By Farah Elbahrawy, Bloomberg Markets Live commentator and reporter

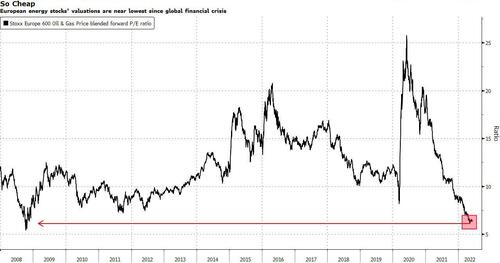

The energy sector has been the winning bet this year for equity investors amid the global stock market rout. Yet despite the rally, valuations have fallen to the lowest since the global financial crisis as analysts are busy boosting their earnings forecasts to reflect the jump in oil and gas prices.

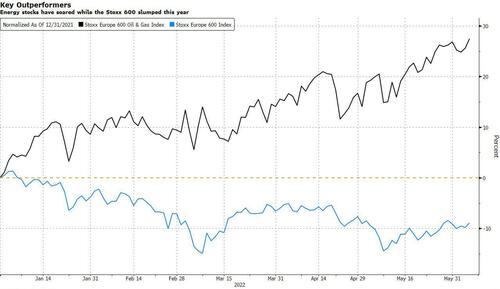

The Stoxx 600 Oil and Gas Index is up 26% this year and just capped its longest monthly win streak since 2004 as the sector finds support from elevated commodity prices after Russia’s invasion of Ukraine.

Still, that’s a far cry from the 64% increase in earnings estimates in that period, which has reduced the sector’s price-earnings ratio to just 6.4 times from 8.5 times at the start of the year.

According to Bernstein strategists Sarah McCarthy and Mark Diver, energy has the biggest upside potential among European sectors “with almost a 70% uplift required for valuations to return to average levels.”

Yet, based on average price targets for the subindex’s members, analysts expect the sector will advance further only 11% the next 12 months, hinting that valuations may remain cheap for a while.

While Liberum strategist Joachim Klement sees high oil and gas prices supporting cash flows for energy companies, he says upside for stocks is likely limited given that the sector has become a consensus buy, the commodity rally is already priced in, and analyst forecasts have gone much higher than the brokerage views as reasonable. “Slowing global demand for oil and gas should limit upside for energy stocks,” he says.

Klement isn’t alone. Bank of America strategists are underweight on the European energy sector based on their expectation that the commodity rally will prove unsustainable against the backdrop of slowing global growth and dollar strength, says strategist Milla Savova.

The bank’s macro projections are consistent with oil & gas stocks underperforming the broad market by more than 15% over the coming months, Savova says. “If the oil price gives back some of its recent gains, this would imply renewed underperformance for energy,” she says.