Note: HFI Research own a position in Bellatrix (NYSE:BXE). The name is regularly updated in our weekly flagship report. This write-up was first posted to premium subscribers on May 10. If you are interested, you can join here.

Finally, something positive for once to report for Bellatrix. We thought we would never see this day come to fruition, but Q1 2017 results could be the first big turning point for the company.

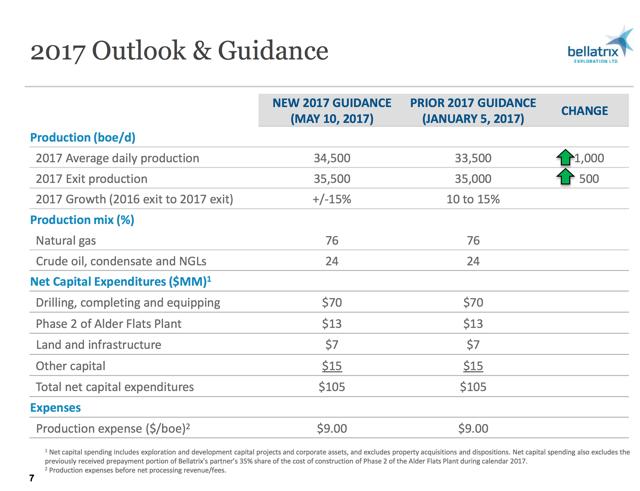

BXE produced 34,750 boe/d, which was above analyst estimates. The well results came in much better than originally expected, and the company is now guiding to a higher average production for 2017 of 34,500 with exit production of 35,500 boe/d.

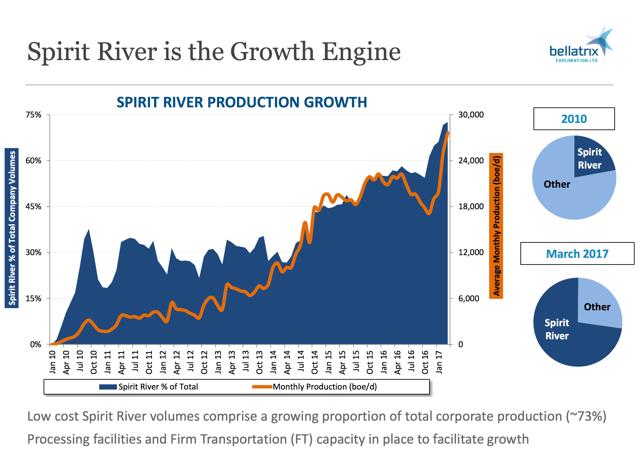

On a production percentage basis, Spirit River is now also a considerably bigger part of the company's overall production.

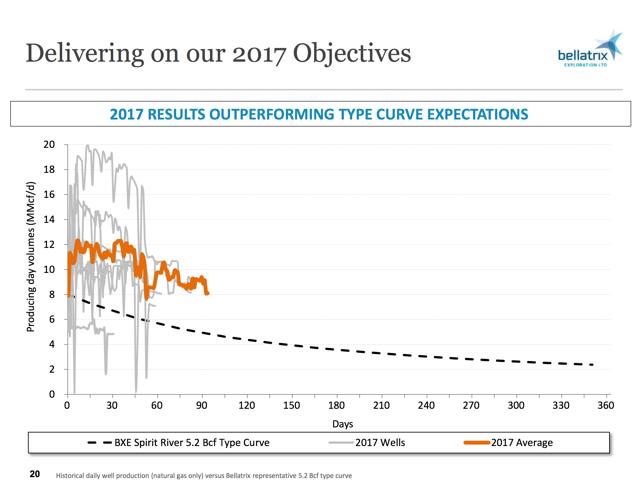

But the key is this new updated chart in the presentation slide showing the 2017 well performances:

BXE has so far produced higher than the risked type curve results. As for the fundamental explanation of why that's the case, we will be making calls to the management team over the next several days for answers.

Looking at BXE's financials, it's on track to cover capex without taking on debt. Although Q1 saw BXE spend more on capex than it made, Q2 should see minimal capex and result in positive free cash flow. BXE reported $0.05 fund flows from operations per share, which is on track for C$0.20 per share.

What we find interesting is that if it's a technological improvement BXE has made that resulted in the higher production, then we expect it to outperform the current guidance. This means that we could see more upside surprise to the current 34,500 boe/d guidance it gave. Now we are mindful that Q2 usually sees minimal drilling due to the wet conditions on the road, but Brent, the new CEO of BXE, has delivered quite nicely on his first quarter, and we are encouraged to see that.

Bank Debt

Another very encouraging sign was delivered in this quarterly release. BXE announced that the credit line has been increased from C$100 million to C$120 million. In addition, BXE entered into an amended and restated syndicated revolving credit facility agreement provided by four financial institutions. The credit facility under the new agreement has an initial term of one year that is extendible annually at the option of the company and subject to lender approval. This is subject to borrowing base test.

It appears that in order to keep the low interest rate, BXE put itself in the situation of a year-to-year credit line facility. This means that it's unlikely BXE will pursue actions that will put the company in more debt. This is a positive development for shareholders in our view, and the higher credit line signals lenders feel comfortable with BXE's current debt situation.

Negatives

The big negative is that opex/boe remains above C$9/boe, which in our opinion is far too high for a natural gas producer. We would like to see this figure move lower from a combination of higher production per boe and more cost cutting.

There weren't any other negatives we see.

Conclusion

BXE's Q1 results were pretty solid, and the operational outperformance was very positive. Brent needs to deliver several more quarters like this to build further investor confidence.

Disclosure: I am/we are long BXE.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.