The Very Good Food Company (NASDAQ:VGFC) is set to take advantage of a significant production ramp-up in 2022, which will fuel the next phase of hypergrowth for the company. However, many obstacles remain that might impede the stock from reaching new heights.

So far this year, the stock is down about 60%. Although this might suggest bad results or a dire outlook, as far as I am concerned, neither is the case. There is a questionable equity offering coming up that has sent the stock down 20% but it doesn’t explain the consistent downtrend of the stock YTD. The reason for the downward movement in 2021 is none other than evidence for a functioning stock market. An unsustainable climb of the stock was coming to an end, which was mainly driven by investing communities across the internet. However, with the stock price at ~$1.80usd, reaching levels before the sudden climb, Very Good Food Company now looks undervalued.

My valuation does not include all relevant risk factors. It is, therefore, to be seen as the bull case if the company can successfully execute on its three pillars of success: Increasing points of distribution, enhancing production capabilities, and finally expansion beyond the Canadian market. Upon successful execution, it estimates The Very Good Food Company to have an upside potential of 3-4x for the end of 2023.

1. Production capabilities

In terms of what will drive the next phase of growth for The Very Good Food Company, an essential piece in the puzzle will be their ability to scale up their production capabilities successfully. This step can be seen as the bottleneck for whether the company will succeed in the future since both the increase of points of distribution and the expansion beyond the Canadian market will depend on the company’s ability to ramp up production. Especially when it comes to expanding into larger retailers, scaling up productions will be necessary even to be considered.

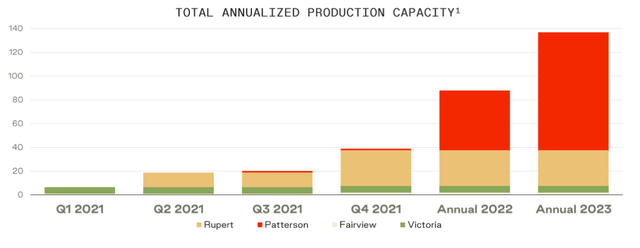

The Very Good Food Company has made tremendous progress in scaling up its productions, having launched the Rupert facility in Vancouver and the Patterson facility in California. In Q1 2021, the company had a production capacity for annualized production of ~5 million lbs. The Rupert facility, which is expected to be fully operational by Q4 2021, is expected to add 37 million lbs. in annualized production, a 7x increase. So far, there have been no delays in the setup of the Rupert facility, which is nice to see from a young company and demonstrates their ability to execute. The Rupert facility will allow the company to smoothly scale up its operations once the Patterson facility is fully operational and fulfill demand in the short term. Once the Patterson facility is fully functional, which is expected to happen by 2023, it will add ~98.5 million lbs. in production volume. Half of the facility is expected to already be operational in 2022.

Investor Presentation

Investor Presentation

Both facilities will add a total of 135.5 million lbs. in annualized production by 2023, an increase of 27x within three years, and will massively boost revenues in 2022 and the years to come. I expect this increase to serve as a significant catalyst for the stock.

2. Expanding into Retail

Currently, most of Very Good Food Company’s revenue comes from eCommerce, to be more precise 73% and just 18% from wholesale. Their long-term target points more towards the other way around of having 70% of revenue come from retail. By 2021 they have set themselves an ambitious goal of expanding to 3,000 retail stores with a total of 15,000 points of distribution. In 2020 they had 1300 points of distribution, having increased to just 1869 by the end of Q2. Although there is evidence pointing towards a significant increase in points of distribution in the latter half of 2021, like expanding distribution with Sobeys in Canada and Earth Fare in the US, a total of distribution points between 7,500 and 10,000 seems more realistic at this point.

Investor Presentation

However, what will be of utmost importance for Very Good Food Company’s distribution network will be its presence in major retail chains by 2022. This decision is usually made in Q4 and would mean the products to be sold in Q1 the following year. At this point, the likelihood of their products being included in major US retail chains is rather hard to predict. However, throughout 2022 with production ever-increasing, so will the probability of getting into a major retailer, which will serve as a massive catalyst for demand.

3. Expanding beyond Canada

As of now, 86% of revenue comes from the Canadian market. Although the Very Good Food Company is already trying to set up eCommerce in Europe and starting a pilot project in China, those plans have the potential of distracting from what should be their primary objective: Expansion and execution in the US market. Success in this regard would more than justify my valuation for the company. The company has made progress by forging partnerships with DoorDash and UberEats for the US market. Another critical partner includes the logistics company 3L, allowing them to deliver their products within 1-2 days in the US. Their logistics partner headquarters is next to the Patterson facility, which ensures the scalability of this partnership and meager costs of interfirm logistics.

Risk Factors

Most of what I stated above is based on estimations for the future. Naturally, this bears more risks, which could substantially change the company’s trajectory and valuation. First and foremost is the risk of delays in the setup of the production facilities. In 2020 alone, the company had a net loss of $13 million, compared to revenue of $4.6 million. Any delays would lead to further cash burn, most likely linked to further equity offerings being necessary and a dilution of shareholders as a result. Management has shown to be reliable when it comes to the proposed schedule for the Rupert facility; thus, a risk exists, but there is no indication for it as of today.

Another significant risk for The Very Good Food Company is the competitive landscape around plant-based alternatives for meat. On the one hand, this means relatively lower margins in the already low-margin food business. On the other hand, this means the company will have to invest in R&D to gain a competitive advantage in terms of taste. Unlike the first risk, this one is substantial, and the subsequent years will have to show if they can compete against the likes of Beyond Meat (NASDAQ:BYND), Impossible Foods, Tattooed Chef (NASDAQ:TTCF), or Oatley (NASDAQ:OTLY).

Valuation

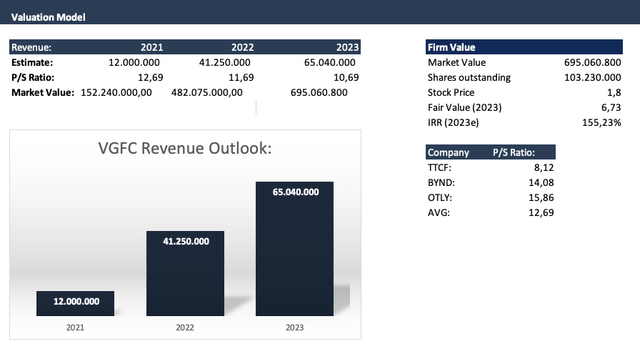

Since The Very Good Food Company is currently unprofitable, I estimated their revenues for 2021 – 2023. To develop a market value and a resulting stock price, I used an industry P/S ((Price-Sales ratio)). For the P/S ratio, I estimated a decline of one base for the coming years since growth will decline.

As for the revenue, I used their estimated production numbers mentioned above for 2021 – 2023 and multiplied them with the average selling price. For eCommerce, that is $14/LB, and for wholesale, $7/LB. Since the revenue surge will most likely come from increased wholesale demand, the margin per LB sold declines from 2021 to 2023, estimated to be around 50/50.

As a result, my estimate for Very Good Food Company’s revenue for 2023 is ~$65 million. Multiplying this with the P/S ratio of 10.69 comes up with a market capitalization of ~$700 million for 2023, more than 4x where it is today.

Conclusion

Although my model suggests almost a 4x return from today’s stock price, this is to be seen with caution since multiple risks are endangering this valuation. However, after the recent selloff, the rewards of investing in The Very Good Food Company are high, whereas I would evaluate the risks as only medium.