https://www.zerohedge.com/markets/stocks-flirt-record-losing-run-commodities-prosper

By Jake Lloyd-Smith, Bloomberg markets live commentator and analyst

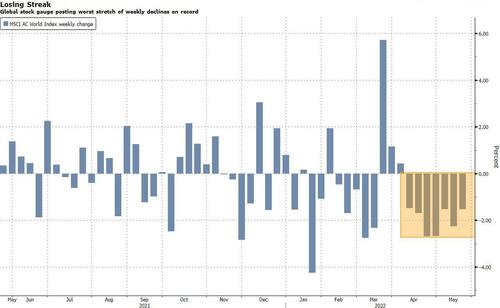

Stocks’ performance has been so abysmal of late that the complex risks an unwelcome record just as commodities keep motoring. The MSCI ACWI Index is on course for a record run of weekly losses. Raw materials? They’re up again.

The theme -- that commodities are in a period of outperformance -- has been around for a while. Last year, the stock gauge did great, up 17%; but the Bloomberg Commodity Spot Index did lots better, 27% higher. In 2022, the contrast is much more consequential, with stocks swooning while commodities have rallied to a record.

The underpinnings are equities suffer as inflation spikes, the Fed wakes up, and fears of a recession gather force, while raw materials have prospered from war-induced stresses, low stockpiles, weather shocks, and their appeal as a hedge.

Some stock commentators are sticking to their guns, at least in terms of the US market. Still, it’s far from certain the Powell Fed has a handle on this inflation goblin just yet, with them seen behind the curve. At the same time, commodities remain well-placed, from wheat and gasoline to aluminum and copper.