Avila Energy Corporation Is Pleased to Annouce the Results of Its Independent Reserves Evaluation and the Acquisition Completed November 1, 2022, in East Central Alberta

Friday, April 28, 2023 10:15 PM

Avila Energy Corporation

https://avilaenergy.com/

CALGARY, AB / ACCESSWIRE / April 28, 2023 / Avila Energy Corporation (CSE:VIK) ("Avila" or the "Company") is pleased to announce the results of its Independent Reserves Evaluation and the Acquisition Completed November 1st, 2022, in East Central Alberta.

The Company's independent reserves evaluation (the "Evaluation), which was completed by Deloitte LLP, the Company's Qualified Reserve Evaluator ("Deloitte" or "QRE") of Calgary, Alberta, which was conducted in accordance with the definitions, standards and procedures contained in the Canadian Oil and Gas Evaluators Handbook ("COGEH") and National Instrument 51-101 - Standards for Disclosure of Oil and Gas Activities ("NI 51-101"). The reserve volumes are inclusive of 100% of the Company's recent and acquisitions and represents the corporate reserve volumes as of January 1, 2023.

Reserves Highlights

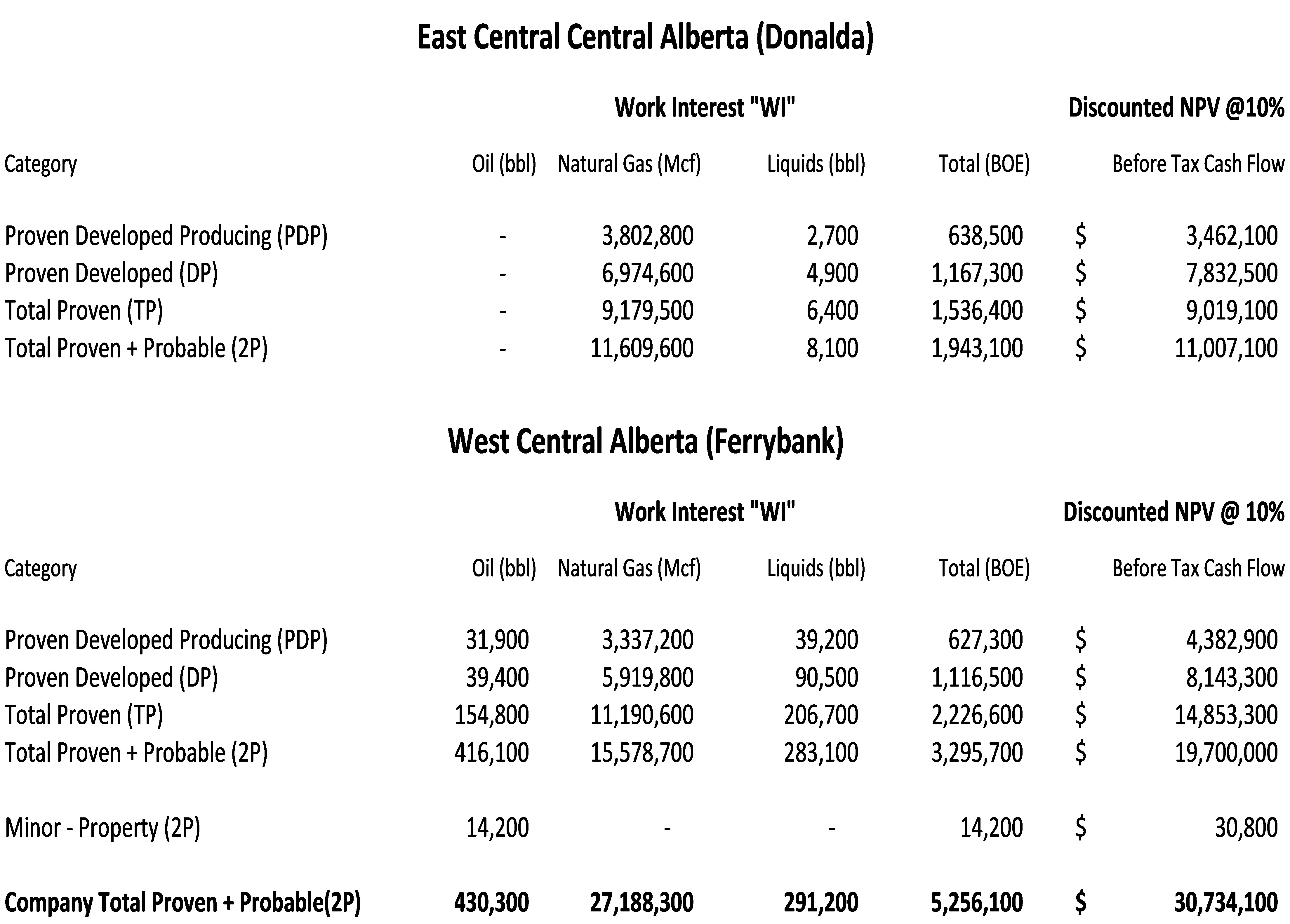

Avila Energy's reserves on a Proven + Probable basis (2P) for the Company is 5,256,100 BOE valued at $30.734 million future cash flows based on a net present value discounted 10% before income taxes (NPV10% BT). The $30.734 million is an estimate of future cash flows and do not necessarily represent fair market value and is supported by a sustainable capital program of CAD $10.432 million for proved reserves and CAD $17.517 million for proved plus probable reserves.

The Company's reserves year over year, before income tax increased as follows.

The Company's Reserves Evaluation before income tax by regions is as follows.**

**Notes

**Notes Based on the QRE (Deloitte LLP) published Price Deck dated December 31, 2022.

- The QRE prepared an independent evaluation of reserves and future net revenues derived from, the Petroleum and Natural Gas assets interests of Avila according to the Canadian Oil and Gas Evaluation Handbook ("COGE Handbook"); and

- As required, these reserves and future net revenues were estimated using forecast prices and costs (before and after income taxes) according to the requirements of National Instrument 51-101 ("NI 51-101"). The effective date of this evaluation is January 1, 2023. Both acquisitions, WCA and ECA properties closed prior to the effective date of this report. The closing date of the WCA acquisition was September 1, 2022, and the ECA acquisition closed on November 1, 2022.

- For further information, the reader is encouraged to look to additional documentation filed on SEDAR.

- The inflation rate is 0% in 2023, 2.3% per year in 2024 and 2% per year starting in 2025.

- Estimated future undiscounted development costs, in dollars, at April 1, 2023, were CAD $10.432 million for proved reserves and CAD $17.517 million for proved plus probable reserves.

- Well abandonment and reclamation costs for existing wells with reserves assigned and locations are included at the well level. These costs vary between $10,000 and $75,000 per well, based on the vertical depth of the zone and product type. These costs are based on area averages taken from the Alberta Energy Regulator (AER) Directive 011 called the "Alberta Regional Well Abandonment Table". Reclamation costs are taken from the AER Directive 011 section called "Alberta Regional Well Reclamation Table". At the request of the Company, a $2,000 salvage cost has been applied to CBM wells and $5,000 to all other wells at the end of the life of the forecast. The Company consider this position to be inline with the assessed values for all of the Company's wells and facilities estimated net present value of decommissioning liabilities, of $3,334,487 as at December 31, 2022 (2021- $282,594), based on an undiscounted total future liability of $7,620,706 (2021 - $178,897). These payments are expected to be incurred over a period of 1 to 50 years with most costs to be incurred in 2038. At December 31, 2022, this was based on a credit-adjusted risk-free rate 5.39% (2021 - 1.66%) and an inflation rate of 2.0% (2021 - 3.4%) were used to calculate the net present value of the decommissioning liabilities.

- The net present values disclosed may not represent fair market value.

- Totals may not add exactly due to rounding.

Upon the deliver of the evaluation and taking into consideration the condition of the assets and the facilities at the time of the acquisition was recorded as follows.

On November 1, 2022, the Company acquired 100% interest in oil and gas properties in East Central Alberta the Donalda Area. The transaction was accounted for as business combination under IFRS 3 - "Business Combinations" as the assets met the definition of a business. The total purchase is comprised of $1,800,000 in the form of a promissory note.

The following purchase price allocation is based on management's best estimate of the fair value assigned to the Assets acquired and the liabilities assumed. Management determined the fair value of the oil and gas properties to be $11,007,129, which was based on the NPV of 10% discounted cash flows created by an independent QRE. The assumption of $981,744 in discounted decommissioning liabilities and asset retirement obligation was based on the future value of $3,772,618, an inflation rate of 2.0%, credit adjusted risk free rate of 5.39% and life of the asset of 9 to 50 years.

| Net assets acquired | | |

| Petroleum and natural gas properties and equipment | | | 9,376,563 |

| Asset Retirement Obligation | | | 981,744 |

| Exploration and evaluation assets | | | | | | | 1,630,566 |

| Facilities | | | | | | | 1,920,600 |

| Pipelines | | | | | | | 7,474,440 |

| Deferred Tax Liability | | | | | | | (4,582,333) |

| Decommissioning liabilities | | | (981,744) |

| Fair Value of Net Assets Acquired | | | 15,819,836 |

| Less: Total consideration to be paid in Cash | | | (1,800,000) |

| Gain on acquisition | | | 14,019,836 |

| | | | | | | |

| | | | | | | | |

Best, estimates were determined based on available information at the time of preparation of these Financial Statements. The Company continued its review to determine the identification of intangible assets, assumption of liabilities, identification of contingent liabilities and working capital adjustments during the allowable measurement period, which shall not exceed one year from the Closing.

Acquisition Cost

The Company did not incur any acquisition cost.

Revenue and operating income

The acquisition contributed $874,852 in revenue, royalty expense of $84,916 and $560,070 in direct operating expenses, in the two months, from November 1 to December 31, 2022, resulting in $229,866 of net operating income.

About, Avila Energy Corporation (CSE:VIK) ("Avila" or the "Company")

The Company is an emerging CSE listed corporation trading under the symbol (‘VIK'), and in combination with an expanding portfolio of 100% Owned and Operated oil and natural gas production, pipelines and facilities is a licensed producer, explorer, and developer of energy in Canada. The Company, through the implementation of a closed system of carbon capture and sequestration anticipated to be approved for construction in 2024 and an established path underway towards the material reduction of Tier 1, Tier 2, and Tier 3 emissions, continues to work towards becoming a Vertically Integrated low-cost Carbon Neutral Energy Producer. The Company continues to grow and achieve its results by focusing on the application of a combination of proven geological, geophysical, engineering, and production techniques.

ON BEHALF OF THE BOARD

Leonard B. Van Betuw

President & CEO

Contact phone number: (403) 451-2786