New Found Gold Corp (TSX-V: NFG, NYSE-A: NFGC) is a Vancouver-based gold exploration company with promising ongoing operations in the provinces of Newfoundland and Labrador, along the Trans Canada highway, as well as in Ontario. This mineral exploration company identifies and develops primarily gold producing projects and its most promising of those are a 100% interest in its Queensway project in Gander, Newfoundland, a group of 86 mineral licenses and over 6,000 claims totaling over 150,000 hectares, and its “Lucky Strike” project in Kirkland Lake, Ontario which is over 11,500 hectares in size. New Found was initially incorporated in 2016 under the name Palisade Resources Corp but has been known as New Found since a name change in June of 2017.

Recent Performance

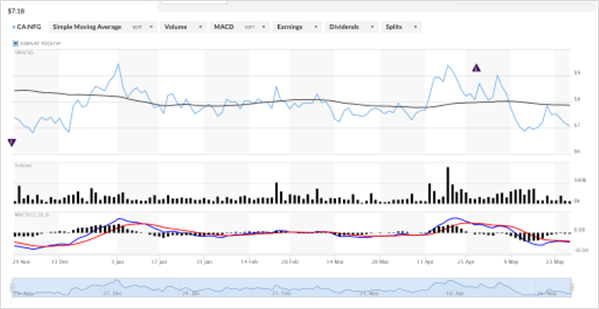

New Found Gold has had a turbulent six months.

Data courtesy of Marketwatch.com; click the link for updated data.

Data courtesy of Marketwatch.com; click the link for updated data. In the six months ending on May 27th, 2022, New Found has seen its price rise from the start at $7.39 Canadian/share to above $9/share on three separate occasions and fall below $7/share on four, with its current price sitting at $7.29.

Like most gold exploration companies, news of new drilling results and the buying and selling of shares by insiders makes these stocks volatile, and New Found is no exception. Fortunately, for New Found, much of their news is positive, and they have a strong investment insider, Eric Sprott.

The Company

New Found has a solid funding base that it can utilize for its exploration activities. New Found states that there is a kitty with $106 million in working capital. New Found has sufficient cash reserves to keep searching and verifying high-value sites for an exploration company with solid prospects.

Queensway Project

New Found’s Newfoundland Queensway project is a multi-site project along two well-known gold-producing fault lines, the JBO fault and the Appleton fault. These two faults are part of a significant suture called the Dog Bay Line that formed with the closing of the Iapetus Ocean. New Found’s Queensway project is right in the middle of the Dog Bay Line.

Prospecting in the Queensway area began in the late 1980s and the first discovered gold was recorded then. New Found identified this area as one with high potential and accumulated land holdings along more than 105km of the strike.

New Found’s project is divided into the North and South Queensway sections by Gander Lake, which spans from east to west across the fault lines. Much of New Found’s focus so far has been on the North Queensway section. This section has several high-grade gold targets identified that span along the Appleton fault for 9.5 kilometers and the JBP fault for 12.4 kilometers (the golden areas in the map above). In both the North and South Queensway sections, make up a large-scale regional tilling program that has successfully identified large gold in till anomalies that coincide with the faults (the red areas in the map above). South Queensway has produced six of these anomalous areas as well. There are also gold showings that have been identified in both the North and South Queensway sections (red triangles above.)

The North Queensway section has been subdivided into several high-value zones that have undergone an extensive tilling and drilling program to determine their potential.

A recent (May 4th) announcement from New Found states that surface gold has been found north of their Keats Zone with intersections of 275 g/t Au Over 2.15m and 8.70 g/t Au Over 6.75m.

This surface gold is on top of several core drilling sample results that have produced grades of over 10g/ton. And the following results were some of the recent drilling highlights of the May 4th announcement.

The company’s ongoing drilling program is moving into high gear. This drilling program for Queensway will be a total of 400,000 meters of samples taken. Also, with these results, the company stated that it had added a 12th drill to its current program, and it has planned to continue adding an additional two drills to complete the full drilling package.

On June 6, NFG announced assay results from 39 diamond drill holes designed to further delineate and expand the network of high-grade gold veins and associated structures at the Keats Zone. This included 9.12 g/t Au Over 8.20m & 42.6 g/t Au Over 11.75m Starting 9m From Surface & 55.1 g/t Au Over 5.10m at the Keats Main Zone.

Six drills are operating in and around Keats, with three working to tackle mineralization correlated to the main plunge and to depth, while an additional three drills are working at Keats North to follow-up on the recent near surface discoveries such as the 275 g/t Au over 2.15m in NFGC-22-538 (reported on May 4, 2022), 8.70 g/t Au over 6.75m in NFGC-22-533 (reported on May 4, 2022) and 43.9 g/t Au over 3.85m in NFGC-22-515 (reported on April 13, 2022). Meanwhile, six more drills are systematically testing along the north segment of the AFZ.

Chrysos PhotonAssay Testing

On May 5th, New Found announced the shipment of Queensway drilling samples to MSALAB for testing. The Chrysos PhotonAssay method used by MSALAB for assay testing is expected to produce much faster results and will be a cost-saving choice over traditional assay methods. This new assay procedure aims to provide better information to New Found and allow them to adjust its target drilling based on the received results.

Lucky Strike

New Found’s second major project is called Lucky Strike, and it is in Kirkland Lake Area of Ontario, about 30 km North-East of Macassa. It comprises a total area of 10,000 hectares, and it is part of the Abitibi greenstone belt. This belt has produced over 180 million ounces of gold so far and has been mined for more than 100 years. The Kirkland Lake Camp in purple below shares a fault line has produced 40 million of those 180 million ounces.

Lucky Strike sits along the Misema-Mist Lake and the Mulven-Kinabik faults that come together and form the Kirkland Lake Fault. Lucky Strike has been prospected for years and had its first drilling samples taken in 1922 where it returned a 0.9-meter section with 24.6 grams of gold per ton.

Since those original samples, drilling samples have been taken that have produced 9.3 g/t over a 2-meter section.

The Lucky Strike property has the promise to be a great producer for New Found. Their current focus on Queensway makes sense in that they are devoting the most resources to the area where they have more proof of success potential, but once established, a similar scientific exploration process will be conducted at Lucky Strike.

Success Formula for Exploration

New Found’s major advantage is that it conducts its exploration activities in the most professional and scientific of manners. With its Queensway project, New Found initially identified areas of high potential, getting the rights for further exploration. Currently, it is conducting a logical and science-based step-by-step process to find the best areas of Queensway that will give it the highest returns as soon as possible. New Found is able to accomplish this with its significant working capital, which will allow it to drill and map out the area before any mining is needed. The idea is that New Found wants to gain the most from the low-hanging golden fruit in order to get some quick successes.

Analyst Coverage

BMO Capital Markets on June 6 initiated coverage with an outperform-speculative risk rating and a C$10.00 price target.

We are initiating coverage of New Found Gold with a $10 target price and an Outperform (Speculative) rating based on the high-profile Queensway discovery in Newfoundland, Canada," the investment bank said in a note. "New Found has identified what appears to be a large system of high-grade gold mineralization, centered on a wide, high-grade core in the Keats zone that, while early stage, holds potential in our view for high-margin extraction. NFG's exploration leverage from the sizeable $76mm 2022 exploration program is substantial but only tests a small portion of the Queensway land package."

Shareholder Structure

New Found has influential backing that sees the potential of the project. The two largest shareholders are Palisades Goldcorp and Eric Sprott, each with nearly a third of the total shares.

In November 2021, Canadian gold investor Eric Sprott purchased CAD$48 million worth of New Found Stock which made up a 21% interest in the company. He has since added to his investment; in April 2022, he purchased an additional 14 million shares, another 10% of the company, at a price of about CAD$8.39. While we can not say that Sprott has inside information, he has put his money where his mouth is, and he believes that a price of $8.39/share in New Found Gold is worthwhile. Just to reach his purchase price, an investor would be looking at an increase of about 16% from the most recent close.

Recent Additions

NFG recently appointed Ron Hampton, the new chief development officer. Ron previously worked with Centerra Gold, where he oversaw a "feasibility study and pre-execution planning" for a $600-million gold and copper mine in Northern British Columbia and a $1.2-billion operation in Colombia. NFG also saw Dr. Quinton Hennigh resign from its board of directors though he will remain around as an adviser through his role as geologic and technical director of Crescat Capital. Dr. Hennigh has been "progressively phasing out his pre-existing roles in public companies" to allow him to work independently.

Summary

New Found Gold’s Queensway project has been set up in the middle of a gold-producing region, and the results of its ongoing tilling and drilling program have been consistent with high-quality gold on the surface as well as in the drilling samples that it continues to take. The scientific exploration procedure that New Found is following to identify the best areas of their property and the use of the most up-to-date assay methods means that they are efficiently using their over 100 million in capital to ensure success in their exploration activities. New Found Gold has the backing of some very prominent gold investors who know the Canadian market and are willing to back companies that they feel have potential. At the current price, New Found Gold is sitting at a discount, and if the results of the most recent drilling come back positive, then investors in the company will likely see an excellent return.

Disclosure: I have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours I wrote this article without external assistance, and it expresses my personal opinions. I was not compensated for this article, and I have no business relationship with any company whose stock is mentioned in this article.

#CEOStockResearchComp