https://www.zerohedge.com/energy/wti-extends-gains-after-delayed-doe-data-confirms-crude-draw-us-production-rises

After "systems issues" 'delayed' last week's inventory, supply, and demand data from the EIA, the admin will report this week's data as well as last week's combined following API reported a notable build the prior week and a surprise draw last week.

API (last week)

API (this week)

-

Crude -3.799mm

-

Cushing -650k

-

Gasoline +2.852mm

-

Distillates +2.613mm

So over the last two weeks, API reports (net) a small crude build, notable Cushing draw, large gasoline build and small distillates build.

Oil prices are notably higher again today following reports that Iran-deal-talks have failed and news that Libya has halted oil exports. Additionally, OPEC's pre-meeting reportedly concluded with no discussion of oil policy, focusing instead on administrative affairs, including an update to the group’s manifesto of guiding principles known as its Long-Term Strategy.

Meanwhile, a deluge of ugly macro data provides some fodder for the oil bears (though it is being dominated by supply fears for now)...

“Recession fears are just that -- fears,” said Stephen Brennock, an analyst at brokerage PVM Oil Associates Ltd.

“In the meantime, oil fundamentals remain solid.”

So all eyes are back on the official inventory and demand data...

DOE (net of the two weeks)

-

Crude -2.762mm

-

Cushing -782k

-

Gasoline +2.645mm

-

Distillates +2.559mm

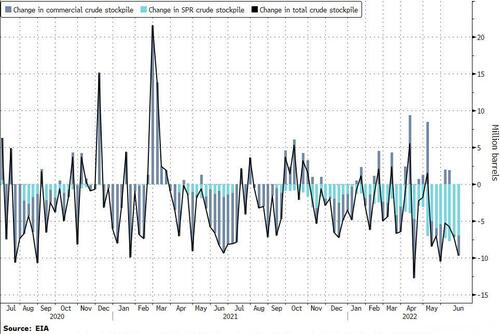

The official data shows a small crude draw (API showed a small crude build), Cushing a 6th weekly draw of the last 7 (confirming API's net draw). On the product side both gasoline and distillates showed unexpectedly large inventory builds (also confirming API's data)...

Source: Bloomberg

The headline draw in crude stockpiles of 2.76 million barrels was boosted by the withdrawal of another 6.95 million barrels of crude from the SPR last week.

However, as Bloomberg's Javier Blas noted in a tweet:

"Over the last 2 weeks, the US gov has injected 13.7 million barrels from the SPR into the market. And yet, commercial oil stockpiles still fell 3 million barrels over the period. Just imagine if the SPR wasn't there. Or what would happen post-Oct when sales end"

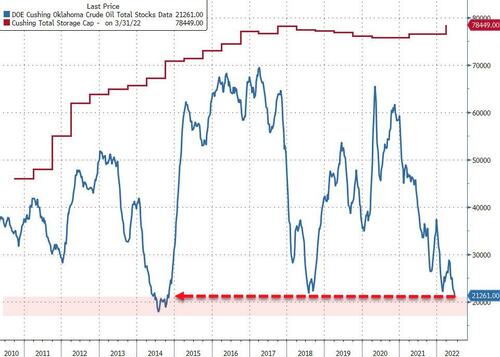

Cushing inventories are getting very close to operational-low-limits again...

Source: Bloomberg

Cushing storage tanks require a minimum level of oil to maintain normal operations, which traders estimate at ~20M barrels.

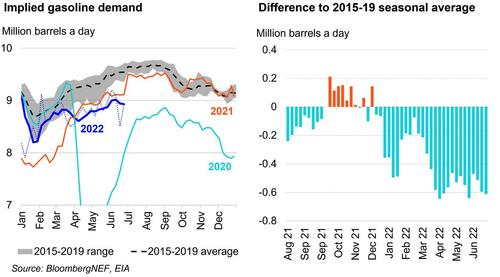

Gasoline demand finally appears to be succumbing in a more substantial way to record high gasoline prices. As Bloomberg reports, the past two weeks show the four-week moving average of product supplied falling back below 9 million barrels a day, meaning demand is now more than 600 thousand barrels a day below typical seasonal levels.

Source: Bloomberg

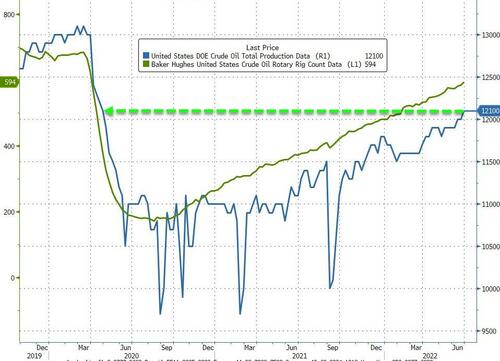

US Crude Production rose to its highest since April 2020...

Source: Bloomberg

WTI was hovering around $113.50 ahead of the EIA data and extended gains modestly after the data...

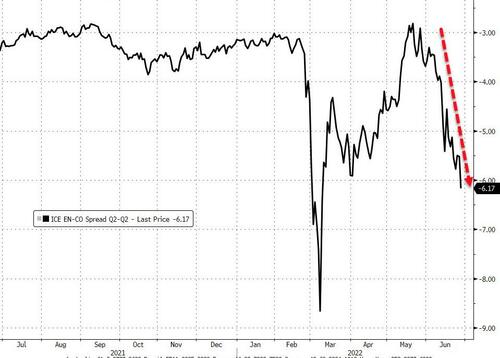

Finally, we note that the tight supply situation in oil (especially European) is revealing itself in the WTI-Brent spread, grew to $6.19, the widest in almost three months.

Source: Bloomberg

“European demand will remain robust, especially as natural gas supplies run out, while the North American demand for crude is weakening,” said Ed Moya, senior market analyst at Oanda.

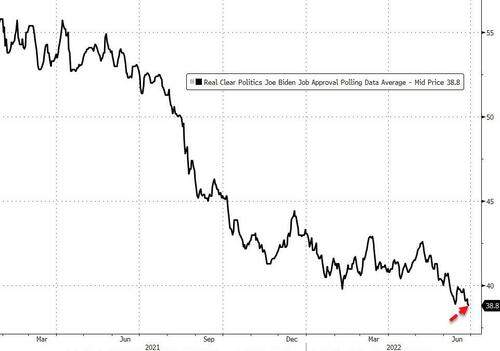

This is not good news for President Biden as prices are rising...

Source: Bloomberg

And his ratings are hitting record lows.