https://simplywall.st/stocks/ca/materials/tsx-ncu/nevada-copper-shares/news/when-will-nevada-copper-corp-tsencu-breakeven

We feel now is a pretty good time to analyse Nevada Copper Corp.'s (TSE:NCU) business as it appears the company may be on the cusp of a considerable accomplishment. Nevada Copper Corp. engages in the exploration, development, and operation of mineral properties in Nevada. The company’s loss has recently broadened since it announced a US$20m loss in the full financial year, compared to the latest trailing-twelve-month loss of US$24m, moving it further away from breakeven. The most pressing concern for investors is Nevada Copper's path to profitability – when will it breakeven? In this article, we will touch on the expectations for the company's growth and when analysts expect it to become profitable.

See our latest analysis for Nevada Copper

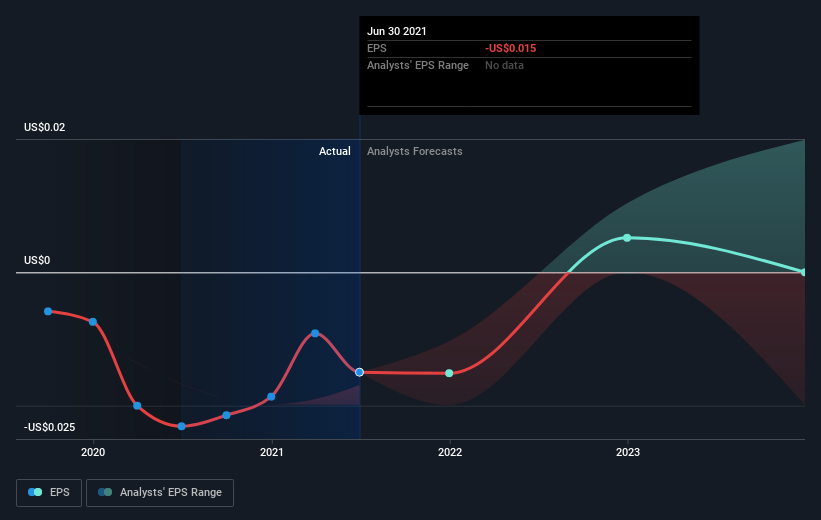

Consensus from 4 of the Canadian Metals and Mining analysts is that Nevada Copper is on the verge of breakeven. They anticipate the company to incur a final loss in 2021, before generating positive profits of US$11m in 2022. Therefore, the company is expected to breakeven just over a year from now. What rate will the company have to grow year-on-year in order to breakeven on this date? Using a line of best fit, we calculated an average annual growth rate of 77%, which is extremely buoyant. Should the business grow at a slower rate, it will become profitable at a later date than expected.

TSX:NCU Earnings Per Share Growth September 10th 2021

TSX:NCU Earnings Per Share Growth September 10th 2021 Given this is a high-level overview, we won’t go into details of Nevada Copper's upcoming projects, but, take into account that by and large metals and mining companies, depending on the stage of operation and metals mined, have irregular periods of cash flow. This means, large upcoming growth rates are not abnormal as the company is beginning to reap the benefits of earlier investments.

One thing we would like to bring into light with Nevada Copper is its relatively high level of debt. Typically, debt shouldn’t exceed 40% of your equity, which in Nevada Copper's case is 50%. Note that a higher debt obligation increases the risk in investing in the loss-making company.

Next Steps:

There are key fundamentals of Nevada Copper which are not covered in this article, but we must stress again that this is merely a basic overview. For a more comprehensive look at Nevada Copper, take a look at Nevada Copper's company page on Simply Wall St. We've also compiled a list of pertinent aspects you should look at:

- Valuation: What is Nevada Copper worth today? Has the future growth potential already been factored into the price? The intrinsic value infographic in our free research report helps visualize whether Nevada Copper is currently mispriced by the market.

- Management Team: An experienced management team on the helm increases our confidence in the business – take a look at who sits on Nevada Copper’s board and the CEO’s background.

- Other High-Performing Stocks: Are there other stocks that provide better prospects with proven track records? Explore our free list of these great stocks here.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.