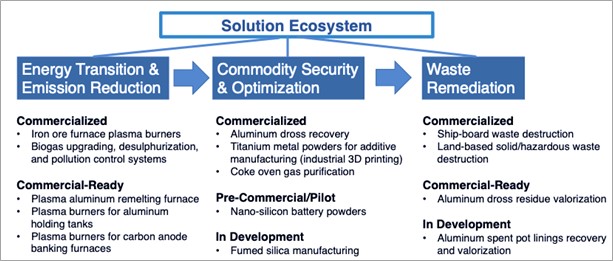

RE:RE:RE:RE:Tamarackflop never saw obvious FACTS on XEBECI would wager a guess there tamaracktop that one of the main reasons why you are posting here more is that your "star" pick Xebec Absorption (T.XBC) went bankrupt and you don't get the "admiration" from your constant posting on that SH board (you basically "flew the coop" there). You definitely fit the description of a narcissistic person. From your post history, once your "generational wealth builder" XBC went belly-up, I would bet that you looked at the top viewed companies on SH and found both PYR and EXRO, hence why you post on both the PYR and EXRO boards (without owning shares in either company). Also, your due diligence is amateurish at best, you basically go through financials and pick numbers that fit your narrative. I also do due diligence (financial statements too), but I have met Peter a couple of times and have done site visits at PYR's first production facility. I have seen the work and progress done on the Gen 2 Quartz Reduction Reactor (QRR) to the Gen 3 QRR for HPQ Silicon. I have also seen the original "demo" unit of the DROSRITE recovery furnace to actual full size units. Also observed PYR's NexGen Plasma Atomization tower in operation producing powers for additive manufacturing. With all the "due diligence" you claim to do there tamaracktop, I bet you don't know that PYR's first production facility houses a complete working version of the waste destruction system that PYR has sold to the US Navy. Each year the US Navy sends individuals to receive training on how this system works. Just think of the due diligence that the US Navy has done before selecting PYR as one of their suppliers on their US aircraft carriers (and PYR is the only non-US company to have technology onboard these carriers). I would wager it is a lot more due diligence than you would be capable of doing there tamaracktop. I'm somewhat puzzled by you tamaracktop, you claim to be an "ex-30 year broker from RBC" but your research/due diligence is rudimentary at best. I've always approached brokers/investment analysts with a grain of salt, and you're no exception. I'll also point out that I owned Xebec Absorption previously but could see the writing on the wall with all of the acquisitions going on (I sold out and did very well). Warren Buffett calls multiple acquisitions "diworsification", and you, as a "broker" should have picked up on this tamaracktop. Generally speaking, an acquisition takes awhile, and multiple acquisitions would take considerable time/talent to successfully integrate. Again, you being a "whiz broker" should have picked up on this. I'll also point out that 30 years of service is vastly different than 30 years of experience. There is a big difference. Financials are past looking, I am looking to the future (investing for the future). What PyroGenesis has done in the past couple of years is excellent, namely advancing their technology and solutions. PYR's business potential has drastically increased during the past couple of years, look at the new markets PYR has entered, new patents filed/granted, the second production facility coming online, and the growth in employee headcount. From PyroGenesis' Annual Information Form (AIF), this describes each of PYR's product offerings/solutions (keep in mind that a number of these solutions recently became commercialized): Within each category the Company offers several solutions at different stages leading up to commercialization, including the partial list in the diagram below:

The Company believes its strategy to be timely, as multiple heavy industries are committing to major carbon and waste reduction targets at the same time as many governments are increasingly funding environmental technologies and infrastructure projects – all while both are making efforts to ensure the availability of critical minerals during the coming decades of increased output demand.

While there can be no guarantee, the Company believes this evolution of its strategy beyond a greenhouse gas emission reduction emphasis, to an expanded focus that encapsulates the key verticals listed above, both improves the Company’s chances for success while also providing a clearer picture of how the Company’s wide array of offerings work in tandem to support heavy industry goals.

PyroGenesis’ market opportunity remains large, as major industries such as aluminum, steelmaking, manufacturing, and government require factory-ready, technology-based solutions to help steer through the paradoxical landscape of increasing demand and tightening regulations and material availability.

As more of the Company’s offerings reach full commercialization, PyroGenesis will remain focused on attracting influential customers in broad markets, and ensuring that operating expenses are controlled to achieve profitable growth.

PyroGenesis is gearing up for exponential growth, fantastic work Peter and Team! Long and Strong in PyroGenesis!