We are currently witnessing a major disruption in the world’s largest car market, that will have massive implications for the biggest carmakers as they seek to manage the switch from fossil fuel vehicles to electric.

Potentially millions of petrol and diesel cars may about to become unsellable in China as the country implements new vehicle emissions standards, and as EV demand booms. With China already experiencing a car inventory crisis, the next three months could spell disaster for some legacy auto companies.

Auto News recently reported that the China Auto Dealers Chamber of Commerce (CADCC) posted an article on March 23 on WeChat saying that dealers could be left with hundreds of thousands of non-compliant unsellable petrol and diesel vehicles once China’s new emission standard is implemented in July.

According to its website, the CADCC had over 8000 auto dealer members as of 2019.

More details on the CADCC March 23 article – now deleted – were given on the Shanghai Metals Market SSM news site on Monday in post titled Industry Association Appeals for Delayed Enforcement of Imminent China VI B Emissi on Standards to Tackle Huge Inventory Pressure

The Chinese metals industry publication is justifiably concerned as the inventory crisis will have massive flow on effects for auto industry metals suppliers.

The SSM article says the deleted document stated that the CADCC had “received reports from many auto dealer groups that the upcoming full implementation of the China VI B emission standards will bring enormous pressure to the survival of auto dealers.”

SSM reports that in the document the CADCC appealed for three measures on behalf of the majority of auto dealers.

- Postpone the implementation of the China VI B emission standards to January 1, 2024;

- Car makers should stop producing new cars that do not meet the China VI B emission standards;

- Auto OEMs should allocate existing new cars that do not meet the China VI B emission standards to dealers as soon as possible, and launch sales promotions.

Industry has had plenty of warning of new emission standards

China released its rule for stage 6 light-duty vehicle emissions limits in December 2016, so manufacturers have had 7 years to bring their vehicles into line.

The “China 6 standard” is being implemented in two phases. The first phase, 6a took effect on July 1 2020 and the 6b standard will be implemented on July 1 2023.

The China 6 standard applies to light-duty vehicles up to 3,500 kg powered primarily by gasoline or diesel.

The International Council on Clean Transport (ICCT) says the China 6 standard combines best practices from both European and U.S. regulatory requirements in addition to creating its own.

While the inventory crises is hitting Chinese dealerships hard, the biggest impacts will be felt by legacy auto companies who have failed to shift to electric vehicles.

Inventory crunch will hit foreign legacy auto makers hard

The glut of hundreds of thousands of high polluting vehicles sitting in Chinese dealerships comes as Chinese consumers shift rapidly to EVs. Over 25% of all new cars sold in China in 2022 were electric.

According to the China Association of Automobile Manufacturers (CAAM), 27 million vehicles were sold in China in 2022, with almost 7 million being EVs. China accounted for around two-thirds of global sales of EVs last year.

Although the inventory crisis is playing out in China, counterintuitively Chinese car manufacturers may actually benefit while foreign legacy auto companies sales plummet in the world’s largest car market.

This is because electric vehicles make up a much higher proportion of the total production of Chinese automakers like BYD, while foreign companies like Toyota and Volkswagen are manufacturing and selling mostly petrol and diesel cars in China.

So it will be predominantly Japanese, German and US carmakers that are hit the hardest by the inventory crisis while Chinese EV companies as well as Tesla will continue to see demand grow.

This trend is already playing out in 2023.

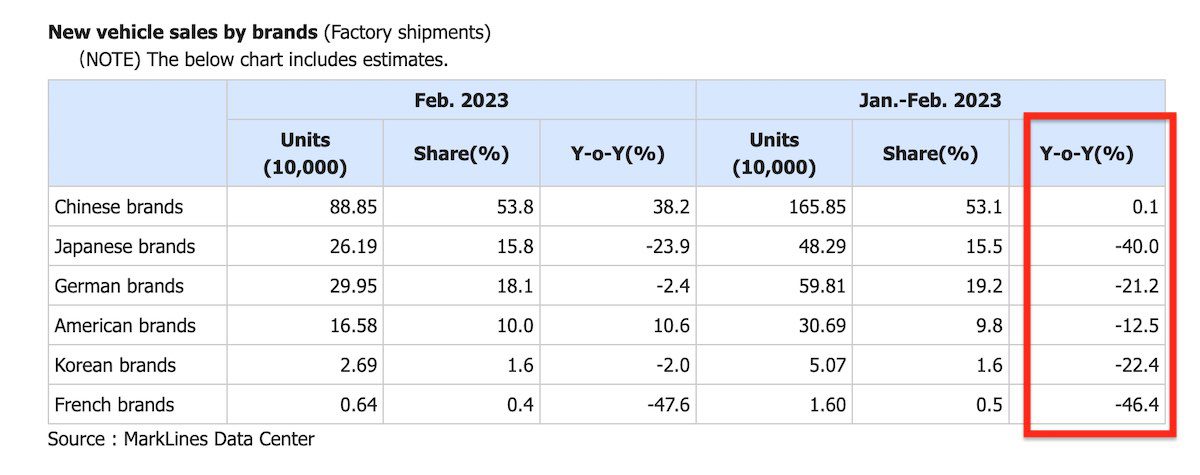

In the first two months of the year, sales of Japanese brands in China have dropped by 40% year-on-year. German and Korean brands have dropped by around 20% while US brands have dropped 12.5%.

Meanwhile, Chinese brands have held steady with losses of ICE sales being offset with increased EV sales domestically. Chinese market vehicle sales by brand country. Source. Marklines using CAAM data

Chinese market vehicle sales by brand country. Source. Marklines using CAAM data

And this trend is accelerating rapidly. EV output in China totalled 7 million units in 2022, an increase of 97% on 2021, while sales of electric vehicles rose by 93%.

The imminent implementation of new pollution standard will compound this trend even further.

Meanwhile, the two largest automakers in the world Volkswagen and Toyota aren’t even planning on launching mass produced EV models until 2027, which is still 4 years away.

Could the Chinese inventory crisis lead to a broader collapse?

The German and Japanese car giants are also two of the most indebted companies in the world, both with almost $US200 billion of debt and highly questionable valuations on their internal combustion factory assets.

An inventory glut of unsellable vehicles in the world’s largest car market is the last thing these companies need and with ICE vehicles sales plummeting, it’s difficult to see how they will survive.

In Japan, automotive manufacturers and the industries that support them are estimated to employ over 5 million workers. Around 8% of Japan’s workforce.

Because of Japan’s disastrous national hydrogen strategy (largely promoted by Toyota), the nation produces a trivial number of electric vehicles and as a result its addressable market in China is vanishing before its eyes.

With Chinese automakers largely shielded from the impacts of the new pollution standards because of their early move to EVs, it’s unlikely that the Chinese government will delay its implementation.

Its looking like the next few months will be crunch time for the legacy automotive industry.

*************************************************************************************

What does all of this mean to SU shareholders?

Not much in the short term.

Legacy OEMS are already preparing for a massive transformation that is happening before our eyes.

At some point, the "too busy to do their homework" analysts on Wall St are going to wake up and go WTF. It is embarassing to the analyst industry that they haven't yet realized that the huge (and unrepeatable) profits made in 2022 have already disappeared in 2023.

The $10 billion profit that Ford made on ICE sales in 2022 easily covered the $2 billion they lost on their EV division. Ford is guiding for a $3 billion loss for their EV division in 2023 but their profit from ICE sales won't be able to hide what is coming. At least Ford is actually trying while GM is pretending. Toyota? Ha!

As I mentioned in my post yesterday, China already makes up 38% of new car sales in the world. As of July 1st, zero % of those sales will be for ICE vehicles. I also mentioned that China sold 6% EV's in 2020 and 15% in 2021 and 30% in 2022.

EV sales in the USA for 2022 doubled over 2021 and amounted to almost 6% of all vehicles sold. Does anyone see a pattern here?

The legacy auto makers certainly do.

The transition is 3 months from being fully done in China and has already passed the tipping point in the USA and Europe.

Anyone that believes that ICE auto makers will continue to produce a significant number of gas guzzling cars beyond 2027 should enjoy the fantasy while they can, but they better not make any investment decisions based upon the fantasy.

Think about what that means for SU which has recently dug deeper into producing and selling gasoline and diesel fuel for the auto industry.

If you insist on enjoying your voyage on the Titanic, please watch for when Elliotte exits SU, as that will be your iceberg.