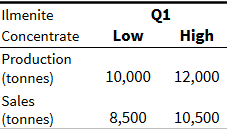

1) Ilmenite

Ilmenite Q1-24 Guidance

Let’s generously assume that in Q1-24 Largo sells 12,000T of Ilmenite (which is 15% higher than the “High Sales”guidance). Assuming the sales prices = US$250/T and that the profit margin = 70%.

Thus Q1-24 Ilmenite Revenue = US$3M; and Q1-24 Ilmenite profit = $2.1M.

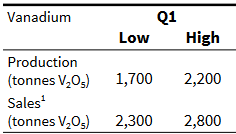

2) V2O5

V2O5 Q1-24 Guidance

Let’s generously assume that in Q1-24 Largo sells 3,000T (or 6,614,000 lbs) of V2O5 equivalent as compared with Q4-23’s 2,605T . In Q4-23 the average quarterly price for the benchmark EuroV2O5 = US$6.46/lb. We all know that the price for the benchmark V2O5 declines further in Q1-24 with the current price = below US$6/lb. In Q1-23 Largo’s average per pound sold = US$7.69/lb. Let’s generously assume that somehow the same price (US$7.69) will be achieved in Q1-24.

Thus Q1-24 V2O5 revenue = $51M or ~US$7.0M higher than the previous US$44.17M of Q4-23.

In Q4-23 the Total Costs = US$60.6M and Net Loss before tax = $44.17 - $60.6 = (US$16.4M);

Let’s assume a 15% reduction and that Q1-24 Total Costs (excluding Ilmenite costs) = $51M vs a Total Revenue (excluding Ilmenite) $51M.

Thus the Q1-24 V2O5 Earnings before tax = Revenue - Costs = $51M - $51M = $0

Conclusion: In the above scenario Largo can realize a Net Earnings before tax of US$2.1M as follows:

Total Earnings before tax = V2O5 Earnings + Ilmenite Earnings = $0 + $2.1M = US$2.1M.

However, what is the chance for the above scenario to happen?