Government cutting back on SPR.. Oil hitting $120..The government will be cutting back on SPR because they know that the economy by year's end wont need it. There's no way that the economy will be as bullish as it was when Oil hit $120 for the first time and with all the new Oil production coming on line from these days of drilling will be more than enough and we are already seeing surplus inventories. Oil started selling off in June and lately, the economy has been showing a steady decline in activity plus the latest round of interest rate hikes hasn't even worked into the system. When the LARGEST Global economy is heading lower with confirmation from the FEDs that we are heading into a recession then how can Oil hit $120 in a recession? And the second largest economy (China) feeds off of the US plus China has its own problems and they're also drilling for new Oil and NG supplies like their recently discovered offshore reserve.

See when I post something I back it up with facts so I'm all about Oil you guys can figure out the SP.

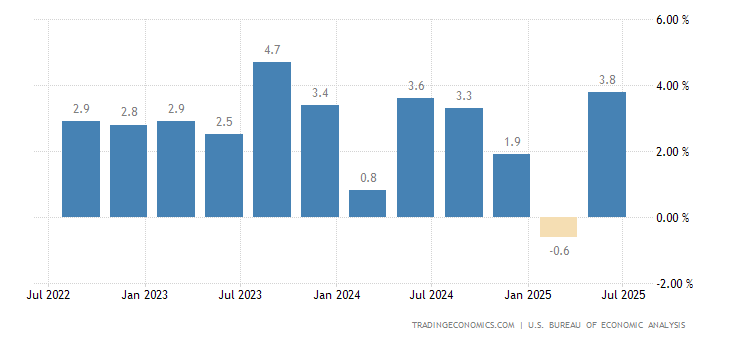

US GDP Growth Rate doesn't look bullish  US GDP Annual Growth Rate isnt bullish

US GDP Annual Growth Rate isnt bullish