After yesterday's rise in WCS, more good news for ZAR's North Dakota assets and their upcoming sale.

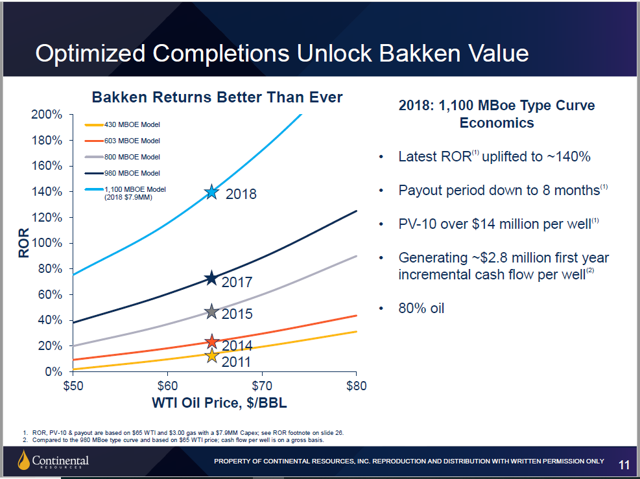

The full article is below and talks about CLR's Bakken assets whose ROR has doubled since 2017. The pipeline capacity has caught up with production and the big pricing spread has been significantly reduced while things have been also helped by the new completion techniques in the Bakken Basin:

https://seekingalpha.com/article/4179383-continental-resources-can-soar-without-bottlenecks

I quote the excerpt about the Bakken assets that has very positive implications for ZAR's North Dakota assets:

The Permian problems continue to make headlines. But at least one major producer Continental Resources (CLR) has found a permanent solution to Permian bottlenecks. Management just will not go to the Permian because this company has fantastic returns elsewhere with far cheaper acreage.

Source: Continental Resources May, 2018, Investor Update

That rate of return (click on May 2, investor update) with about an 8 month payback rivals returns in the far more expensive Permian. While much of the analysis centers upon depending upon one basin, Continental is busy proving there is a whole country out there to drill for oil. Not only have the returns on the wells drilled improved, but costs are lower than they were a few years back.

New pipeline capacity is slowly eliminating the Bakken oil differential of a few years back. The Bakken is still fairly far away from much of the refining capacity of the United States. But even that distance appears subject to some incremental improvement in the future.

Source: Continental Resources May, 2018, Investor Update

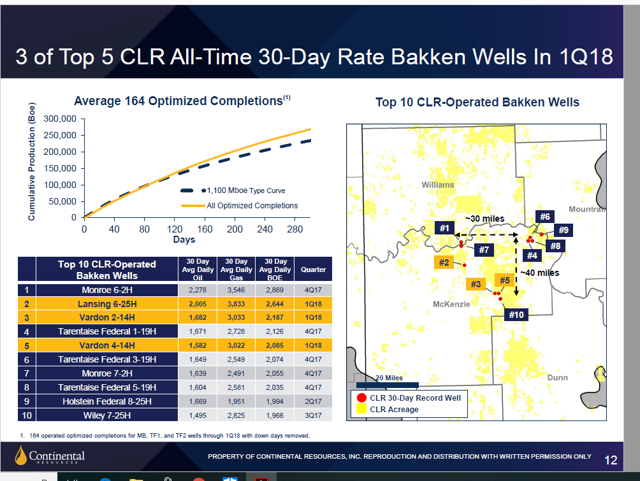

Management is still working on more improvements to further increase the rates of return and decrease the payback period. Many of the higher rate return wells are in the four county area shown above. But these continuing improvements will expand the amount of Bakken leasing area that is viable during the next inevitable downturn.

The first slide showed that the rate of return on wells drilled in the Bakken nearly doubled over the past year at current oil pricing. That is an absolutely brutal rate of improvement. If that rate of improvement continues, the Bakken could yet again become the prime drilling area that it was years ago. But the other areas will improve also as breakeven points for new wells continues to drop furiously.