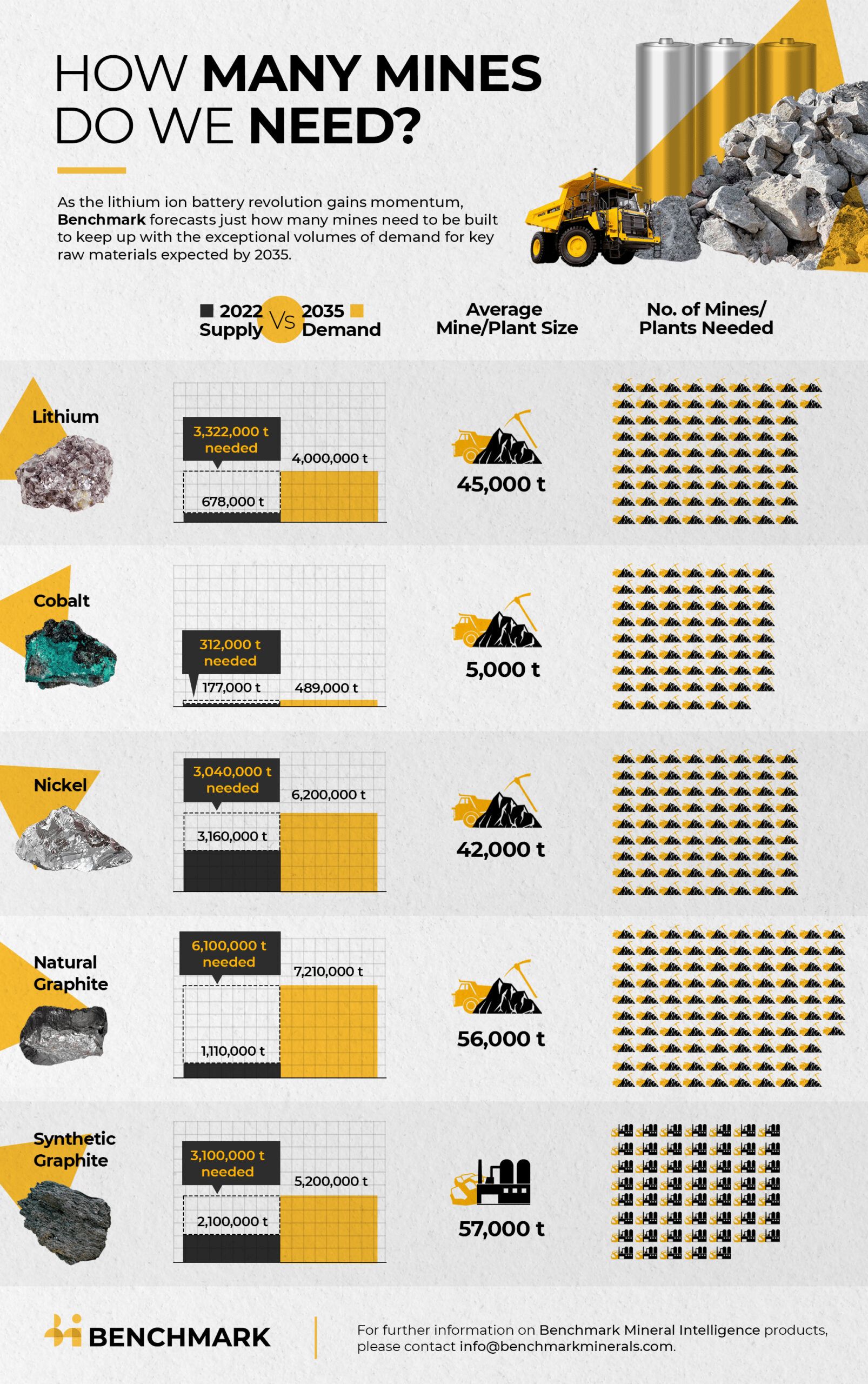

RE:The reality of some of these strategic deals. Last man standing? CNC? Not following your logic here. Lithium production needs to go up considerably and this isn't possible its going to take time. Nickel is almost half way where it needs to be so that everyone can drive an EV. Lithuim as you can see in this image has quite a ways to go. Hence the lack of interest in ultra low grade deposits. The risk is too high!

apapas1973 wrote:

We are all aware that OEMs are scrambling to lock in future nickel with upcoming nickel producers. And unfortunately due to the lack of abundance of the raw material, these OEMs have to be proactive and sign with juniors that are still in the exploration phase of their business cycle. The problem with this is that there are many unknowns during the early phase of exploration. Most projects haven't been derisked yet. And I think these OEMs will find themselves in some hot water in future . IMO. My belief is that some of these deals will fall through once OEMs come to the realization that not only will they have to continue to invest money into the project that will lead to diminishing returns but also that some wont even get built altogether. FPX has its own problems with continued insider selling and I don't know why, Giga you can forget about, it's not getting built and then there's Talon metals with the Tesla deal. This has some legs but the project is way too small (for now) even with their recent updated resource and the stock has also been diluted to oblivion with the current number at 780 million shares outstanding with more money needed to continue to explore. Also They can only option up to 60% of this project. There is one company however, that sits in a miner friendly jurisdiction, that has infrastructure in place and a multi decade resource that's going to get built ahead of the others. Not to mention the talk of fast tracking it. (The early bird gets the worm.) Can anyone guess what company will be left standing? And if our resource shows even a fraction of what Mark is referring to, we'll have enough to go around even to the OEMs that need to look for a new supplier. GLTA