Chevron eyeing higher returns for shareholders from “world-c Chevron eyeing higher returns for shareholders from “world-class” assets in Guyana

Feb 29, 2024 ExxonMobil, News, Oil & Gas

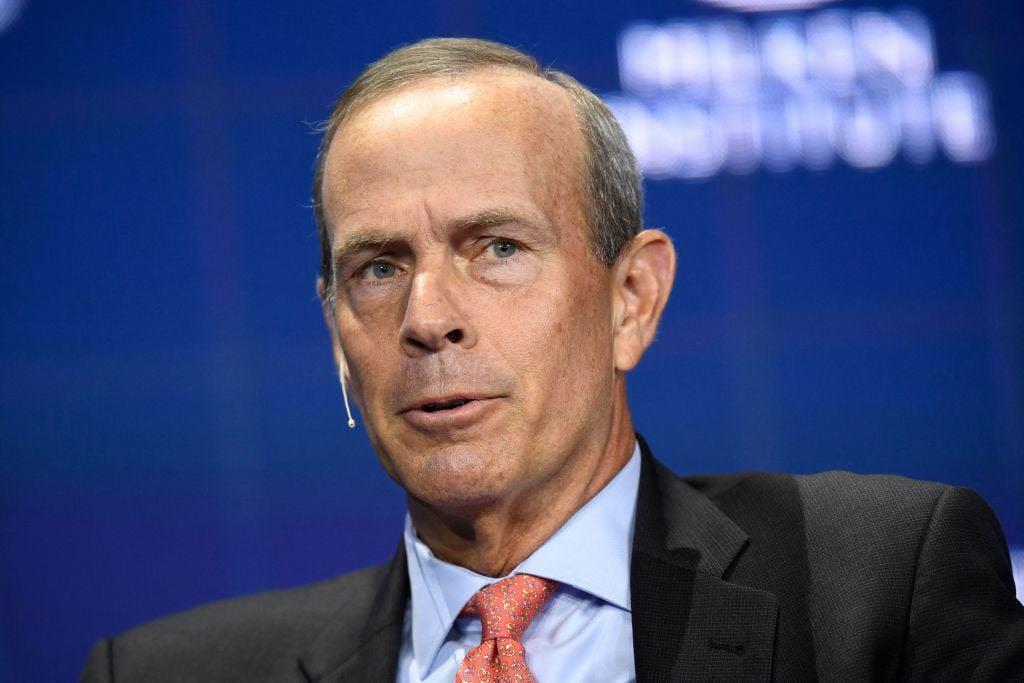

Chairman and Chief Executive Officer (CEO) of Chevron, Mike Wirth

Kaieteur News – United States oil major, Chevron Corporation is eyeing higher returns for its shareholders from the “world-class” assets in Guyana, through its deal to acquire Hess Corporation.

Hess Corporation through its subsidiary, Hess Guyana Exploration Ltd. holds 30 percent interest in Guyana’s lucrative Stabroek Block, where over 11 billion barrels of oil has been discovered since 2015.

On October 23, 2023 Chevron announced that it entered into a definitive agreement with Hess Corporation to acquire all of the outstanding shares of Hess in an all-stock transaction valued at $53 billion, or $171 per share based on Chevron’s closing price on October 20, 2023. Under the terms of the agreement, Hess shareholders will receive 1.0250 shares of Chevron for each Hess share. The total enterprise value, including debt, of the transaction is $60 billion.

In a statement, Chevron said the acquisition of Hess upgrades and diversifies Chevron’s already advantaged portfolio. The oil company noted, “The Stabroek block in Guyana is an extraordinary asset with industry leading cash margins and low carbon intensity that is expected to deliver production growth into the next decade.”

To this end, it signaled, “The combined company is expected to grow production and free cash flow faster and for longer than Chevron’s current five-year guidance.”

Chairman and Chief Executive Officer (CEO) of Chevron, Mike Wirth said the company is now positioned to strengthen its long-term performance and further enhance its “advantaged portfolio by adding world-class assets.”

Meanwhile, Chevron’s Chief Financial Officer (CFO), Pierre Breber highlighted that the addition of Hess is expected to further extend the company’s free cash flow growth. “With greater confidence in projected long-term cash generation, Chevron intends to return more cash to shareholders with higher dividend per share growth and higher share repurchases,” Breber remarked.

Chevron is one of the world’s leading integrated energy companies. The company, headquartered in the United States, produces crude oil and natural gas; manufactures transportation fuels, lubricants, petrochemicals and additives; and develops technologies that enhance our business and the industry.

While the oil company is optimistic about the Hess deal, it must now iron out differences with its major competitor, ExxonMobil, the operator of the Stabroek Block with a 45% stake.

The two American companies are at loggerheads over the Hess deal which may head to arbitration. ExxonMobil stated on Monday its intention to potentially pre-empt Chevron’s acquisition of the stake, which forms a crucial component of its deal with Hess. The disagreement centers on Exxon’s assertion of a right to first refusal regarding any sale of the Stabroek block.

Kaieteur News reported yesterday that Chevron, in a securities filing, cautioned that the dispute could jeopardize its US$53 billion deal for Hess. Should the deal collapse, Hess might face a breakup fee of US$1.7 billion.

Exxon said in a statement that it wants to ensure it will “preserve our right to realize the significant value we’ve created and are entitled to in the Guyana asset,” adding it is “working closely with the Guyanese government to ensure their rights and privileges.”

Meanwhile, Hess and Chevron said, “The right of first refusal provision is not applicable to the merger. We are fully committed to the transaction and do not believe the ROFR or these discussions will prevent its successful completion.”

Chevron has since indicated that the dispute could wind up in arbitration if the two sides cannot reach a settlement