Looking Ahead The Federal Reserve and other central banks are hemmed in. The number of hikes the Fed can do without pushing economies into recession is limited the U.S. debt level of 125%, corporate debt level of 80%, and personal debt level of 75%. Any efforts by the US to curtail deficit spending is counteracted by baked in programs to less the impact of inflation on people like indexed pensions etc.

Real interest rates are going to stay negative as the Fed will be unable to hike rates above inflation rated. This is good for gold.

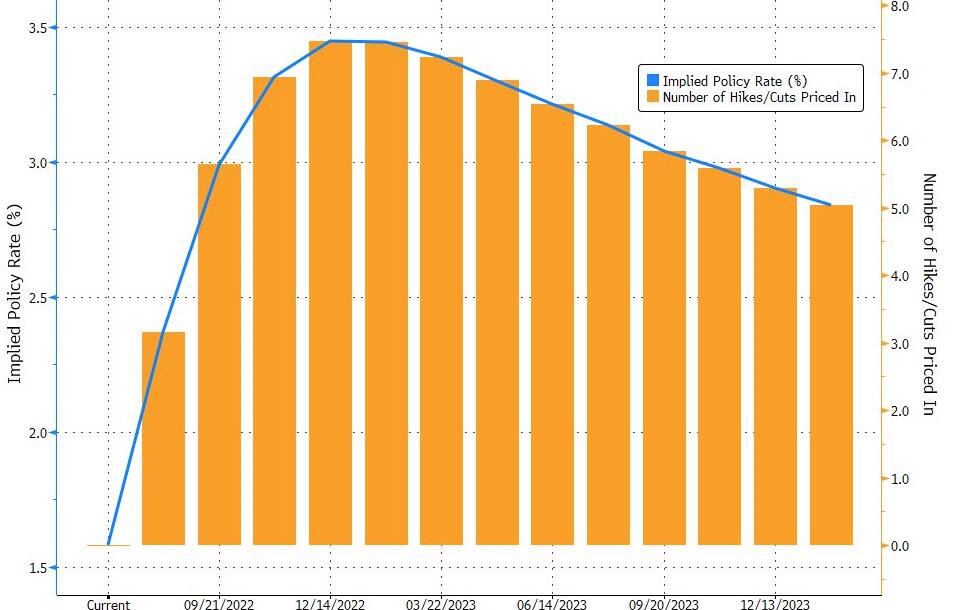

The market has already baked in that the Fed will have to start pulling back rates by the end of the year. See following graph.

NFG will bounce right back and on further drill results and 43-101 resource estimate make new highs.

This is why the bashers have come on board.