it simple and appealing; we’re just reapplying that same skill set with InstaCoin and the NFT market,¨ said Rabin Zhang, the team’s head of blockchain.

The recent furore surrounding NFTs has been focused on single expensive tokens, for instance Mad Dogs “Crash & Burn,” which sold at over $3.9 million. InstaCoin has a different approach, as explained by its founder Gianni O’Connor:

¨We think the future is in millions of low-cost NFTs ranging from $2-$20. We know that millions of people around the world have powerful cameras 24/7 via smartphones which makes them content creators already. With Instacoin they can now financially capitalize on that content.”

InstaCoin Testing Complete

Shortly after Codebase’s investment, InstaCoin announced in mid-April a global submission to the Apple store platforms for imminent release.

The app, which promises to simplify the creation of NFT assets from a user’s social media, has gone through extensive scale and blockchain testing as well as creating full language compatibility with the Chinese markets and European block.

InstaCoin NFT platform

InstaCoin NFT platform While NFTs are the new and most popular way to sell digital content across the world, up until now the focus has been mainly on large value sales.

The InstaCoin app intends to bring the creation and auction element to the everyday person, with the aim of building a new million-dollar marketplace.

Conclusion

Early-stage investments are always about upside. With the explosive rise of ethereum thanks to the promise of DeFi and the latest NFT craze, blockchain technologies have once again become synonymous with exponential growth.

As American billionaire and famous “shark” investor Mark Cuban puts it, “the upside is truly unlimited” in the overall blockchain space.

This is exactly what Codebase had in mind when it invested in Arcology, a revolutionary, industrial-grade blockchain platform designed to meet the current market needs for scalability and performance, on its way to mass adoption worldwide.

It has also set eyes on capturing market share from major networks such as ethereum, whose success has been inhibited by network congestion and rising transaction fees, the same issues that Arcology promises to solve.

And by venturing into the NFTs with its InstaCoin acquisition, Codebase has become an early entrant into a new investment space that’s already generating billions of dollars in asset sales from the get-go.

Codebase Ventures Inc.

CSE:CODE, FSE: C5B, OTCQB:BKLLF

Cdn$0.165, 2020.05.13

Shares Outstanding 46,123,011m

Market cap Cdn$8.0m

CODE website