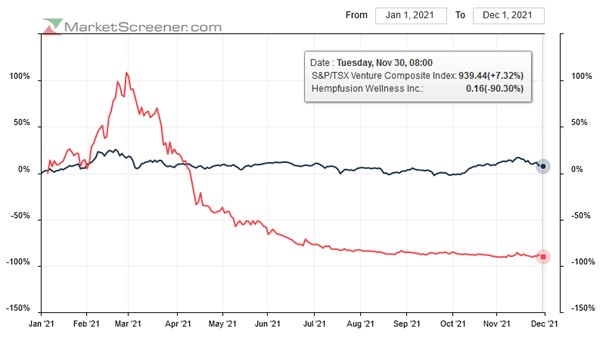

$CBD affected tax-loss selling makes it a solid investment I just finished reading this very informative article from Sophic Capital which supported some thoughts I had on one of my picks, HempFusion Wellness ($CBD.u $CBDHF).

The SC article explains the annual event of tax-loss selling which is when "market participants sell stocks at a loss to reduce capital gains earned from other investments."

Tax-loss selling has no official start date but it is a phenom that generally starts in the late Fall and slows considerably about a week before Christmas.

As of November 30, half of the stocks in the tech- and ESG-focused sectors, with an MC < $100M, had declined 62% from their 52-week highs.

This seems like a grim situation (and it is for some) but many stand to benefit from it. According to SC the characteristics to look for when investing in a small/micro-cap company that was hit by tax-loss selling are:

- A good management team

- A significant equity offering in 2021

- No fundamental change in the business (but the stock keeps falling)

- And a strong balance sheet

The article specifically shouted out $CBD.U for having these traits. Specifically, SC highlighted that the main reasons to invest in the CBD, probiotics, and OTC pain suplements company are that:

- It owns an undervalued probiotics brand (currently the fastest growing in the U.S.

- It acquired Sagely naturals which is the #1 selling topical CBD brand in the U.S

- Has revenue guidance for 2022 of $20-$25M (growth of 50% to 100%)

- Strong top-line growth and a plan to improve cost structure should improve profitability throughout 2022

- CBD regulatory change could be a significant catalyst

- And it goes on for 5 or 6 more points. If you invested in $CBD or thinking about it definitely check out their full feature in this article.

[img] [/img]

[/img]

Even if investing in $CBD isn't for you, if you are interested in micro/small-cap investing in general I would definitely check out the full article which also highlights $LPS $MYID $HIRE $GA and $MEAL among others, and generally makes a very compelling argument for capitalizing off of tax-loss selling.

https://sophiccapital.com/a-particularly-taxing-time-for-canadian-micro-and-small-cap-stocks/

Currently $CBD is trading at $0.155 (up 3.33% so far today). MC is $25.349M