This week, the North American stock markets managed to showcase some contrasted performances.

While the NASDAQ and S&P 500 reached record highs, driven by optimism around potential Federal Reserve rate cuts, the Dow Jones also enjoyed a solid rally. Meanwhile, the TSX, which hit a new high last week, has underperformed so far this week.

Amid this backdrop, several TSX-listed companies are making headlines with significant updates, strategic movements and quarterly reports. Here’s a closer look at three notable companies.

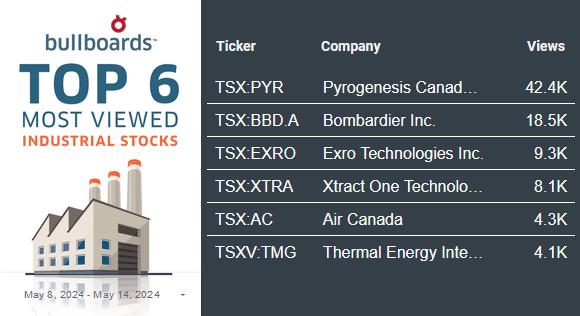

Exro Technologies Inc. (TSX:EXRO, Forum), a leading clean-technology company, has captured investor attention with its recent strategic initiatives. After the acquisition of SEA Electric on April 5, 2024, Exro provided its first update, underscoring transformative shifts and promising growth prospects.

For the quarter ended March 31, 2024, Exro reported impressive revenue of C$1,263,211, a significant leap from C$324,769 in the same quarter last year. This growth is a solid case for the company’s proactive strategy in acquiring SEA Electric, aimed at creating a larger, revenue-generating entity with a clear pathway to profitability. The acquisition integrates complementary technologies, positioning Exro at the forefront of the commercial electric vehicle (EV) market, which is increasingly driven by regulatory and environmental imperatives.

What the “Buzz”

Our Bullboards have up to 2 million pageviews a day. Get the inside scoop on conversations around the most significant trends and stock appreciations in our weekly wrap up.

Get “Buzz on the Bullboards” delivered to your inbox every Thursday!

Buzz on the Bullboards | Sign Up Here

Exro’s industry-leading propulsion technology, enhanced by its proprietary Coil Driver, aligns well with the evolving demands of the EV sector. The company is committed to delivering more than 250 propulsion systems in the first six months post-acquisition, with an ambitious plan to achieve cash flow positivity by Q2 2025. The strategic alignment and enhanced operational capabilities have already begun to yield improved results, promising strong revenue growth in 2024 and beyond.

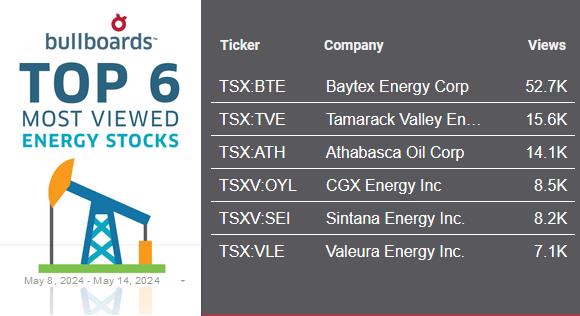

Tamarack Valley Energy Ltd. (TSX:TVE, Forum) has released its 2024 Sustainability Report this week, reflecting on its 2023 performance and marking the fifth consecutive year of delivering this crucial document to stakeholders. The report highlights Tamarack’s commitment to environmental, social, and governance (ESG) principles.

Over the past three years, Tamarack’s business has undergone significant transformation, with more than 90 per cent of production now emanating from its core Clearwater and Charlie Lake assets. The company’s strategic acquisitions in 2022 have solidified its position as the largest public producer in the Clearwater heavy oil basin. Tamarack’s collaboration with 12 First Nation and Metis communities to create the Clearwater Infrastructure Limited Partnership stands out as a noteworthy achievement, fostering long-term economic participation for Indigenous communities.

In terms of operations, Tamarack has demonstrated a strong commitment to health and safety, completing 13 emergency response plan simulations and 1,353 inspections in 2023. The company has also achieved substantial environmental milestones, including a 56 per cent improvement in methane emissions intensity compared with its 2020 baseline and significant reductions in freshwater consumption.

Oncolytics Biotech Inc. (TSX:ONC, Forum), a clinical-stage biotechnology company has reported a robust financial position with C$29.6 million in cash and cash equivalents as of March 31, 2024. This financial stability supports the company’s operational activities and strategic initiatives through critical milestones and into 2025.

During Q1 2024, Oncolytics used C$7.5 million in operating activities, a slight decrease from C$7.8 million in the same period last year. This reflects the company’s focused efforts on managing operational expenses while advancing its clinical programs.

Specializing in immunotherapy for oncology, a highlight for Oncolytics is its preliminary collaboration with the Global Coalition for Adaptive Research, aimed at evaluating pelareorep for first-line metastatic pancreatic ductal adenocarcinoma. This collaboration is poised to develop a seamless Phase 2/3 master protocol to test multiple investigational therapies for pancreatic cancer, with the goal of generating registration-enabling data.

As these companies continue to navigate their respective sectors with strategic initiatives and innovative technologies, they offer intriguing opportunities for investors. Keeping abreast of the latest developments on the TSX and beyond is essential for making informed investment decisions. Stay tuned for more updates and insights into the dynamic world of stock market investing.

For previous editions of Buzz on the Bullboards: click here.

The material provided in this article is for information only and should not be treated as investment advice. For full disclaimer information, please click here.