Mission Ready Solutions Inc. (CVE:MRS) On The Verge Of Breaking Even

Mission Ready Solutions Inc. (CVE:MRS) is possibly approaching a major achievement in its business, so we would like to shine some light on the company. Mission Ready Solutions Inc. provides personal protective solutions to the global defense, security, and first-responder markets in Canada and the United States. With the latest financial year loss of CA$744k and a trailing-twelve-month loss of CA$5.7m, the CA$17m market-cap company amplified its loss by moving further away from its breakeven target. The most pressing concern for investors is Mission Ready Solutions' path to profitability – when will it breakeven? Below we will provide a high-level summary of the industry analysts’ expectations for the company.

Check out our latest analysis for Mission Ready Solutions

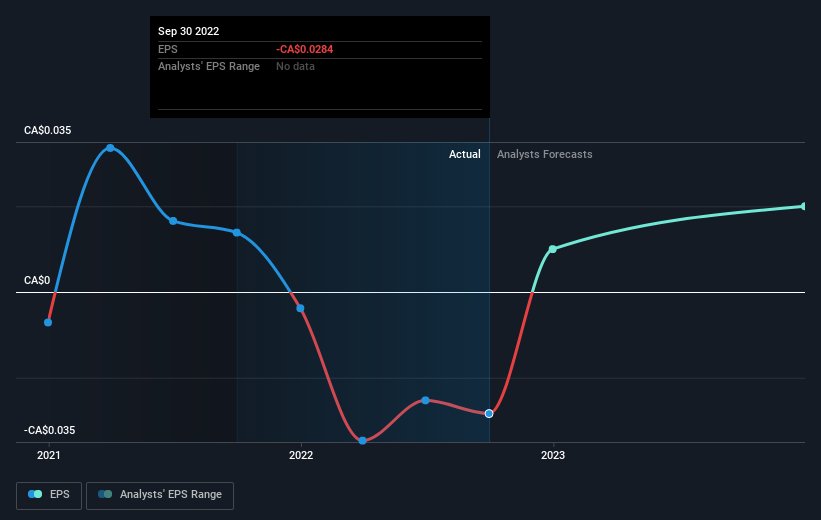

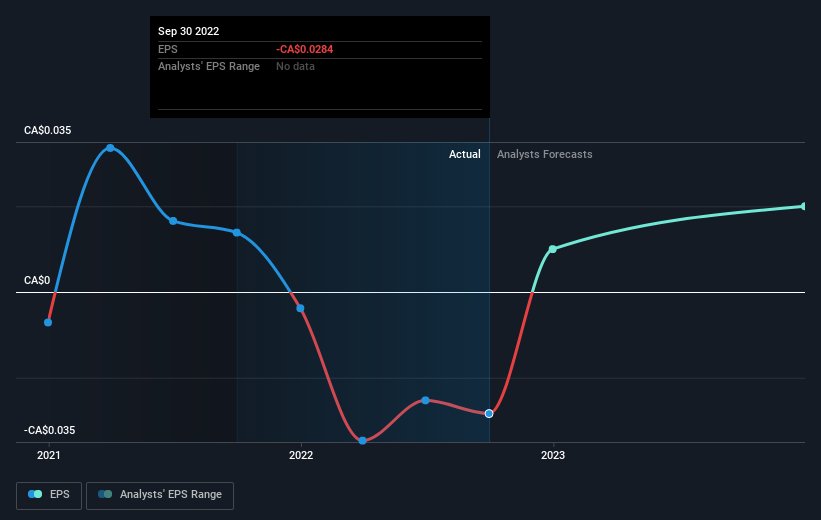

Expectations from some of the Canadian Aerospace & Defense analysts is that Mission Ready Solutions is on the verge of breakeven. They expect the company to post a final loss in 2021, before turning a profit of CA$1.4m in 2022. Therefore, the company is expected to breakeven roughly a year from now or less! How fast will the company have to grow to reach the consensus forecasts that anticipate breakeven by 2022? Working backwards from analyst estimates, it turns out that they expect the company to grow 180% year-on-year, on average, which signals high confidence from analysts. Should the business grow at a slower rate, it will become profitable at a later date than expected.

earnings-per-share-growth

earnings-per-share-growth

Underlying developments driving Mission Ready Solutions' growth isn’t the focus of this broad overview, but, bear in mind that by and large a high forecast growth rate is not unusual for a company that is currently undergoing an investment period.

One thing we would like to bring into light with Mission Ready Solutions is its debt-to-equity ratio of 115%. Typically, debt shouldn’t exceed 40% of your equity, which in this case, the company has significantly overshot. Note that a higher debt obligation increases the risk around investing in the loss-making company.