A few interesting clips from this article about 4 years ago. I agree with some of his comments and have watched this stock potentially be manipulated or see investors not really know what this property potentially has in the ground. Much of his analysis has truely hit the nail on the head with much more to come. I still feel the eastern flats has near surface resources and is under explored along with the numerous other targets that have shown solid high grades in many of the trenching exploration activities. My question is how far is management going with exploring new targets? Are we looking at a potential farm in by a major? We obviously have to go to market for more $, but what we have in the ground so far, lets hope we don't give away shares for peanuts as we have done in the past few financings. Gold markets are tough right now, but this is potentially an diamond in the rough!

Just remember these clips were from about 4 years ago, but we are seeing some predictions exceeded. And we only trade at .04 for months and only as of Friday jump up to .065. Crazy valuation based on what we potentially have in the ground. You need to read the "Bottom Line" comments at the end if you are at all interested in this stock. GLTA

Gold juniors are trading at cheap levels overall right now and there are some that trade at pretty absurd valuation. Valuations one would expect at the depths of a bear market and a gold price of around $1,200 or so. In my opinion this is the best investing environment I have yet to see in this space. It’s getting almost impossible to make mistakes (overpaying) when such a vast amount of risk is already discounted in many of these companies. In this piece I will explain why I own shares of Omai Gold Mines, which I think is one of those absurdly cheap juniors, ...."

"The case is very simple in my pinion. The company is trading at a valuation on par with some grassroot explorers even though the company owns an asset that used to be a top tier mine with potentially a couple of millions of ounces left behind (More on this later). If that wasn’t enough there is significant and probable exploration potential all over the project. I do think this project has a good chance of becoming a mine again and I think Silvercorp Metals and Sandstorm Gold Royalties feel the same as they own 15.1% and 9.9% of the company respectively. The only negative factor that I see is that it is in Guyana which is not a tier #1 jurisdiction. With that said I think Omai is way too cheap and that there is a relatively good chance to get at least a 5+ bagger within 24 months. A 5X would have the company valued at US$138 M which I certainly don’t think is a stretch if the company is successful in showing multi million ounce potential (which I see as likely in that timeframe). I get that Guyana should have a discount but this is simply irrationally cheap for an asset of this quality in my opinion…

Lastly I would say that Sandstorm Gold Royalties is in the business of owning ROYALTIES on MINES. A stake by said company basically says, again, that they think it has a decent shot at becoming a mine simply due to the quality of the project. With an Enterprise Value of ~US$23 M one readily can see that nothing of the sort is priced in. So as I see it either Sandstorm Gold (and Silvercorp) are incompetent or Omai Gold Mines is a steal at these prices."

As can be read above the Omai Gold Mine produced a whopping 3.8 million ounces of gold during a period of time where gold averaged US$350 per ounce. In other words it was a very high quality mine. As far as I understand IAMGOLD, who used to mine the deposit, decided to wind down the mine and move the plant when they made another big discovery in the area. This perhaps “hasty” decision is what has provided the opportunity for Omai Gold Mines. Remarkably the Omai Gold Mine has only seen 87,845 meters of drilling. This is pretty astonishing given how much gold was mined. It also suggests that there is no way that the mine and the surrounding area has seen anywhere near enough exploration drilling. In other words IAMGOLD pretty much just upped and left with potentially a lot of “money still at the table”. "

"What should be obvious is that there certainly looks to be a lot more at depth at Wenot than what has been mined so far as the slide suggests; “Mineralization remains robust at this depth with no indication of decreasing”. Furthermore those are some good bulk mineable intercepts. This is obviously a very big deal since it means that exploration upside is not potential but PROBABLE. This greatly affects the risk/reward calculation since probable upside is a lot more valuable than potential upside (all else equal). The best part is, as stated earlier, that Omai Gold Mines is pretty much valued like it was involved in pure high risk, grassroot exploration. Further evidence of there being probable “low hanging fruit” at Wenot can be found in a recent NR that presented “the results from a program of logging and sampling of 6,000 meters of unassayed core from a 2012 drilling program that had been preserved by the Guyana Geology & Mines Commission"

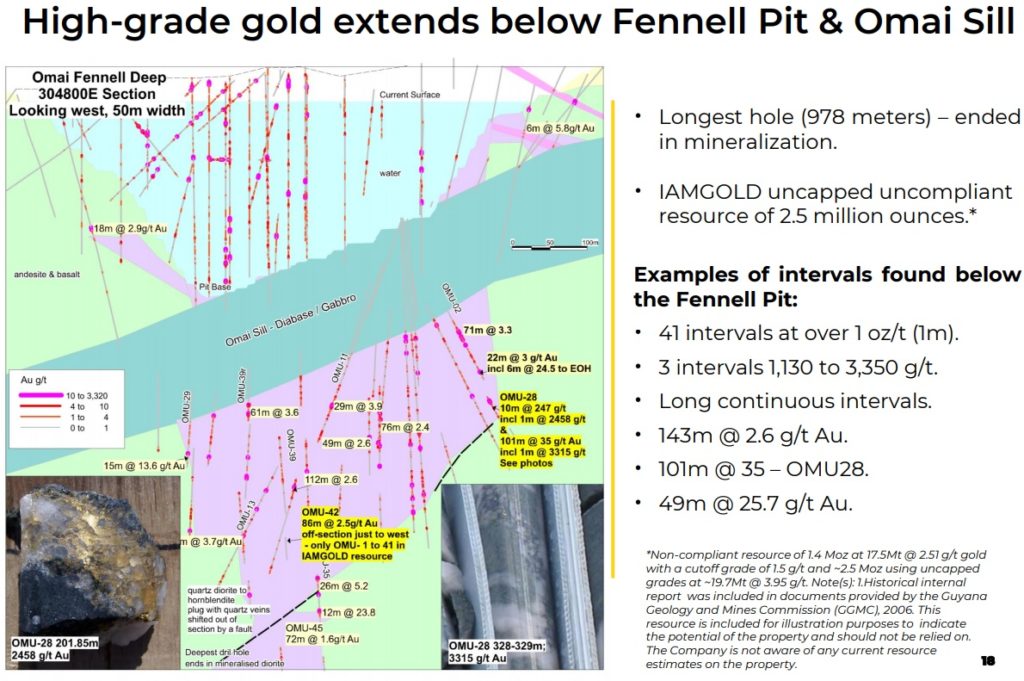

"Fennell is a very interesting side of the Omai story. The Fennel system was open pit mined down to a sill contact. Even though the sill itself is barren the system actually keeps on going beyond it at depth. Said sill appears to simply have split the system judging by the numerous extraordinary drill intercepts that are located below it:

Highlighted intercepts:

- 143m of 2.6 gpt

- 101m of 35 gpt

- 39m of 25.7 gpt.

…Those are obviously some pretty obscene intercepts and one can understand why this system was a very high quality mine. One would think a lot of this could result in an underground bulk mine that enters at the bottom of the historic pit. Also note that IAMGOLD had an uncapped uncompliant resource of up to ~2.5 million ounces here. Lastly, note the comment that reads “Longest hole (978 meters) ended in mineralization”. How deep can this system go? I don’t know but the next slide should really hammer in the potential in this underexplored gold system at Fennell:"

"… Is the Enterprise Value of Omai Gold Mines starting to look really silly by now (if not before)? Well I sure think so since most juniors would kill for intercepts, (a noncompliant) resource and obvious exploration potential like we are seeing at Wenot and Fennell."

"Bottom Line

You will only see opportunities like this in a sleeper stock during bear market sentiment levels. This case is yet another example of why I love the current market environment. Being able to pick up stories like this, for a fraction of sunk costs and with substantial upside potential on top, for a bit over US$20 M should not be possible when gold is trading around US$1,800/ounce. I mean we have two large companies backing Omai which indicates they think there is a reasonable chance that this project will really become a mine again. This is not really surprising given the amount of “inferred” ounces one can imagine at both Fennell and Wenot. The surprising part is that nothing of the sort is priced in. With an expected NI 43-101 resource update planned for this year I think the “fuse is lit”. If the market does not appreciate the opportunity right now it probably will when the already banked success (value) will be out in black and white.

I cannot stress enough how important I see the backing from Silvercorp and Sandstorm to be. One is a producer and the other is a one of the best and smartest royalty companies out there. If they can foresee this becoming a material mine then who am I to argue? And as it gets closer and closer to it looking like an actual mine the valuation we are seeing now will look very silly in hind sight I think.

As always there are no guarantees of anything in this space and I would not bet the farm on any one company no matter how good the risk/reward looks. With that said I see this as a situation of where almost nothing positive is priced in (banked- or future success) which results in risks being to the upside in my opinion. If it doesn’t work out at all for some reason then too bad. If it does work out and this becomes say a >3 Moz mine then I can see >10 bagger potential with time.

Key Points

- Already got a substantial amount of “inferred gold” ounces in the ground (Margin of safety)

- Potentially more than 2 Moz

- Obvious exploration potential to boot at both projects as well as district scale potential (Free upside)

- Was a mine not long ago…

- Ground is disturbed already

- Proof that operating a mine in that exact location is doable

- Backed by two much larger companies (Vote of confidence)

- Most importantly cheap as hell in my opinion (Excellent Risk/Reward)"