Aheadofthecurve.com article on Max Resource Corp Pulled from

aheadoftheheard.com Max Resource (TSXV:MAX; OTC:MXROF; Frankfurt:M1D2) is one step closer to drilling its CESAR copper-silver project in Colombia, having identified the first two drill targets resulting from an induced polarization (IP) survey.

This week, Vancouver-based Max reported the initial results of a high-resolution ground IP survey done at the URU District, where the company is focusing its exploration efforts. More on the results below.

For the past two and a half years, Max has not only been discovering high-grade copper zones on its flagship CESAR property, but is expanding these areas, moving ever closer to confirming the existence of a huge copper-silver system.

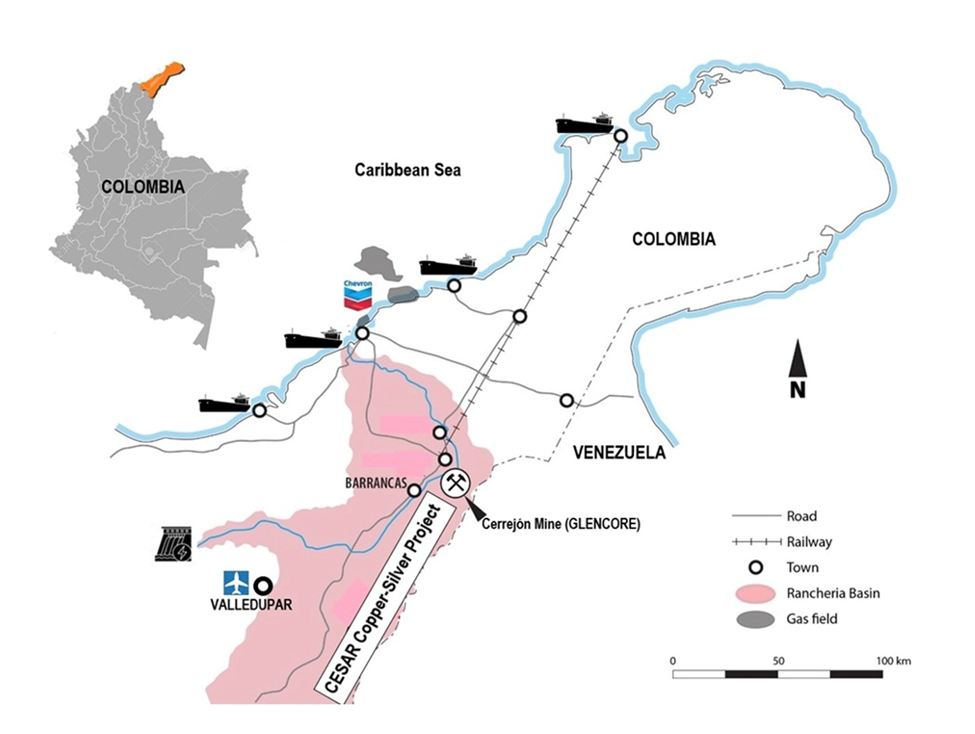

The project sits on a massive sedimentary system covering a significant portion of the 200-km-long Cesar Basin, a geological feature that extends for over 1,000 km from the northern tip of Colombia southwards through Ecuador and Peru.

Location of CESAR property

Location of CESAR property Max has so far received 19 mining concessions covering a total area of 186 km² (additional concessions are pending) — more than any other company has ever received in Colombia.

This significant milestone paves the way for Max to initiate drilling on its URU concessions.

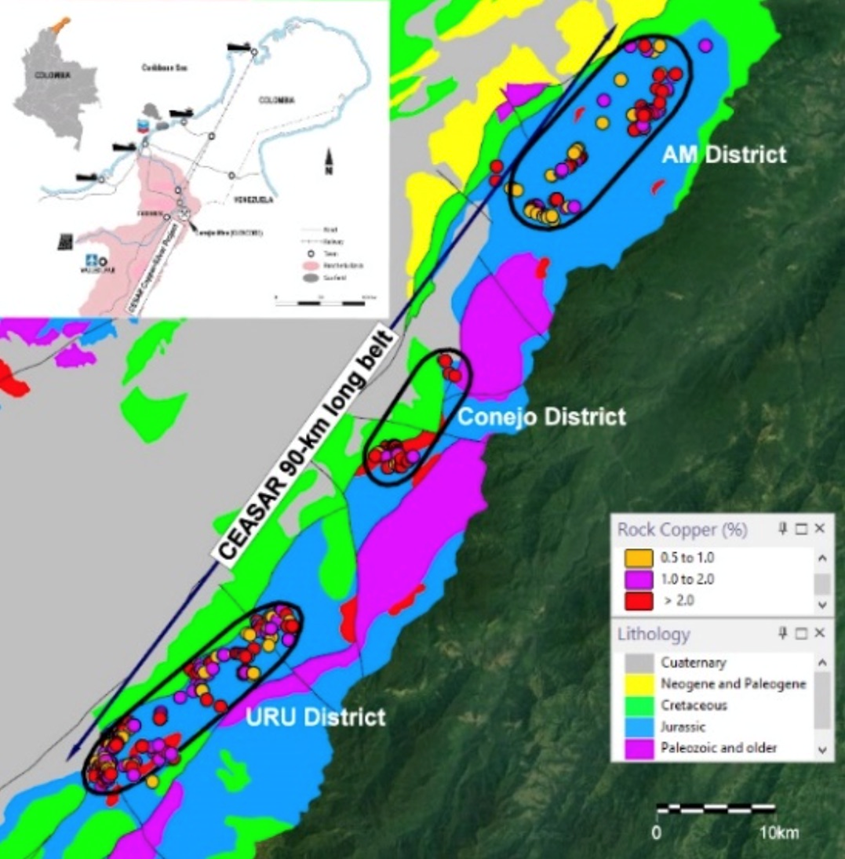

URU District

The URU discovery spans a major structural corridor and remains open in all directions. Geologically, Max compares the sediment-hosted copper-silver mineralization at URU to that found in the Central African Copper Belt.

Almost half of the copper known to exist in sediment-hosted deposits is contained in the CACB, including Ivanhoe Mines’ 95-billion-pound Kamoa-Kakula copper deposit in the DRC.

Location of URU District, to the lower left

Location of URU District, to the lower left IP

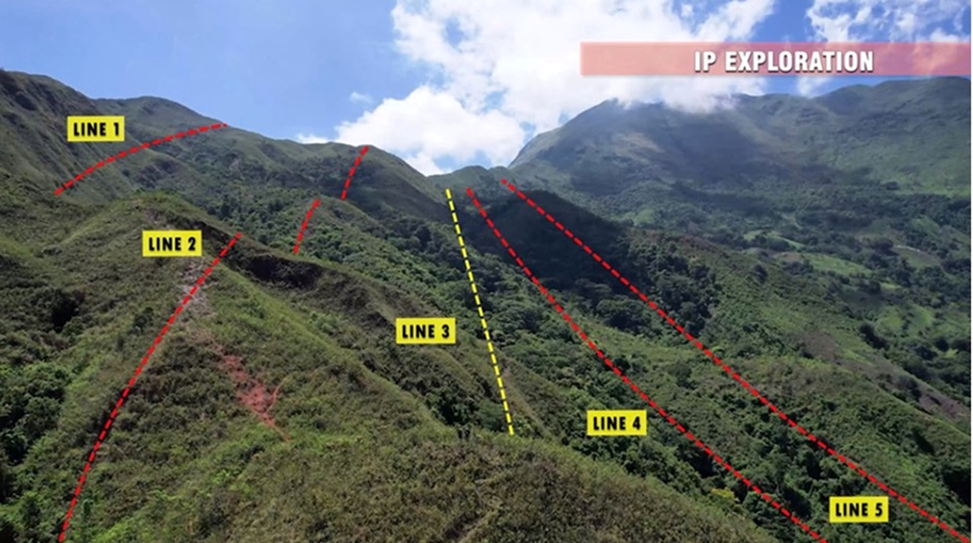

To follow Max’s progress at CESAR, it is important to understand the sequence of events. First, the Max field team conducted an IP survey at URU so that they could see in three dimensions what the mineralization looks like before they start drilling it. Because the primary copper mineral is highly conductive chalcocite, it lights up nicely on an IP geophysical survey.

IP is beneficial not only for helping to guide the drilling, but in showing the market the size and magnitude of the deep-seated structures Max is expecting to find with the drill bit.

URU ground geophysical survey lines

URU ground geophysical survey lines To perform an IP survey, technicians place electrodes into the ground. A current is injected into the transmitting electrodes and the potential is measured at the receiving electrodes. The survey grid is typically composed of lines 100 meters apart, and is normally perpendicular to the strike. Chargeability and resistivity data is collected, then processed into maps and models for interpretation. The crew then moves on to the next target.

Drilling

The next step for Max after doing IP at URU, is to drill. Here we must present a clarification. In Colombia you do not apply to the government to get drill permits, instead getting permission to drill involves four steps: first, a mining concession has to be applied for and approved, then registered with the government; second, each individual landowner has to agree with and sign the concession agreement; third, the government issues an environmental permit including a baseline water permit; fourth is a site visit by government officials to confirm everything is in order. Note that after all four steps are completed, an exploration company is free to drill any time, anywhere on the concession.

One thing that can delay the process is the water permit. But there is a way to circumvent this, and that is to haul water in. Max would get locals to build an access road ending high up the mountain where Max plans on drilling; the water would then be pumped to the drill pad locations. This is the easiest way to handle the water permit and we at AOTH imagine that’s how Max will do it.

In the latest news release Max says it is “planning drill sites and planning to mobilize the diamond drill rig late next month.”

I talked with CEO Brett Matich shortly after the Aug. 9 news release came out. He told me there was no way he would say this without Max being in the position to execute on the drill program.

IP drill targets and interpretation

According to Max, the IP chargeability on the survey correlates with two copper-silver rich discoveries at “URU Central” that extend at least 200m below surface. The two drill targets are “URU-C” and “URU-CE”.

URU-C returned chip channel widths of 9.0m @ 7.0% copper + 115 g/t silver (new results) and 16.8m @ 8.3% copper + 146 g/t silver at the lower levels of the prospect. The upper level, 190m in elevation higher, is +290m along strike and returned 4.9% copper + 41 g/t silver along a 52m ridge line. These are also new results, with true widths TBD.

The second discovery, URU-CE, is located 750m to the east of URU-C. It consists of substantial-sized outcrops with visible copper mineralization +15m wide, trending south-southwest for 250m of strike, open in all directions. Assays are pending.

URU Central forms part of the 20-km-long URU District, located along the southern portion of the CESAR North 90-km-long copper-silver belt.

“The initial IP survey has achieved the objectives of defining the vertical dimensions of the primary chalcocite-bearing mineralized body at the two URU Central discoveries. Max is preparing drill sites and planning to mobilize the diamond core drill rig late next month, initiating the first ever drilling program targeting copper-silver mineralization on its URU mining concessions,” said Max’s CEO, Brett Matich, in the Aug. 9 news release.

“Concurrently, Max continues its regional exploration programs along the 90-km-long CESAR copper-silver belt, utilizing its approximately $20 million treasury,” he added.

In our opinion, the two targets Max has conjured up are impressive. From the video screen grab below, the lower portion of URU-C is 290 meters long by 9 meters wide by 200m deep, with a specific gravity of 2.8. The target on the right, URU-CE, is 250m long by 15m wide by 200m deep, also with a specific gravity of 2.8. By our calculations that’s 3 million tonnes of copper.

At URU we know that chargeability relates to mineralization, thus the IP survey confirms what we thought we had on surface, to a depth of 200m. The next step is to go in with a drill to ground-truth the IP, and establish the grades.

According to Max, Initial results show the primary chalcocite mineralization extends from surface and displays a clearly defined chargeability contrast with the known unmineralized barren wall rocks. The IP results indicate that the defined surface mineralization appears to continue both along strike and at least 200m vertically at the two parallel discoveries (URU-C and URU-CE).

The 4-line-km survey also confirmed a strong correlation between between surface copper-silver-rich rock geochemistry and IP chargeability zones.

Important to note, is the fact that we are currently looking at an area of only about 1 km x 1 km; the strike at URU is 20 km, meaning there is a great deal of work left to be done – Max has barely scratched the surface. The fact that we already have two parallel zones that are open laterally and at depth, imo is a great start.

Without jumping too far ahead, I envision that targets like URU-C and URU-CE, located at relatively high elevation, are open-pittable by razing the top of the hill, then going underground.

The latter point is especially intriguing. Max has identified literally hundreds of outcrops throughout the various CESAR zones, including URU, Conejo, AM North and AM South. These silver and copper outcrops are mostly found on the hillsides, but what we don’t know is what lies underneath. Presumably there had to have been a significant mineralizing event(s) for there to be such widespread outcropping mineralization. There appears to be massive tonnage up in the hills (@ URU-C and URU-CE we estimate 3Mt of copper), but what connects the system? The only way to find out is to keep doing the geophysical surveys and to keep drilling the best targets.

As Max starts drilling at URU, likely next month, it will keep pursuing other drill targets through the four-step process described above. In Colombia, no drilling can occur without a concession agreement, the permission of landowners, an environmental permit and an official site visit.

Max is already well on track to proving its exploration model, which is to identify and sample surface outcrops, work up drill targets using IP, then obtain the necessary permissions and permits for drilling.

Rinse and repeat for the next target, and the next one, and so on.

In my opinion IP worked to a T, it told Max that what they identified through sampling at surface, goes to at least 200m depth, which is important because previously, they had no idea of how deep it goes.

The next step is to get a drill on it and test it. At this point the drilling objectives are limited, Max doesn’t need to go very deep, all it needs to know is the mineralization carries grade to depth. Step-outs and deep drilling can be done later.

Selective drilling with successful assay results should prove to a major mining company that Max’s CESAR property hosts a huge sediment-hosted copper-silver system comparable to the largest in the world.

Max Resource Corp.

TSXV:MAX; OTC:MXROF; Frankfurt:M1D2

Cdn$0.36 2022.08.11

Shares Outstanding 160.2m

Market cap Cdn$58.2m

MAX website

Richard (Rick) Mills

aheadoftheherd.com

subscribe to my free newsletter

Legal Notice / Disclaimer

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

Any AOTH/Richard Mills document is not, and should not be, construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

AOTH/Richard Mills has based this document on information obtained from sources he believes to be reliable, but which has not been independently verified.

AOTH/Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness.

Expressions of opinion are those of AOTH/Richard Mills only and are subject to change without notice.

AOTH/Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission.

Furthermore, AOTH/Richard Mills assumes no liability for any direct or indirect loss or damage for lost profit, which you may incur as a result of the use and existence of the information provided within this AOTH/Richard Mills Report.

You agree that by reading AOTH/Richard Mills articles, you are acting at your OWN RISK. In no event should AOTH/Richard Mills liable for any direct or indirect trading losses caused by any information contained in AOTH/Richard Mills articles. Information in AOTH/Richard Mills articles is not an offer to sell or a solicitation of an offer to buy any security. AOTH/Richard Mills is not suggesting the transacting of any financial instruments.

Our publications are not a recommendation to buy or sell a security – no information posted on this site is to be considered investment advice or a recommendation to do anything involving finance or money aside from performing your own due diligence and consulting with your personal registered broker/financial advisor.

AOTH/Richard Mills recommends that before investing in any securities, you consult with a professional financial planner or advisor, and that you should conduct a complete and independent investigation before investing in any security after prudent consideration of all pertinent risks. Ahead of the Herd is not a registered broker, dealer, analyst, or advisor. We hold no investment licenses and may not sell, offer to sell, or offer to buy any security.

Richard owns shares of Max Resource Corp. (TSX.V:MAX). MAX is a paid advertiser on his site aheadoftheherd.com