At this point in time with gold moving up... civil unrest in Turkey ...terror...and European countries pulling apart ...world debt...negative interest rate..and the Donald... Hillary show down south...wow how could gold not be at 2000...crazy times !

So what about MTO ...OSK..Sprott .I for one think that Osk will make an offer for MTO in a share swap...8 cents is a joke and if we show a profit like I expect and the price is still locked in this range you will have your answer...

Now for the Sprott factor as I like to call it is when he buys in the open maket... its like insurance and that he is sending a message that he is in...many say Sprott is only out for himself ...I say whats wrong with that ...below is a good example of why you want a major shareholder who cares about his name and investments..and what he can do for a company....you also see his friends like Osk and others invested as well...

Barkerville Gold

Barkerville Gold is another example of the company where Eric Sprott plays a role of a white knight rescuing the fallen business. But before going further, let me remind the old story.

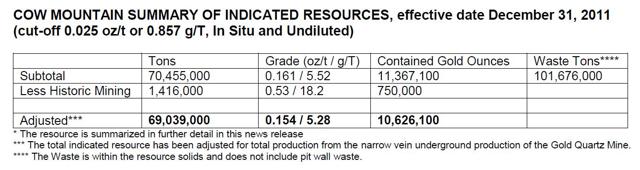

On June 28, 2012, Barkerville Gold announced that its Cow Mountain gold project contained 10.6 million ounces of gold:

On that announcement, in just two trading days the company's stocks went up from C$0.80 to C$1.67. Shortly after this spectacular increase, the British Columbia Securities Commission halted trading in the company's stocks for around a year. Then, in August 2013 Barkerville published the technical report on Cow Mountain claiming that the deposit contained "only" 6.6 million ounces of gold.

I do not want to go deeper into history but since that time the company's problems were escalating. As a result, at the end of fiscal year 2015 Barkerville was close to going bankrupt:

- Total assets were standing at C$39.7 million

- There was nearly no cash (only C$0.5 million)

- Debt was standing at C$21.3 million

- Short-term payables were C$10.0 million

- As a result, the company's equity was just C$1.1 million

Further, the company was unprofitable in 2015. What is more, it reported negative cash flow from operations of C$5.7 million.

Then, in middle 2015 Eric Sprott appeared. Now the company looks totally different (as of February 29, 2016):

- Assets: C$46.8 million

- Cash: C$25.1 million plus C$10.5 million in available for sale investments

- Practically no debt (only C$0.3 million)

- Equity of C$35.3 million

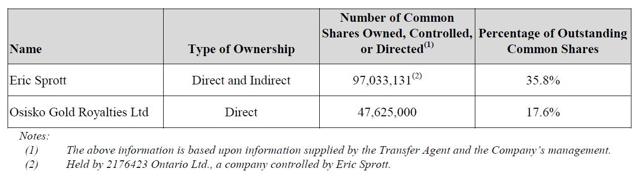

Well, to be honest, Mr. Sprott, apart from rescuing the company, rescued also his good name. Simply put, he, through his subsidiary, was the company's biggest lender. When it was obvious that Barkerville could not service its debt (gold loan, granted by Mr. Sprott's subsidiary), Eric Sprott agreed to exchange it for the company's shares. Add to that Osisko Gold with its investment in the company (Osisko acquired 32 million common shares for gross proceeds of C$10.2 million) and you have the "new" Barkerville with two major shareholders:

Source: Management Information Circular

These big changes among Barkerville shareholders were accompanied by changes in the company's management (on July 6, 2016, Chris Lodder was appointed as the company's CEO).

Now, the main question is whether Barkerville is able to rebuild its reputation. I have no idea so instead of answering this question let me list the major assets of the company:

- A number of deposits located in the Cariboo District, British Columbia, Canada. Main properties, Cow Mountain and Bonanza Ledge contain (according to the last, updated technical report) 4.8 million ounces of gold (of which 2.8 million ounces account for indicated resources and 2.0 million ounces are classified as inferred resources) and 102 thousand ounces of gold (in measured and indicated resources), respectively

- QR Claim - a gold property located in British Columbia; between 2010 and 2014 it was a small operation delivering around 10 thousand ounces of gold in annual production (fiscal year 2012).

Summing up - Barkerville Gold is a company in trouble. Its biggest investor, Eric Sprott, and the new management team have a lot of work to do to regain investors' trust. Fortunately for the company, since January 2016 investors have been very busy in buying Barkerville's stocks. As a result, these stocks went up from C$0.23 to C$0.76 (an increase of 236%) and now the company's market capitalization stands at C$192 million. It looks like Eric Sprott, despite being wrong on the company in the past, still attracts investors to this investment idea:

Source: www.stockcharts.com

https://seekingalpha.com/article/3988681-eric-sprott-additional-resource-sector-picks?li_source=LI&li_medium=liftigniter-widget