Skyharbour Resources Ltd. (TSX: V.SYH, OTCQB: SYHBF, Forum) holds a portfolio of five uranium projects, covering approximately 200,000 hectares, in the prolific Athabasca Basin in Saskatchewan, Canada. Management’s mandate is to build a portfolio of high quality projects, advance these projects through exploration, forge strategic partnerships with companies who can advance non-core projects, and position the company as an attractive acquisition target.

The 85,000 km2 Athabasca Basin in northern Saskatchewan, and northeastern Alberta, is the most significant uranium metallogenic district in Canada. It is currently the only location in the world to host very high-grade uranium deposits. The basin hosts all of Canada’s currently producing uranium mines, which account for over 15% of global production. There are several world class deposits within the Athabasca Basin, including Cameco Corp. (TSX: T.CCO, NYSE: CCJ, Forum).

McArthur River (reserves of 337 Mlbs at 11% U3O8) and Cigar Lake (reserves of 222 Mlbs at 17% U3O8), as well as NexGen Energy and Fission Uranium’s high grade uranium deposits in the southwest portion of the Basin.

The global annual demand is expected to grow to over 97,000 tonnes by 2035, an increase of 30% from current levels.

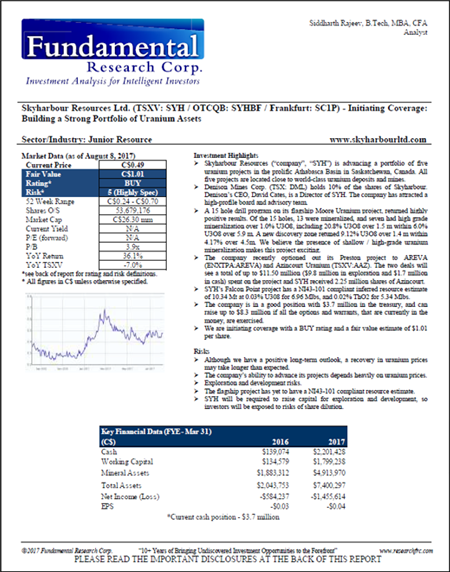

Based on the Analyst report below, we assign a speculative fair value estimate of $52.5 million on the Moore Uranium project (based on a $3.5 / lb multiple). We assign Falcon’s inferred resource of 6.96 Mlbs, discounted by 50%, at $2.5 / lb, a valuation of $8.70 million. Our overall valuation on Skyharbour is $1.01 per share. For conservatism, we have not accounted for any value from the company’s other projects.

Full Disclosure: Skyharbour Resources Ltd. is a paid client of Stockhouse Publishing.

[Click Image Below For Full Report]